by William Smead, Smead Capital Management

Linda Ronstadt set the world on fire with her powerful ballads in the 1970’s. One of her popular hit songs was the cover of a Doris Troy song called “Just One Look.”1

“Just one look and I fell so hard

In love, with you, oh oh

I found out how good it feels

To have, your love, oh oh”

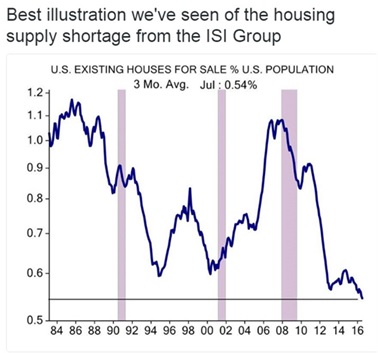

While recently analyzing this chart, in just one look we were incredibly excited about the economic need it represents and the business possibilities surrounding meeting that need.

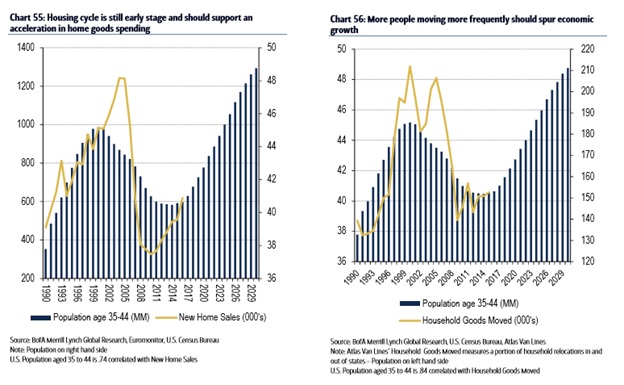

We have a severe housing shortage in the U.S. which will take years to solve. It should drive economic growth for the next decade, provide good quality jobs and promote confidence which we’ve lacked since the financial crisis of 2007-2009. Meeting this need would be powerful for homebuilders, building suppliers, real estate agencies, mortgage lenders, title companies, etc. The researchers at Merrill Lynch sent us another chart:

“ Just one look and I know

I’ll get you someday, oh oh”

Most professional investors are unlikely to make money on common stocks which benefit from meeting this economic need because it hasn’t yet filtered its way into share prices. We feel that only investors operating in three to five-year time frames will “get you someday” and make the money from these demographics. We’ve compared it to sitting on a surf board waiting for a big set of waves to come. If you aren’t waiting in the surf offshore, it will be very hard to paddle out there once the big waves show.

“Just one look and I knew

That you were my only one, oh oh

I thought I was dreaming

But I was wrong, oh yeah yeah”

Just one look at the charts below and you should now that we aren’t “dreaming.” It has been so long since housing drove the U.S. economy that most common stock investors don’t remember which stock sectors did well and why.

Our observation is that just one look at these charts would bring you to a few conclusions. First, interest rates could rise substantially the next five years. This would be very good for banks like Bank of America (BAC) and an insurer like Aflac (AFL). Second, businesses tied directly and indirectly to housing could flourish and their stocks could be significantly undervalued until these truths are obvious to other major market participants. Investors are afraid of this quarter’s earnings report on a homebuilder like NVR (NVR), because they think that homebuilding might be peaking compared to five years ago at the low watermark.

Third, the only guarantee we’ve ever had in the stock market is that things will change. The S&P 500 Index has very little direct participation in homebuilding and the peripheral industries attached to it. Local news is one example of an industry which flourishes on people being over 35 years of age with children. Gannett (GCI) seeks to create a nationwide digital and print newspaper organization at today’s fire-sale prices while nobody cares. It gushes free-cash flow and could return its entire share price via free-cash flow in six years at the current rate. If that holds true, every year it survives past six would be pure profit.

“(That’s all it took, just one look)

I’ll build my world around you”

As long duration investors we are using our bottom up stock picking methodology. If companies meet our eight criteria and we can take “just one look” at its correlation with the charts above, we like to “build our world” (portfolio) around them.

Warm Regards,

William Smead

1Lyrics: http://bit.ly/2dBnuub. Songwriters: Doris Payne and Gregory Carroll.

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO and CEO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

This Missive and others are available at www.smeadcap.com.

Copyright © Smead Capital Management