Volatility Ahead?

by Blaine Rollins, CFA, 361 Capital

Just when you thought that Yellen was your largest Central Banking worry, along comes Abe and Draghi to steal the spotlight. Maybe Time Warner should sign the three central bankers to star in “Suicide Squad 2: The End of Low Volatility.” No doubt it would scare the pants off of any levered Risk Parity fund manager and get better reviews than whatever D.C. Comics released to the theaters this summer.

The Bank of Japan remains in a pickle. Now the ‘widowmaker’ trade is no longer hurting its investors (those short Japanese Govt. Bonds) and interest rates are ripping. Mario Draghi added to the interest rate rocket party by implying that the ECB has not discussed an extension of their bond buying program past March 2017. This doesn’t mean they won’t, he just said that they haven’t talked about it. With European economic data still very weak, one would think that some version of QE will continue but in a skittish, low volatility market, Mr. Draghi’s comment was akin to screaming ‘Fire’ in a showing of any Marvel Comics movie.

So, is this the end of the Bond and Equity markets? Probably not. Everyone just is a bit too wired up after a dull summer which is why a 100-point move in the Dow feels like a 10% correction. I agree that the average equity market is more fully valued today, but there are some sectors and geographies which are undervalued and some which are overvalued. While it is unfortunate that the high correlation of the market does rip around so many markets and asset classes, this is also your opportunity to make adjustments and position to buy those investments which will outperform and sell those which will underperform. The credit markets remain very healthy even with a seasonally large amount of supply hitting the market this month. And expectations on the Fed to raise rates this month are still at only 30%, even with the recent less than amazing economic data. But don’t forget the Fed playbook: When the world looks scary, they put away the rate hike hammer and pull out the verbal easing wand. Do you think that it will be any different this time?

So enjoy the rise in volatility, you know that you were missing it. And if it is not enough for you, just turn to your front page stories regarding crazy world leaders with bigger nukes and leading Presidential candidates with health issues. Better get some popcorn.

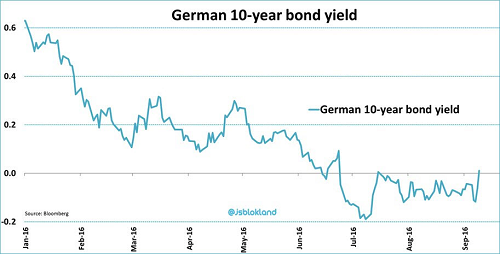

Draghi’s comments started a volatile week in European yields which quickly became a global issue that bled to all asset classes…

@jsblokland: ICYMI! The German 10-year bond #yield rose to above zero for the first time in almost two months. #ECB

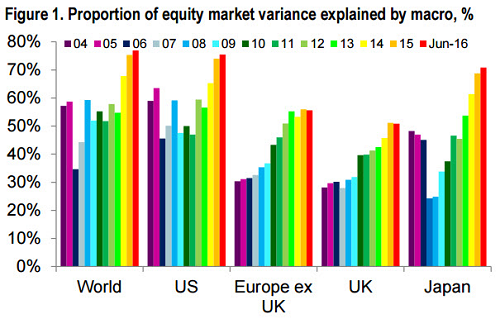

And Citigroup will remind you that any comments and actions by the ECB or the BoJ have an increasing impact upon the price of that small cap stock in your IRA…

While equities broke out of their two-month trading range, it was bonds that left investors more unsettled…

The hit to bonds is easy to explain: Everyone’s last dollar has been put into some form of fixed income…

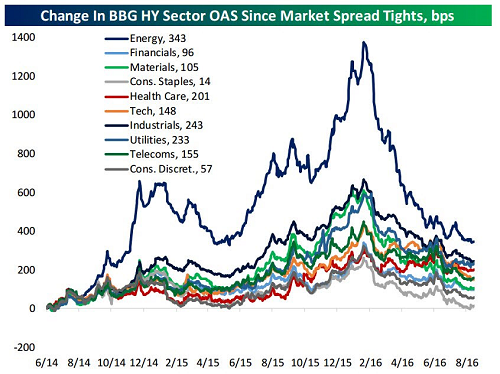

But while interest rates were hit, Credit is still showing few signs of weakness…

(@georgepearkes/@bespokeinvest)

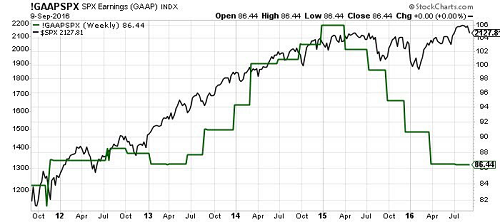

Stocks versus earnings…

Some will look at this chart and believe that Stocks must follow earnings lower. While I do believe in the long term that stocks follow earnings, in the short term I think stocks will look past specific weaknesses toward the future 12-24 months. In this case, the weaknesses causing the earnings correction is lower Energy earnings (due to the fall in prices) as well as the stronger U.S. dollar. The fact that stocks are higher today than a year ago suggests to me that the big money in the market is betting on better earnings out of Energy companies, maybe a weaker U.S. dollar and likely higher core earnings from the S&P 500.

(@TheEuchre)

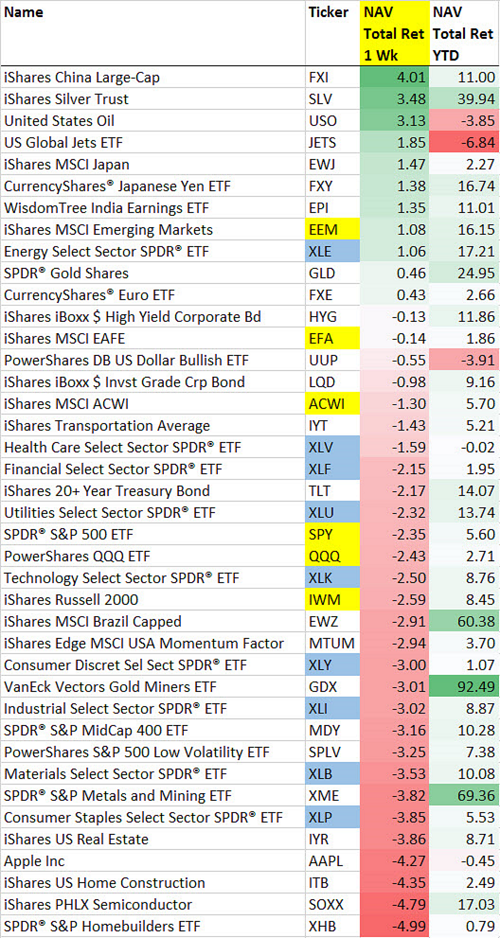

A quick glance at last week shows you that it wasn’t a complete bloodbath. There were spots to hide in the Emerging Markets, Energy, Precious Metals and High Yield…

(Prices as of 9/9/16)

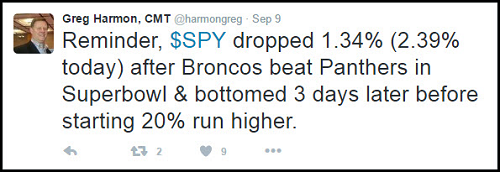

A special map of the future market for Denver Broncos fans…

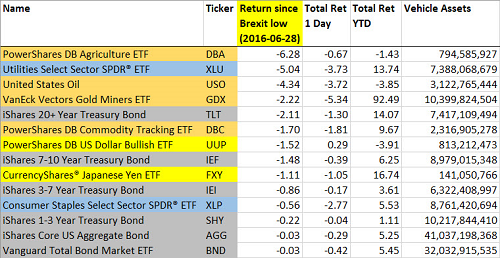

Always interesting to look at the violence after a big day like Friday…

This is a list of important ETF assets trading below the Brexit vote. If the Central Bank skittishness continues, do you really want to own these assets as interest rates glide higher and investors continue to look for other assets to own? A reversion bounce may occur from Friday. If it happens, I would take the bounce and go hunt somewhere else.

(Prices as of 9/9/16)

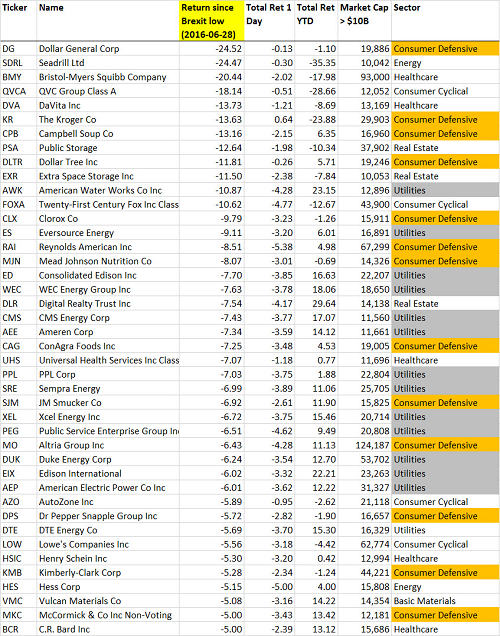

This is the same filter run for Large Cap stocks…

Note the heavy concentration of Staples and Utility stocks. Lots of bond proxies on this list. Sell them on a bounce and go find some non-bond proxies.

(Prices as of 9/9/16)

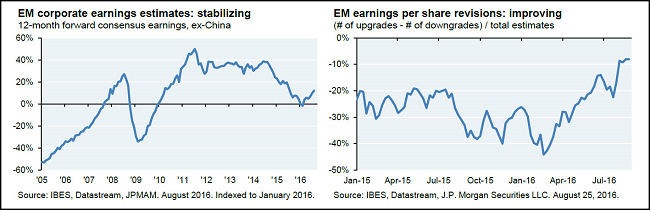

Need some equity non-bond proxies? Look into the Emerging Markets where valuations are cheap and earnings revisions are improving…

(JPMorgan)

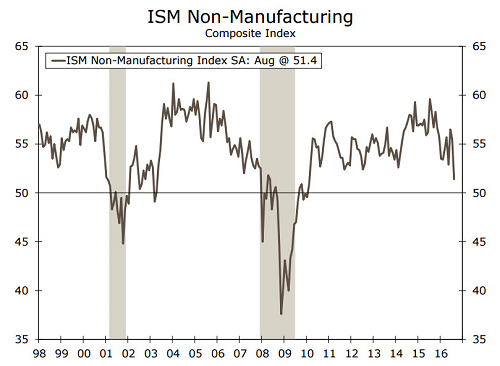

The ISM Non-Manufacturing was as ugly as the ISM Manufacturing the week before. Tough to get fired up about a rate hike after both of these numbers.

(Wells Fargo Securities)

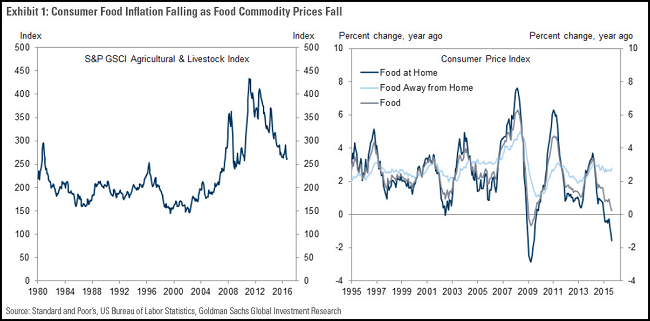

Rent/housing and healthcare inflation are slowing and now food prices are heading negative…

Food is about 15% of the CPI. It is getting very cheap to eat at home versus eating out. Plus it is much more fun to cook with the family.

Good for Apple to push its now old-aged, tech-backward user base to move forward. Wires are so 20th century…

Genius retail marketing for any college bookstore as kids return to the dorms this month…

(@KetanVora4)

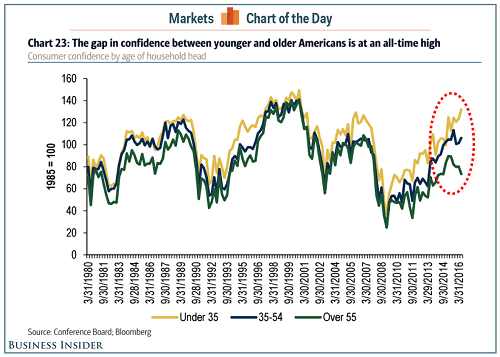

A fascinating BoA Merrill Lynch chart…

Millennials are finding jobs easy to get today so they are happy? Meanwhile older Americans are worried about low interest rates and retirement? Or does it all have something to do with something on Netflix or HBO that I haven’t watched?

Finally, we will never forget…

(@TBPInvictus)