by Clifford Stanton, 361 Capital

The Oracle of Omaha once said “Diversification is protection against ignorance; it makes little sense for those who know what they’re doing.” With respect to Mr. Buffett, we’d disagree, at least with the second part of that statement. Even investors who know what they are doing need protection against ignorance – ignorance of, or uncertainty about, the future that is.

Proper diversification is a must if your goal is to build a portfolio that you can actually stick with over multiple market cycles, including tumultuous times. Of course it’s one thing to diversify the idiosyncratic risk in a stock or bond portfolio – that isn’t particularly difficult – it’s another problem entirely to diversify a multi-asset class, multi-manager portfolio. And that requires explanation, because surely a multi-asset class, multi-manager portfolio is, by definition, diversified, right? Yes, but…

Investors routinely over diversify at the manager/fund level, filling portfolios with so many SMAs, mutual funds and ETFs that they end up with expensive index portfolios that still aren’t diversified in a way that is beneficial; in a way that materially reduces volatility. Simply adding more funds isn’t effective if the risk exposures that new funds bring to the portfolio are redundant or highly correlated to those already contained in the portfolio.

True diversification is difficult because volatility reduction is only achieved when correlations are really low. For example, if you take two assets with a correlation of 0.7, equally weighted and with the same volatility, you only diversify away about 8% of the volatility, leaving you with 92% of the undiversified volatility. If that correlation drops to 0.5, 87% of the undiversified volatility still remains. Even with a correlation of 0, about 70% of the undiversified volatility remains.

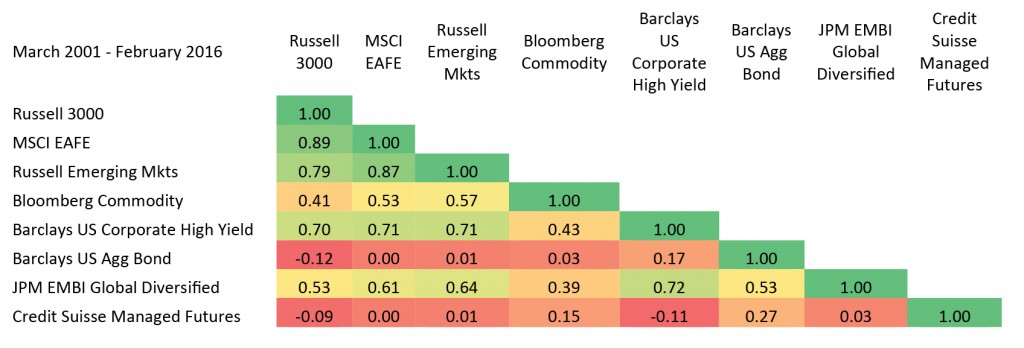

With that knowledge in hand, consider the following correlation table.

With the notable exceptions of investment grade debt and managed futures, the correlations are rather high in the context of the math we just laid out. Now, that can’t be applied directly to any pair of assets in this matrix because these assets all have different volatilities, but with the full admission that this is an oversimplified exercise, a back of the envelope analysis would suggest that many “diversifying assets” don’t reduce volatility all that much. The takeaway is that those few assets that are truly uncorrelated are hugely valuable to a portfolio.

Historically, bonds have played the role of the uncorrelated asset, and they have done an admirable job. But volatility reduction is only part of the equation; an asset class or strategy must have a meaningfully positive real return expectation to warrant inclusion in a portfolio. And with the 10-year Treasury at 1.78% as of April 4, well, you get the picture.

True diversifiers are rare, but as the correlation chart reveals, there is another option beyond investment grade debt, one with arguably better expected returns at this point – Managed Futures.

There are many strategies that fall under the Managed Futures label, with the most common approach being trend following, that is, buying assets that are trending higher and shorting assets that are trending lower. The primary differences amongst trend following strategies are the asset classes that are traded, and the durations of the trends that managers are attempting to capitalize on. But there are other approaches within the category as well, such as short term counter-trend strategies. To be clear, counter-trend trading models are not the opposite of trend following, rather they are indifferent to longer term trends. Counter-trend models offer a systematic approach to sell short-term overbought levels and buy short-term oversold levels. This meanreverting behavior allows counter-trend models to thrive in markets with a lot of back and-forth price movement.

Importantly, while both trend following and counter-trend strategies can be effective in their own right, it’s worth noting that in addition to being uncorrelated to traditional assets, these disparate approaches to managed futures tend to be uncorrelated to one another. And as we’ve demonstrated, most investors can use all of the uncorrelated assets they can get.