by James Picerno, The Capital Spectator

US stocks and bonds managed to eke out gains last week as the remainder of the major asset classes slumped, based on a set of representative ETFs.

Vanguard Total Stock Market (VTI), which tracks US equities, edged up 0.5% for the five trading days through Friday, Sep. 16. The advance follows the previous week’s sharp slide for US equities.

Last week’s big loser: foreign stocks in developed markets. Vanguard FTSE Developed Markets (VEA) dropped 1.7% in unhedged US dollar terms. The negative total return marks the second straight weekly loss for this slice of global equity markets.

The downside bias in assets generally last week weighed on an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights. The benchmark eased 0.3% for the week through Sep. 16.

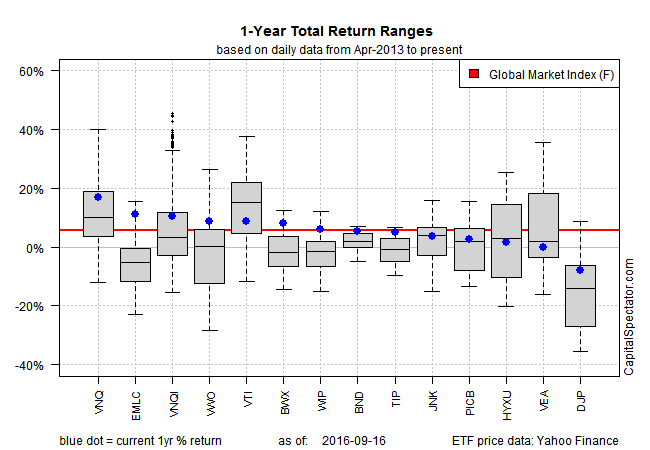

In the trailing one-year column, however, nearly all the major asset classes are posting gains. Leading the pack: US real estate investment trusts (REITs). Vanguard (REIT) is ahead 18.3% for the 12 months through Sep. 16.

Red ink for the trailing one-year return among the major asset classes is currently limited to broadly defined commodities. iPath Bloomberg Commodity (DJP) is down 8.3% for the past year—the only loss for the major asset classes over the last 12 months.

GMI.F’s trailing one-year return is still positive, although last week’s trading pared the gain to a 5.8% total return through Friday.

Copyright © The Capital Spectator