by Ben Carlson, A Wealth of Common Sense

I grew up in the finance industry working in the institutional consulting world. Most consultants provide a wide range of services but what they’re all really selling is their due diligence capabilities for choosing money managers to invest on behalf of these large pools of capital. They often use buzzwords like ‘alpha’ and ‘access’ to get their clients’ attention, but very few allocators of institutional money ever really spend much time judging the results of these manager-of-managers.

Consultants are probably one of the least scrutinized groups in the investment field, which has always been bizarre to me because they oversee tens of trillions of dollars for large pensions, endowment and foundations.

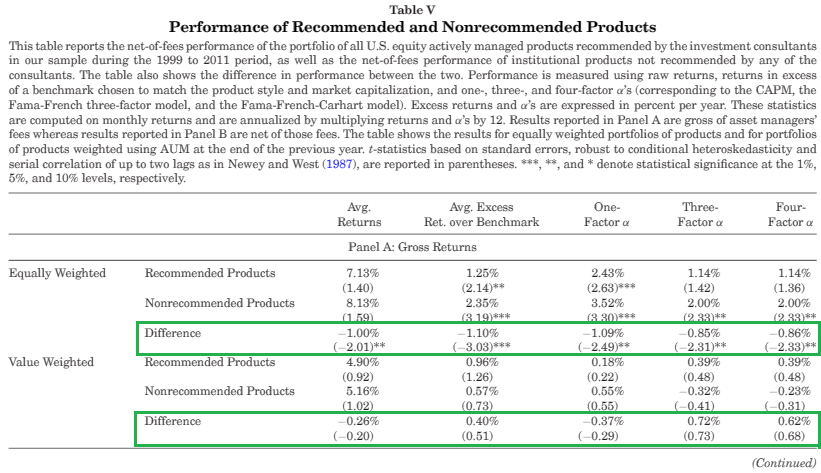

The latest issue of the Journal of Finance has a new research paper on these institutional investment consultants as a group. The results aren’t too pretty in terms of their ability to pick above average money managers (emphasis mine):

Investment consultants advise institutional investors on their choice of fund manager. Focusing on U.S. actively managed equity funds, we analyze the factors that drive consultants’ recommendations, what impact these recommendations have on flows, and how well the recommended funds perform. We find that investment consultants’ recommendations of funds are driven largely by soft factors, rather than the funds’ past performance, and that their recommendations have a significant effect on fund flows. However, we find no evidence that these recommendations add value, suggesting that the search for winners, encouraged and guided by investment consultants, is fruitless.

Here’s the data to back up these claims:

One of the problems is that these consulting firms are so concentrated at the top, with the top 10 firms controlling over 80% of all institutional assets. This data is a little stale, but it shows just how large some of these consulting firms are:

The five largest investment consultants in 2011 were Hewitt EnnisKnupp ($4.4 trillion under advisement), Mercer ($4.0 trillion), Cambridge Associates ($2.5 trillion), Russell Investments ($2.4 trillion), and Towers Watson ($2.1 trillion). Not surprisingly, institutional asset managers view being highly rated by these major investment consultants as crucial to their success.

When you’re that large you almost have to invest in the largest money managers which ends up being a de-facto performance chase. It can also be difficult to offer personalized service at that size because you’re more worried about scale than anything.

The other problem is that those who are trying to pick consultants to pick money managers on their behalf don’t really have the expertise required to judge either the money managers or the consultants who are recommending the money managers. So the blame gets passed around and everyone is none the wiser when the results end up being subpar.

Here are a few simple takeaways from this research:

- Picking money managers is hard.

- Picking other people to pick money managers for you is also hard.

- Many of the organizations overseeing these consultants probably aren’t even aware how poor their performance has been.

- Picking money managers should not be the main focus for 95% of all institutional clients.

- Consultants could add value to these relationships if they focused more of their time on client engagement, board education, asset allocation, investment policy and the unique goals of the nonprofits they are working with.

Source:

Picking Winners? Investment Consultants’ Recommendations of Fund Managers

Further Reading:

Consulting & The Smart Money Herd Mentality

Copyright © A Wealth of Common Sense