The calendar has little important data. Friday’s sharp selling was widely attributed to the fear of a Fed rate hike in September. Is it time? Should we fear the Fed?

Last Week

There was not much news, and it was another mixed picture.

Theme Recap

In my last WTWA, I predicted a continuing discussion of the Fed and the timing of the first rate increase, combined with concern over a September market correction. The first part was pretty accurate all week, but the market remained quiet. The modest trading range ended spectacularly on Friday., The “C” word is now on the lips of many.

The Story in One Chart

I always start my personal review of the week by looking at this great chart from Doug Short. The overall range, once again, is very narrow. Doug’s take is that Friday was all about the Fed. He writes as follows:

Today’s action essentially confirms the metaphor of an equity market infant nursing on mother Fed’s breast. The selloff was triggered initially by hawkish remarks by the normally dovish Boston Fed President Eric Rosengren, a voting member of the FOMC. But more surprising was the announcement of an unannounced speech by even more dovish Lael Brainard at the open of the FOMC week, which runs counter to the general policy a silent Fed prior to the FOMC meeting end.

As you will see in today’s “Final Thought,” I have a very different interpretation, still consistent with the data.

Doug has a special knack for pulling together all of the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis and several other charts providing long-term perspective.

A Two-Question Quiz

- The recent Purchasing managers index for manufacturing recently registered 49.4. Last week’s “services” index came in at 51.4. Each data series has a long-term relationship with GDP. Which of these reports implies the higher rate of economic growth? Which one implies an impending recession? [See conclusion for the answer.]

- Suppose you are in an NFL “survivor” pool. You just need to pick a team that will not lose that week. No point spread. What are your odds of making it through two weeks? You may pick the biggest favorite each week.

The News

Each week I break down events into good and bad. Often there is an “ugly” and on rare occasion something really good. My working definition of “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The Good

- Initial jobless claims fell to 259K, down from the prior week and continuing recent low levels.

- The Beige Book was mildly positive, providing support for the modest growth scenario.

- Framing lumber prices remain strong. (Calculated Risk).

- Sentiment remains bullish. Dana Lyons looks at the ISE Call/Put ratio to refute the idea of a “frothy” market.

- Durable goods orders had a solid rebound from earlier weakness, increasing 4.4%

- The JOLTS report registered a new high in job openings and continued strength reflected in the quit rate. This shows the number of people voluntarily leaving their jobs. Josh Brown has a good discussion of this point. The labor market structure from the report is less encouraging. The ratio of unemployment to job vacancies confirms non-recessionary conditions, but also a mismatch between available jobs and workers. (Simple explanation here. Also a good chart via The Daily Shot).

The Bad

- Employment benchmark revisions showed a decrease of 150K jobs over a one-year period ending last March (BLS). While this is a preliminary report, it is usually a good estimate of what we will see in the actual revisions this coming March. Essentially, this means that the job growth over the one-year period ending last March was over-estimated by 150K jobs, described as 0.1% of the labor force. It is a much larger percentage of the reported net job growth. I frequently cite this report as the most accurate count, but one that arrives too late to be of interest to those in the news and financial communities. If you missed my challenging quiz on the employment report, please take a look.

- Rail traffic had another bad week. Steven Hansen (GEI) reports on the 5.7% decline for the month of August.

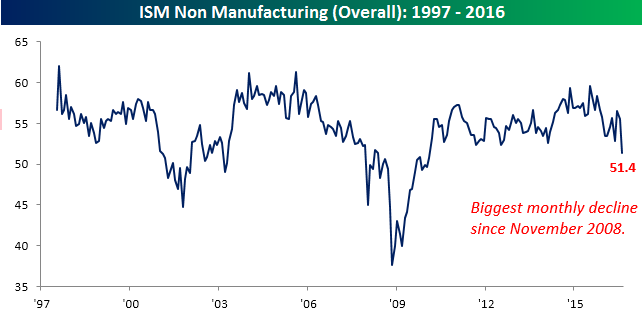

- ISM non-manufacturing dropped to 51.4. As Bespoke notes, this was the biggest monthly decline since 2008.

