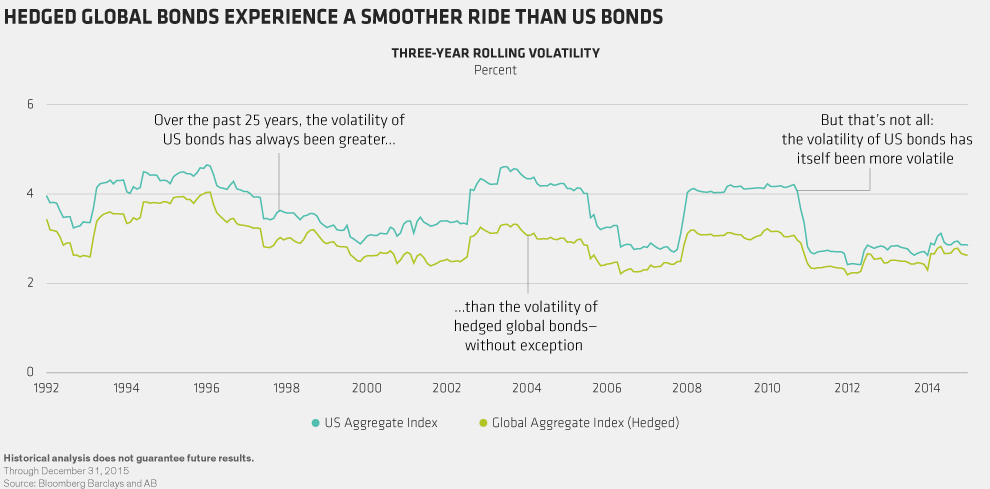

Worried About Volatility? Go Global (Bonds)

by Fixed Income AllianceBernstein

Investors worried about interest-rate volatility should think hard about their commitment to the US bond market. And not just because US rates are poised to rise. Over the past quarter century, US fixed income has been more volatile than the hedged global bond market, often significantly so. But that’s not all: even US bonds’ volatility has been more volatile. Meanwhile, hedged global bonds have preserved more capital during down periods.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein