by LPL Research

The correlation between stock prices and bond yields has disconnected in recent weeks, and has been a popular topic in financial news. Investors typically think of stock and bond yields moving in unison. For example, positive economic data can make investors more comfortable with risk, meaning they sell bonds (bond yields rise), and purchase stocks (stock prices rise). However, over the past month, this relationship has deteriorated, with stock prices and bond yields moving in different directions more days than not. This has raised concerns that bonds may not be able to fulfill their role as a diversifier if stock prices fall.

Our view is that while this indicator is certainly lower than what would be considered normal by recent trends, it has a mixed history. Some of the previous lows have corresponded with significant market events, such as the Federal Reserve (Fed) raising rates in December 2015; or the taper tantrum in 2013, when the 10-year Treasury yield increased by more than 1% over a course of several months. However, the history of the indicator is volatile, and there are many false positives. A quick online search can find similar articles from past years predicting problems due to the declining correlation between stocks and bond yields, but in many cases, no significant market events followed.

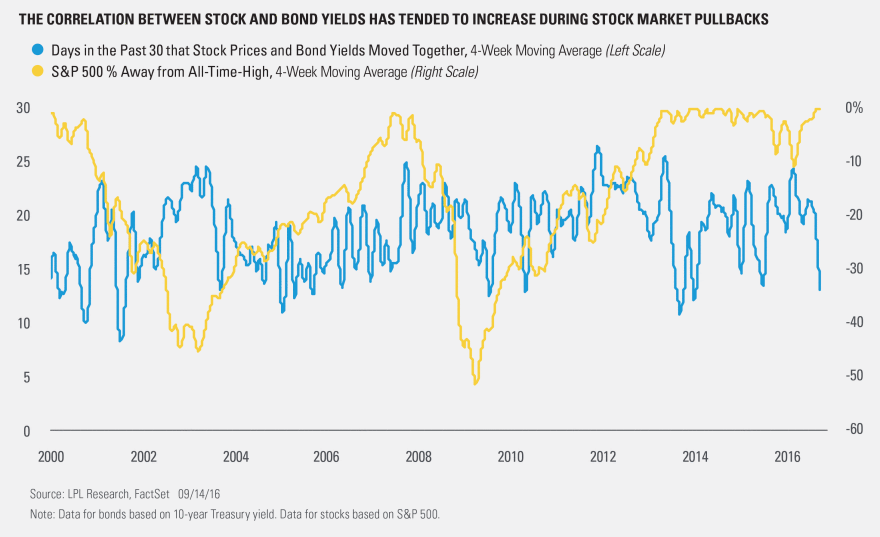

We continue to believe in the diversifying power of bonds, and the chart below shows why. The blue line shows the number of days in the past 30 that stock prices and bond yields have moved in the same direction (higher indicates a more “normal” relationship), while the yellow line shows the size of pullbacks in the S&P 500 over time (0% indicates an all-time high).

As the chart shows, the correlation alone doesn’t appear to predict pullbacks in the S&P 500, and outside of a portion of the financial crisis, the correlation between stock prices and bond yields has tended to increase when the S&P 500 experiences a significant pullback, meaning that bonds have done their job and helped to offset equity losses.

The current divergence between stock prices and bond yields makes for an interesting discussion, but its track record as a predictor of significant market events is mixed at best. Past experience doesn’t appear to support the fear that bonds have lost their ability to help offset equity weakness during stock market pullbacks.

****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-535871 (Exp. 09/17)

Copyright © LPL Research