by Don Vialoux, Timingthemarket.ca

Observations

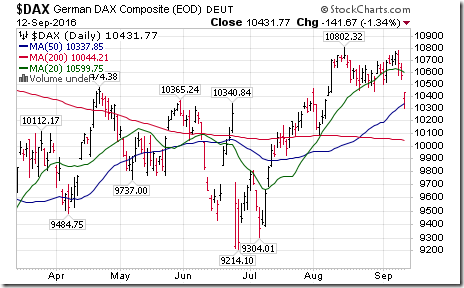

Federal Reserve spokespersons continue to have a significant impact on equity markets. Equity markets moved sharply lower on Friday on “hawkish” comments on the Fed Fund rate by Eric Rosengren. Equity markets around the world extended declines before U.S. equity markets opened yesterday. Both the Shanghai Composite Index and the DAX Index broke below short term support levels

Selling pressures extended into early U.S. equity trade yesterday with another 20 S&P 500 stocks breaking support just after the opening. The VIX Index exploded briefly to over 20%.

Then, more Federal Reserve spokespersons released comments that leaned on the “dovish” side implying less of a chance for an increase in the Fed Fund rate. Notable were dovish comments made by Federal Governor Lael Brainard. Equity markets quickly recovered and the VIX plunged to 15%.

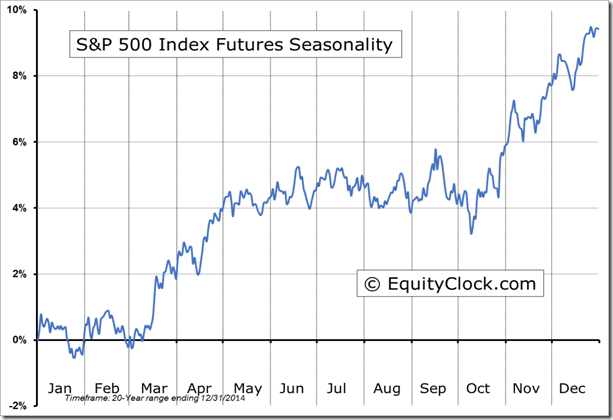