Here is some color from the actual report:

WHAT RESPONDENTS ARE SAYING …

“Relatively stable August, with no sharp increase or decrease in sales or pricing. Labor availability and cost remains a very high focal point.” (Accommodation & Food Services)

“Overall, the oil and gas industry remain in [a] ‘wait and watch’ mode. The price of oil has impacted investment considerably.” (Construction)

“No significant changes to report. Still on track for expansion efforts to begin fourth quarter 2016.” (Finance & Insurance)

“Still recovering from the current downturn in the renewable energy market which is expected to pick up in the fourth quarter.” (Professional, Scientific & Technical Services)

“Stable with some increase in construction activity.” (Public Administration)

“The business environment has softened a bit over the last month. There are now opportunities to fill in the marketplace.” (Retail Trade)

“Midyear [is a] slow time for us, summer build is over, fall is historically light, holiday peak build September and October for peak time November and December.” (Transportation & Warehousing)

“Good, but slowing from previous months.” (Wholesale Trade)

The Ugly

North Korea is a multiple winner of my “ugly” award. The recent nuclear test is viewed as completely unacceptable by most of the world. Can leaders find an action that peacefully accomplishes widespread objectives? Will those having the most influence over N. Korea cooperate? These are important questions, beyond our normal concerns over investments.

Jonathan D. Pollack (Brookings) has a good explanation of why the recent test is different and more threatening than those in the past.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. This week’s award goes to Wisconsin economist Menzie Chinn, who earned a belt full of bullets in a single article. The context is a post for a class in economics. Since so many current financial commentators take pride in not having taken Economics 101, it is a great illustration of why they are wrong! So many mistakes of this sort are made by financial pundits, including intentional misrepresentations. Prof. Chinn illustrates one of the most frequent errors – not using log scales in charts when they are appropriate. Note the deception it would generate in this example, which actually shows a constant rate of increase.

He also debunks the data conspiracy stories, using several links and good explanations. This post might be the single most profitable thing for investors to read this week.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have another light week for economic data. While personally I watch everything on the calendar, you do not need to! I highlight only the most important items in WTWA. Focus is essential.

The “A” List

- Retail sales (T). The biggest report of the week. The odds of a rate hike will increase if this is positive.

- Michigan sentiment (F). Consumer confidence has been strong, helping to support the stock market.

- Initial claims (Th). The best concurrent indicator for employment trends. Quiet strength is the long-term trend, so a spike would be worrisome.

The “B” List

- Industrial production (Th). Volatile data with a big gain last month. Not much is expected, but this remains important.

- CPI (F). Still not important, but this number will start to approach the Fed’s 2% inflation target as year-over-year gasoline prices stabilize.

- PPI (Th). See CPI above.

- Business inventories (Th). July data, but it is another piece in the Q2 GDP puzzle.

- Crude inventories (W). Often has a significant impact on oil markets, a focal point for traders of everything.

FedSpeak will enter the pre-meeting blackout period after Monday. Fed Governor Lael Brainard has been dovish, so her Monday presentation will get plenty of attention.

Next Week’s Theme

Last week brought us more quiet for the first part of the abbreviated week. Friday was a very different story. The sharp decline, ending a two-month string of quiet days, commanded attention. What was going on?

The instant conclusion was fear of a September rate increase from the Fed. That sets the tone for next week. Everyone will be asking: Should we fear the Fed?

Normally I recommend spending very little time on yesterday’s news. As I wrote a few months ago, investors do not get paid for this knowledge – only pundits who get to sound smart after the fact!

This week is a bit different. Having a good sense about what happened Friday is important to our advance preparation. Here is an abbreviated sequence of events:

- Stock futures were set up for a flat opening, just as we had seen all week.

