by LPL Research

How tough has this recent environment been for active managers? According to a recent report by S&P Dow Jones Indexes, in the year ending June 30, 2016, 85% of large cap stocks, 88% of mid caps, and 89% of small caps have underperformed the stock indexes they track. Why is this? This Bloomberg article asked this very question and surmised:

Theories abound as to why the stock pickers have fared so poorly. Some blame the cheap money policies of central bankers for distorting fundamentals. Others note that markets seem to be driven by macro factors—the direction of rates, the rise and fall of energy prices, worries about global growth—rather than the earnings of individual companies.

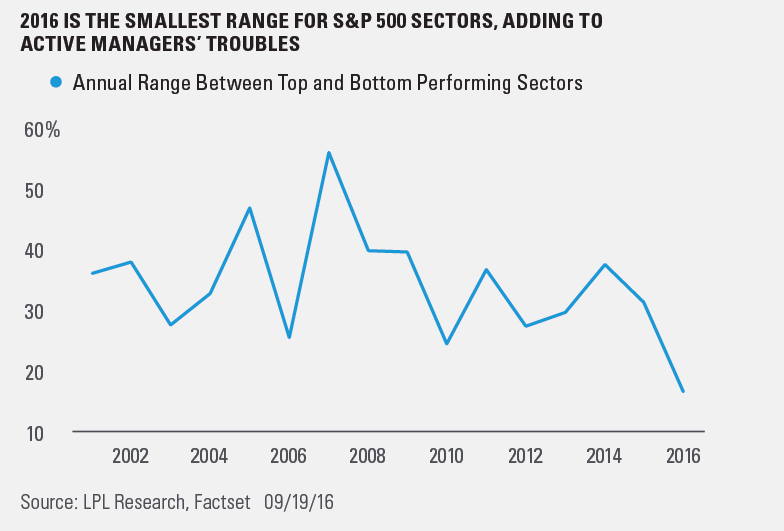

Another answer could be the lack of dispersion in various asset classes and sectors. Think about 2015 for instance: U.S. equities, bonds, and cash all were flat—while commodities were big underperformers. In other words, there weren’t a lot of places to go and find alpha. Or as this Wall Street Journal article noted, the gap between the top performing and worst performing sectors over the past year is near one of the lowest levels ever.

As of yesterday, utilities were the top performing S&P 500 group of 2016, up 17.8%, while healthcare was the worst at 0.90%—for a difference of 16.9%. As this chart shows, should things stay near current levels, 2016 will be the worst year going back 15 years between the top and worst performing sector. That isn’t the best recipe for active managers to outperform.

There are several reasons why active managers have struggled recently and the lack of dispersion between sectors is one key reason. But that does not mean we believe investors should go all passive. We continue to believe in active management, which is cyclical, just like the economy. As volatility increases, the business cycle ages, monetary policy normalizes, and asset classes outside of the S&P 500 perform better, active managers will have their day in the sun (especially the good ones). For more on this subject, along with our thoughts regarding diversification and why it may be poised for a comeback, please read this recent Thought Leadership piece.

****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a nondiversified portfolio. Diversification does not ensure against market risk.

Alpha measures the difference between a portfolio’s actual returns and its expected performance, given its level of risk as measured by beta. A positive/negative alpha indicates the portfolio has performed better/worse than its beta would predict.

Active management: Investment managers attempt to outperform the market by predicting market activity, and can add value to portfolios by anticipating market cycles and continuously changing asset allocation over time.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-537150 (Exp. 09/17)

Copyright © LPL Research