by LPL Research

German banks continue to dominate the headlines, with the largest German bank of them all, Deutsche Bank (DB), down more than 50% this year amid a litany of issues. For starters, negative interest rates in Europe have put a major damper on banks’ ability to create profits. Then, as this CNBC article notes, the U.S. Justice Department just levied a fine of $14 billion on DB to settle penalties regarding mortgage securities sold before the financial crisis in 2008. When you consider DB’s market cap is just under $16 billion, as the article notes, this fine has many concerned about its future. Lastly, an article on Bloomberg came out yesterday afternoon that drove DB and global equities lower on a report that a number of funds that clear derivative trades with the bank have withdrawn excess cash and reduced positions at the lender. In simple English, there are major counterparty concerns as related to DB currently.

We asked Matthew Peterson for his take on European banks and here’s what he had to say:

“It seems likely that the real issues will take months to fully resolve. In the interim, European bank prices will probably be determined by the big global hedge funds and fast money traders. Many of these traders have taken bets against European banks, but some have also been buying them, hoping for a recovery. We have seen this happen before in other banks; they stop reflecting fundamental value and effectively become vehicles for short term traders.”

European bank uncertainty is not a new issue. In fact, back in June in the Weekly Market Commentary, “Overcoming a Wall of Worries,” we listed European bank performance as one of our big concerns. Still, should a major European bank go under or need to be bailed out, this could create a good deal of worry over what dominoes fall next, and likely bring with it global volatility.

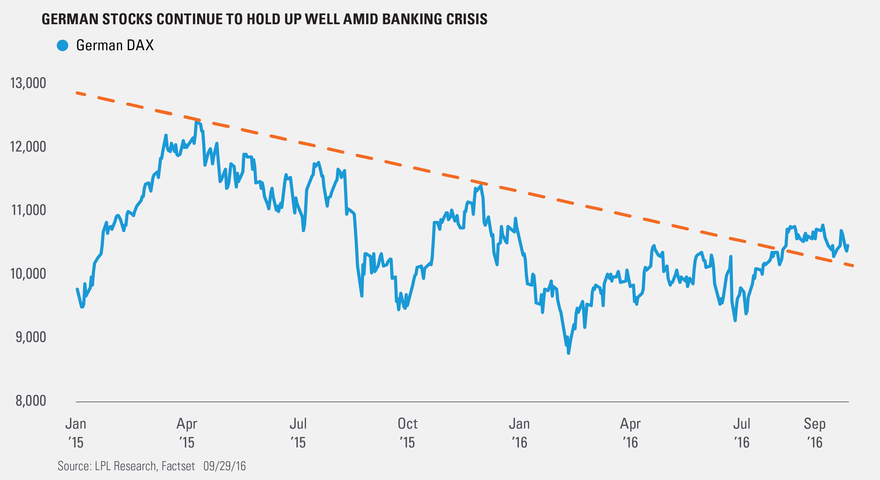

Here’s the interesting part—the German DAX continues to look technically strong. In fact, it recently broke above a trend line that goes clear back to the April 2015 peak.

As long as the DAX can stay above this trend line, we would view Germany as holding up relatively well. Should it break back beneath this trend line, we’d be much more concerned. We will continue to monitor the developments in European banks, as they could be a major market mover over the coming months.

*****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-540778 (Exp. 09/17)

Copyright © LPL Research