- Boston Fed President Eric Rosengren, repeating a speech made in August, stated that gradually removing accommodation was the best way to extend the duration of the recovery. The Boston Globe states that this pushed the Dow 400 points lower.

- Stock futures moved lower by about ½ of one percent when the speech was reported.

- Since markets are not expecting a September rate increase, and only a 60% chance of one before the end of the year, the original move attracted a lot of discussion.

- When the Dow declined a little more, CNBC started running the headline that Fed fears were slamming stocks.

- Several commentators cited the possible end of the Fed support for asset prices. Art Cashin fed the fire, noting in mid-afternoon that if stocks were down 300 on just the hint, an actual increase might take them down 1000.

You will see plenty of commentary on these themes. Feel free to add your own thoughts in the comments, including anything I have missed.

As always, I’ll have a few ideas of my own in the conclusion.

Quant Corner

We follow some regular great sources and also the best insights from each week.

Risk Analysis

Whether you are a trader or an investor, you need to understand risk. Think risk first, reward second. I monitor many quantitative reports and highlight the best methods in this weekly update.

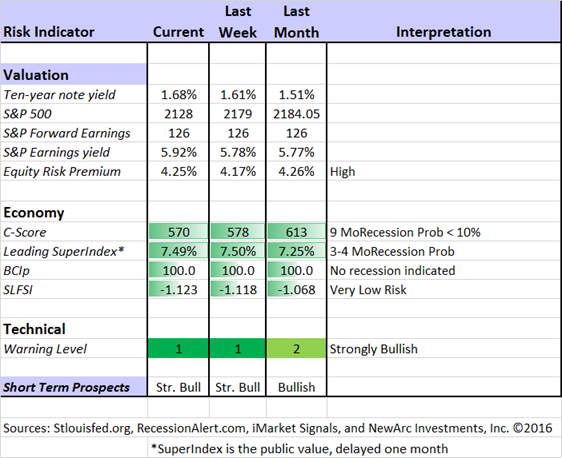

The Indicator Snapshot

The Featured Sources:

Bob Dieli: The “C Score” which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). His subscribers get Monthly reports including both an economic overview of the economy and employment.

The recession odds (in nine months) have nudged closer to 10%.

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature his recession analysis, Dwaine also has a number of interesting approaches to asset allocation.

Doug Short: The Big Four Update, the World Markets Weekend Update (and much more).

The ECRI has been dropped from our weekly update. It was not so much because of the bad call in 2011, but the stubborn adherence to this position despite plenty of evidence to the contrary. Those interested can still follow them via Doug Short and Jill Mislinski. The ECRI commentary remains relentlessly bearish despite the upturn in their own index.

Georg Vrba: The Business Cycle Indicator, and much more. Check out his site for an array of interesting methods. Georg regularly analyzes Bob Dieli’s enhanced aggregate spread, considering when it might first give a recession signal. Georg thinks it is still a year away. It is interesting to watch this approach along with our weekly monitoring of the C-Score.

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies. This week he further explains the possible turning point in earnings. Most people will not understand this until it is too late to profit.

How to Use WTWA

In this series I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. Most readers can just “listen in.” If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide a number of free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!) Free reports include the following:

- Understanding Risk – what we all should know.

- Income investing – better yield than the standard dividend portfolio, and also less risk.

- Holmes – the top artificial intelligence techniques in action.

- Why 2016 could be the Year for Value Stocks – finding cheap stocks based on long-term earnings.

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions or suggestions for new topics.)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and also the best advice from sources we follow.

Felix and Holmes

We continue with a strongly bullish market forecast. Felix is fully invested. Oscar holds several aggressive sectors. The more cautious Holmes also remains fully invested.

Top Trading Advice

Brett Steenbarger is posting many great ideas. Traders should make a daily visit. I sense another book coming! My favorite this week is How to Extract Greater Profits from Our Trading.

If we don’t see the market gain a second wind after our having made an initial entry, the conditional probabilities of getting the move in the other direction continue to increase. We are getting further confirmation that buyers can push the market no higher or sellers can push prices no lower. It is when we see that our initial position is not getting torched and subsequent market behavior is in line with our thesis that we can add a second unit of risk to the trade. We extract more from our trading by being largest when we’re “rightest” and smallest when we’re wrong.

Dr. Brett is also helping with the psychological aspects of your trading – Three Trading Techniques for Building Positive Trading Patterns.

Paul Tudor Jones: Decide on your stop point before you enter a trade. Finance Trends discusses this and some other advice from the great trader. Holmes is barking approvingly.

Another piece of advance preparation is asking yourself whether the prospective trade really has enough edge. Don’t forget to keep the volatility of expected results in mind! Adam H. Grimes takes up this question and provides links to some prior related work.

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read this week it would be the WSJ warning about “structured CD’s.” (subscription required, but you can find it if you Google the title). Many unwitting investors are biting on a pitch that you can double your money in six years with no risk. Some of those needing early access to funds actually lose money on the CD. Performance data are not available for this product, unregulated by the SEC. The WSJ managed to get some results, and they are abysmal.

Stock Ideas

Chuck Carnevale has some good lessons about how to select dividend stocks. For the buy-and-hold income investor he seeks continuity of the dividend as well as limited volatility in the underlying stock. His analysis is rich with stock ideas — some to consider and some to avoid. I hope DIY stock-pickers are reading Chuck’s stories closely. It is important to learn technique and analysis, not just follow someone else’s stock picks.

Abba – no not ABBA – likes T. Rowe Price (TROW). His analysis is based upon a dividend valuation model. I also like the stock, but we write calls against the position to enhance yield.

Market Folly monitors the moves of big investors with good attention to the most recent moves. Warren Buffett now has nearly 80 million shares of Phillips 66 (PSX).

Ready for some biotech stocks? Bret Jensen serves up regular ideas in his forum. His most recent update includes a key stock in the news, Valeant (VRX), which we own as a trade for technical reasons.

Our newest trading model, Holmes, has been contributing an idea each week, a stock we bought for clients a few days ago. I will mention it here, but you can see it a little sooner if you read my new weekly column. I’ll have a “conversation” each week with all three of our models. Since each has a different personality and style, there are often disagreements – especially with me! While we cannot verify the suitability of specific stocks for everyone who is a reader, the ideas may be a starting point for your own research. Holmes may exit a position at any time, and I am not going to do a special post on each occasion. If you want more information about Holmes and exits, just sign up via holmes at newarc dot com and you will get email updates. This week’s Holmes added several stocks, including Cardinal Health Care (CAH).

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read AR every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. This was a really great post. There are several great choices worth reading, including my pick for best advice of the week. My personal favorite is the timely and entertaining advice from Tim Maurer, How Fantasy Ruins Football (and Investing). He discusses several popular financial fantasies. He writes:

Fantasy: Gold is a good hedge against inflation. (Or a good hedge against currency risk, or a good investment. Just take your pick.)

Truth: Of the many traits often attributed to gold as an investment, the only one that really holds up is that the precious metal historically has risen in price when stocks are in deep decline. People tend to buy gold when they are scared (and sell it when they aren’t). But good luck shaving off some of your bullion for bread when The Hunger Games start (or when any dystopian tween books series becomes a reality).

Felix disagrees. That is what makes a market!

I also really liked Ben Carlson’s list of things he learned in his 30’s, especially numbers 9 and 10 (negotiating and saving).

Gil Weinreich of Seeking Alpha takes a helpful look at the “retirement crisis.” There is plenty of good advice. Gil’s series is aimed at investment advisors, but has also attracted many DIY investors, including some who are quite skeptical. It is a good dialogue which figures to help both groups. I am trying both to share and to learn.

Market Outlook

The trade for the next 35 years? Short bonds and long equities! Rupert Hargreaves of ValueWalk reports on Deutsche Bank’s advice and rationale.