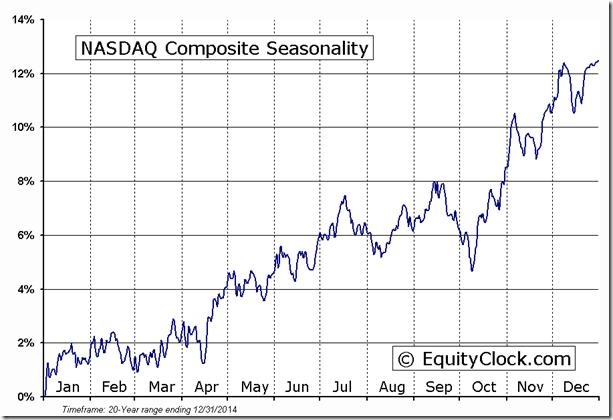

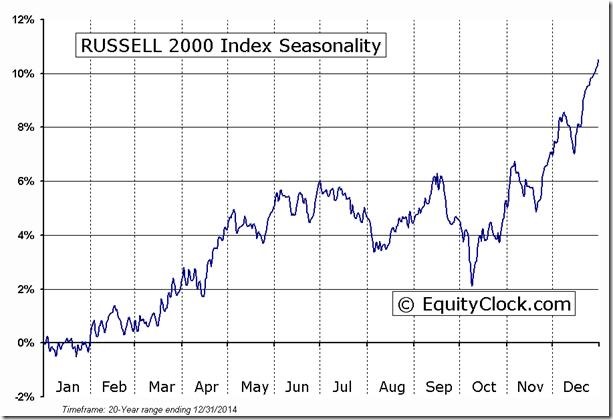

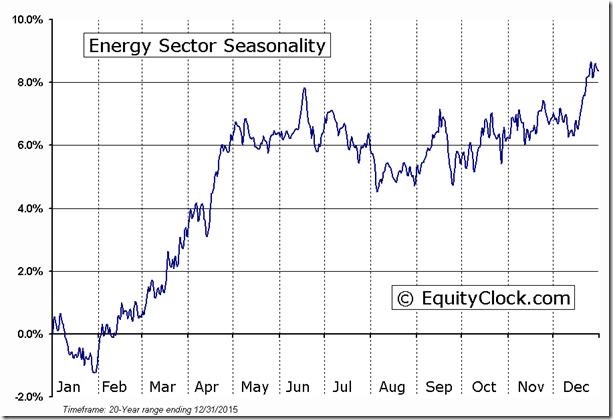

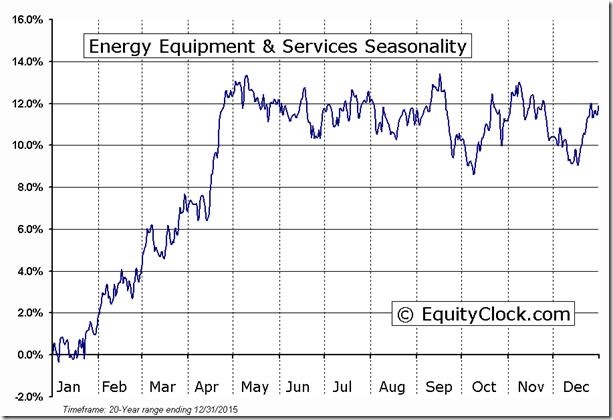

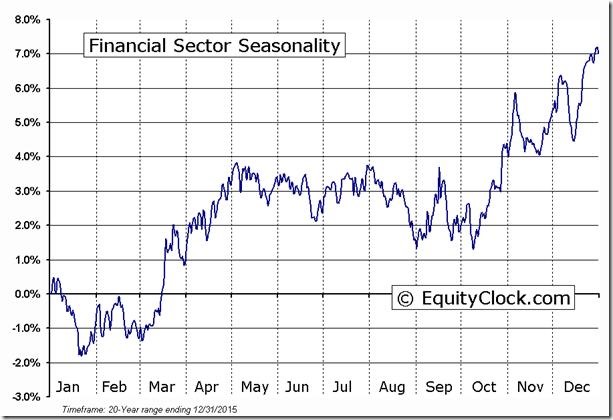

Where do equity markets go from here? Seasonal influences for many equity markets, commodities and sectors historically have tuned neutral/negative during the mid-September to mid-October period. ‘Tis the season for increased volatility!

After the close yesterday, Goldman Sachs released the following comment:

StockTwits Released Yesterday @EquityClock

Gap lower on the S&P 500 Index suggests the start of a new trend.

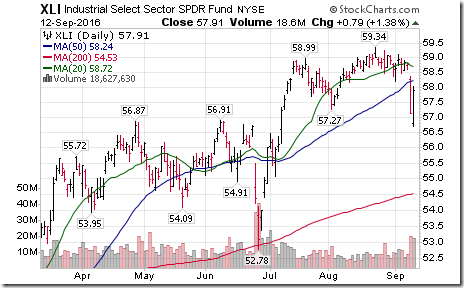

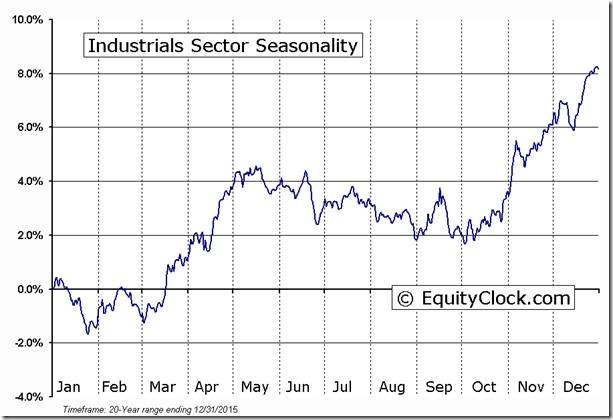

Technical action by S&P 500 stocks to 10:15 AM: Bearish. 20 stocks broke support. Notable were Consumer Discretionary and Industrial stocks: $XLI $XLY

Editor’s Note: After 10:15 AM EDT, one more S&P 500 stocks broke support, Dupont. One stock broke resistance, TripAdvisors.

