“When everyone believes something is risky, their unwillingness to buy usually reduces its price to the point where it’s not risky at all. Broadly negative opinion can make it the least risky thing, since all optimism has been driven out of its price.”

This Howard Marks quote is the perfect way to describe what’s happened with biotech stocks this year. Through the first 28 days of 2016, the SPDR S&P Biotech ETF fell 34%. After 153 days and a 52% gain, it’s apparent that prices declined to the point where they weren’t risky at all.

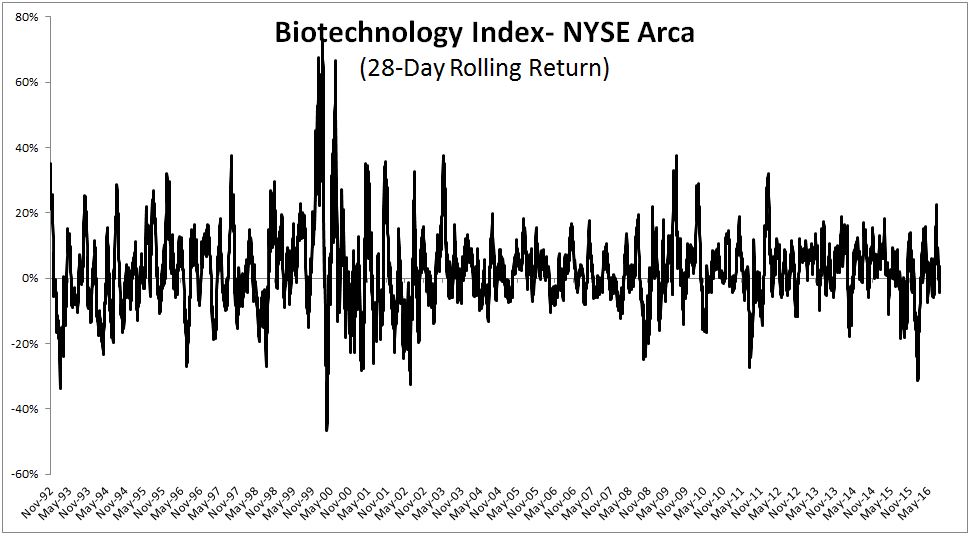

Below is a chart of the Biotechnology Index that has data going back to 1992. The 28 day start to 2016 was the worst performance over such a time since the bursting of the tech bubble.

Of course this realization is only obvious with the benefit of hindsight. We certainly couldn’t know in February when the selling would abate. Furthermore, the idea that assets get more attractive as they decline, while generally true, is extraordinarily difficult to implement in the real world. Nobody taps you on the shoulder and says “son, we’ve arrived at that point.” Here’s an extreme example; from September 1929 through the end of 1931, stocks fell 78%. It would have appeared at that point that prices reflected all of the pessimism. They didn’t. Stocks fell another 50% in the first seven months of 1932.

Of course this realization is only obvious with the benefit of hindsight. We certainly couldn’t know in February when the selling would abate. Furthermore, the idea that assets get more attractive as they decline, while generally true, is extraordinarily difficult to implement in the real world. Nobody taps you on the shoulder and says “son, we’ve arrived at that point.” Here’s an extreme example; from September 1929 through the end of 1931, stocks fell 78%. It would have appeared at that point that prices reflected all of the pessimism. They didn’t. Stocks fell another 50% in the first seven months of 1932.

We know that expected returns rise as actual returns fall, but very few people can turn that knowledge into successful investing results.

Source: Oaktree Clients

Copyright © The Irrelevant Investor