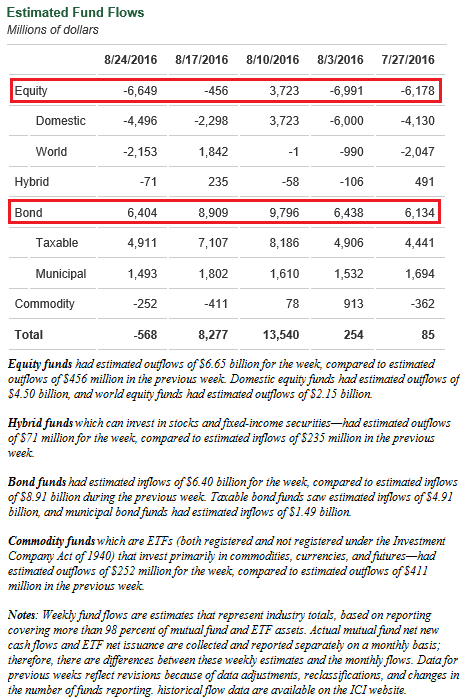

Most investors are ill-positioned for this scenario. HORAN Capital Advisors reports on the continuing dramatic shift between stock and bond fund flows.

Final Thoughts

There really wasn’t any fresh news on Friday, but there must always be an explanation. Consumers demand it! It is a requirement for news reporters. I am reminded of an old book from my student days –a description of how reporters covered a Presidential campaign. The news world was very different in those days. Without instant communications the various news services had quite different deadlines. The wire services had to be the fastest and Walter Mears of the AP was regarded as the best at determining the lead from a complex story. Everyone also wanted to know how the NYT was going to play any news. The Rolling Stone version of the story (from 1972) is an enjoyable read and captures the flavor. Why is it relevant now?

News executives expect solid work, usually judged by reports of other leaders in the field. If you are going to deviate from the accepted lead, you need some special analysis. This is great for investors if they are able to look a little beyond the obvious and tune out the noise. Remember the following:

- Simple dominates – even if it is simplistic.

- Any recent event is a candidate to be the cause.

- Support for popular themes and theories is encouraged. Oil prices were down over 2%, for example. For many this signals economic weakness. Ignore the recent increase in prices.

- Don’t worry if the timing seems a bit wrong. You can explain that. The market was “digesting” the information. Or it was a “delayed reaction.”

- And finally – make it into a big story!

A Reality Check

Not everyone bought into this theme. A number of investment managers questioned the logic. It is hard to sound intelligent when the market is plummeting, unless you have an instant explanation. I do not question Art Cashin’s trader take. There was a lot of money available to traders who perceived the potential for a big directional move. The algorithms joined in, technical levels were violated, and many were waiting for a break from the recent trading range. Those who profit from making sure that people are “scared witless” (TM OldProf) piled on.

Investors have time to analyze and to think more carefully about the causal model. The trading community believes that the economy is weak and fears that the Fed will tighten rates at a bad time. Both elements are necessary. Not only does the Fed see a stronger economy; it is committed to start with modest moves. The early stages of a cycle where very low rates are increased is bullish for stocks and bearish for bonds.

The overwhelming majority of investors made no trades on Friday. Many did not even know what happened until it was over. The vast majority of others are not going to take any action next week. This is good. Investors who try to compete with traders are playing a game they cannot win.

Quiz Answers

-

The manufacturing index of 49.4, if annualized, corresponds to an annual increase in real GDP of 2%. The ISM non-manufacturing index of 51.4 similarly corresponds to real growth of 1%.

One way to think about this is that the economy is still growing even when the secular decline in manufacturing is continuing.

- About 50-50. Even a two-touchdown favorite in the NFL is only about 75% to win. .75 squared is your chance of winning both games. Why should you care? People naturally take apparently obvious events and turn them into sure things. They become way too confident.