‘Tis the season for the Consumer Discretionary sector to move lower until mid-October! $XLY

‘Tis the season for the Industrial sector to move lower into October! $XLI

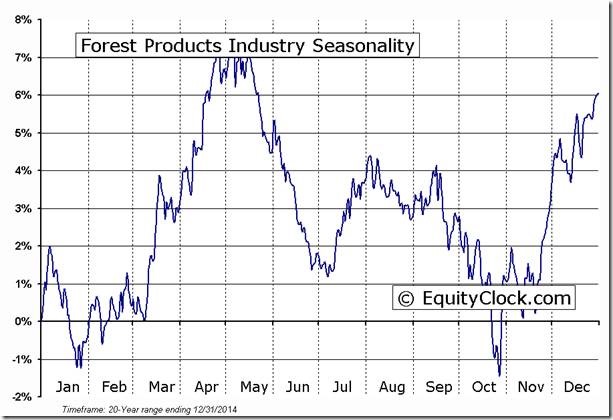

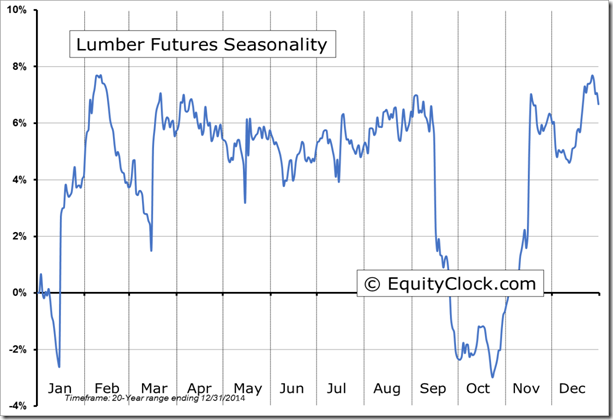

Canadian lumber stocks have completed double top patterns: $CFP.CA, $WFT.CA $IFP. CA

‘Tis the season for the forest product sector to move lower until the end of October!

