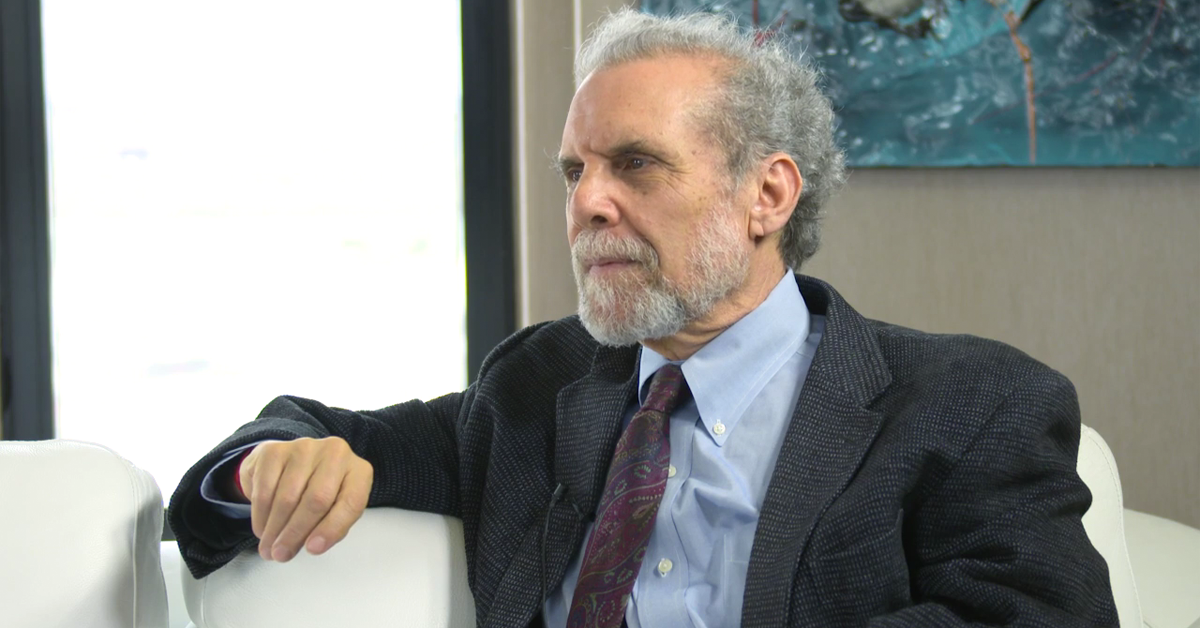

Daniel Goleman: 3 Steps to Better Investing

by Matthew Borin, CFA, CFA Institute

Psychologist and author Daniel Goleman outlined a series of steps financial professionals can take to become better investors and advisers. They are the elements of emotional intelligence: mindfulness, empathy, and relationship skills.

“First, take care of yourself,” he said during a Take 15 interview with Christiane St-Amour Rivard. “Make sure that you’re not too stressed, too goal oriented, too running all the time, to manage your own internal state. To let yourself relax, let yourself have that open time.”

This relates to mindfulness — the self-awareness of thoughts without being pulled in by the disturbing and distracting ones. Effective mindfulness produces a clear and calm mental state in which Goleman says people make their best decisions. Being mindful is essential during a down market, for example.

“For financial advisers, one of the toughest moments is when markets are not doing well,” Goleman said. “People start to panic. That’s a moment when your calm, your clarity, is extremely crucial for the other person to sense that they don’t have to panic.”

Mindfulness is also necessary for innovation. Short-termism and being goal oriented “activates a part of the brain that is antithetical to creativity,” making it difficult to have insights. Goleman recommends scheduling down time to reflect and think about the big picture.

Part of maintaining mindfulness is resilience, or how quickly one recovers from being upset. Financial professionals also have to be mindful and resilient to accomplish Goleman’s second step: empathy.

“Use that calm and clarity to think about your clients, to tune in, to see where they are, to understand how they see the world,” Goleman said.

He defines empathy as mindfulness of others. For financial advisers that means understanding how clients think and feel. Empathy allows advisers to help their clients be mindful and make calm, thoughtful decisions. Your own mindfulness and resilience is crucial to being empathetic.

“When we’re upset, when we’re stressed out, we’re actually not thinking that much about the other person, we’re focused on ourselves,” Goleman said. “It’s very hard to empathize when you’re in an upset, distressed state.”

Finally, advisers can develop skills to better help others.

“Third, put what would you would advise them in terms they can understand, which requires empathy first,” Goleman said.

Financial professionals should not think of developing empathy and relationship skills as burdensome. After all, they are what being a financial adviser is all about.

“Think about it as caring, as being concerned, as wanting to help the other person. That’s what a financial adviser is for. It’s helping that other person manage their wealth . . . in the best way for them in the long term. That’s actually a very compassionate and caring goal,” Goleman said. “By keeping that in mind, financial advisers can have a good moral rudder.”

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit; CFA Institute

Copyright © CFA Institute