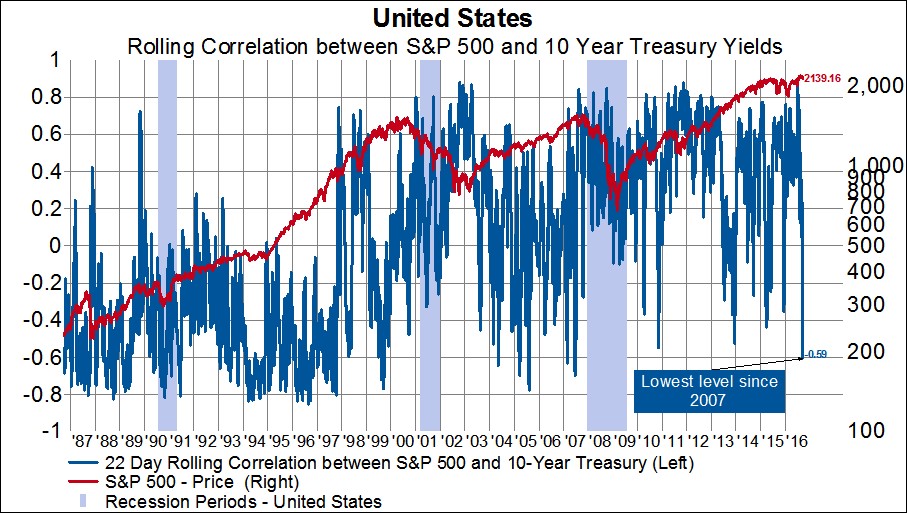

This all leads us to the current environment. In the very short-term, this positive relationship has completely flipped. This is why it feels as if diversification is hard to come by at the moment. As stocks have fallen slightly, bond yields have widened out which hasn’t been the norm since 2000. The current -59% correlation over the past 22 trading days is the most negative relationship stocks and bonds have had since 2007. And since 1999, there have only been five periods where this relationship has been this negative over 22 trading days. Assuming that the world isn’t about to flip into an inflationary period, which seems like a safe bet since central banks around the world are still doing everything they can to fight deflation, then investors should start to again feel like diversification between stocks and bonds is paying off.

Copyright © Gavekal Capital