Trader’s Corner

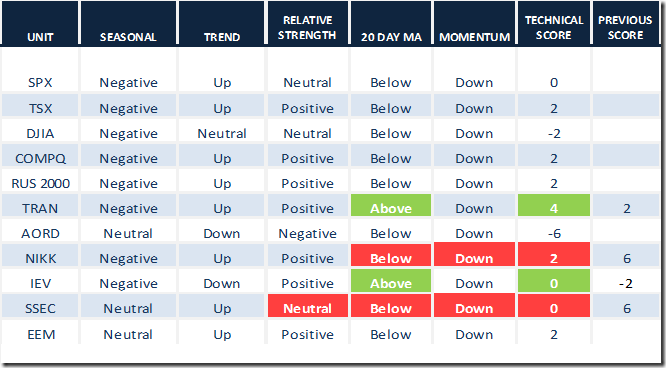

Daily Seasonal/Technical Equity Trends for September 12th 2016

Green: Increase from previous day

Red: Decrease from previous day

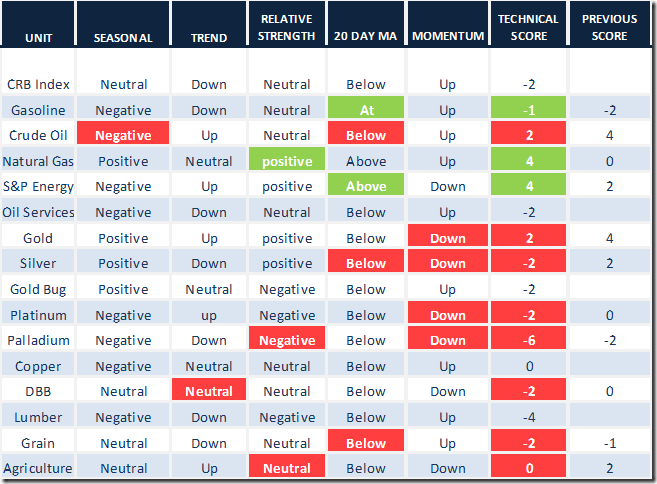

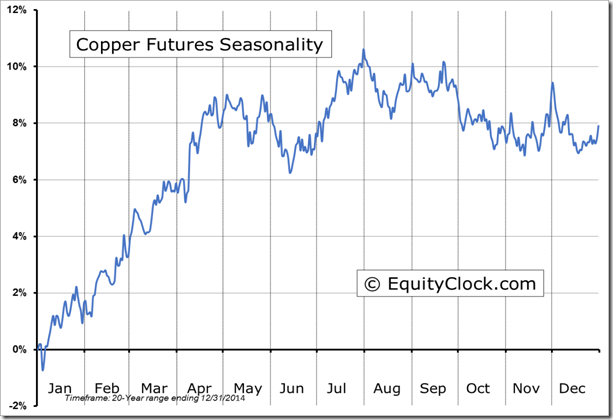

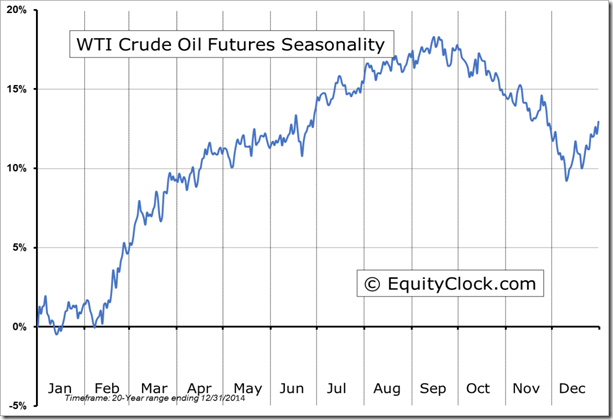

Daily Seasonal/Technical Commodities Trends for September 12th 2016

Green: Increase from previous day

Red: Decrease from previous day

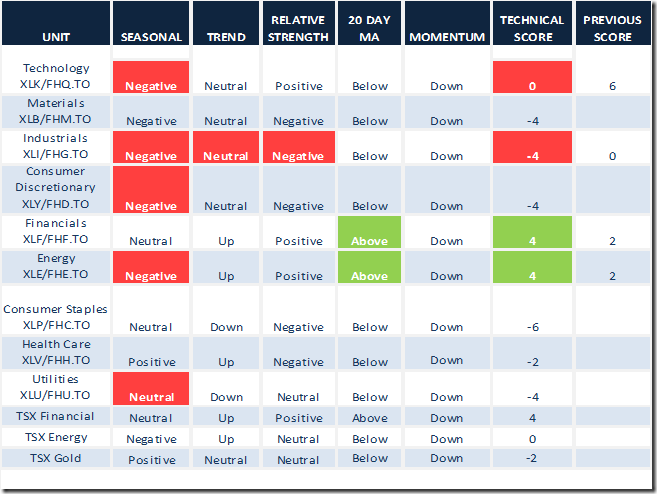

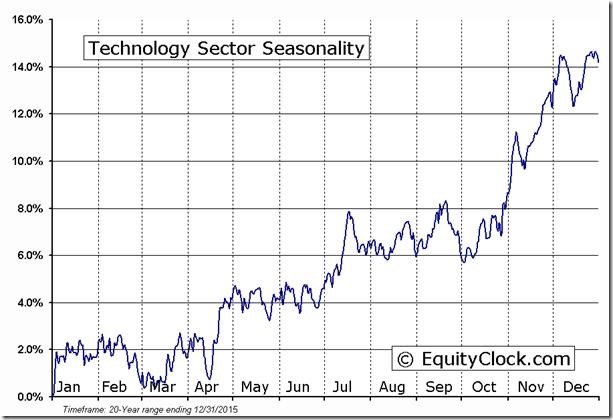

Daily Seasonal/Technical Sector Trends for September 12th 2016

Green: Increase from previous day

Red: Decrease from previous day

Changes in Seasonal Trends in Mid-September

Lots of changes! Many equity markets, commodities and sectors have a history of moving lower from mid-September to mid/end of October.

S&P 500 Momentum Barometer

The Barometer gained 10.40 to 45.00 yesterday. It has recovered to a neutral level, but remains in an intermediate downtrend

TSX Momentum Barometer

The Barometer dropped another 1.29 to 47.41 yesterday. It has dropped to a neutral level and continues to trend down.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca