by LPL Research

Market expectations for Federal Reserve (Fed) rate hikes continue to be volatile. Expectations for a hike at the September Federal Open Market Committee (FOMC) meeting have fallen from 34% to 24% over the past week, after weaker than expected readings on the August jobs report and Institute for Supply Management (ISM) non-manufacturing Purchasing Managers’ Index (PMI). Though expectations for the September meeting have fallen, market expectations for a December rate increase have held steady over the past week at 56%. Although a rate hike would obviously push short-term rates higher, many investors are more interested in what may happen to longer-term rates, given that intermediate- and long-term high-quality bonds have higher duration, and therefore more interest rate sensitivity, than their short-term counterparts.

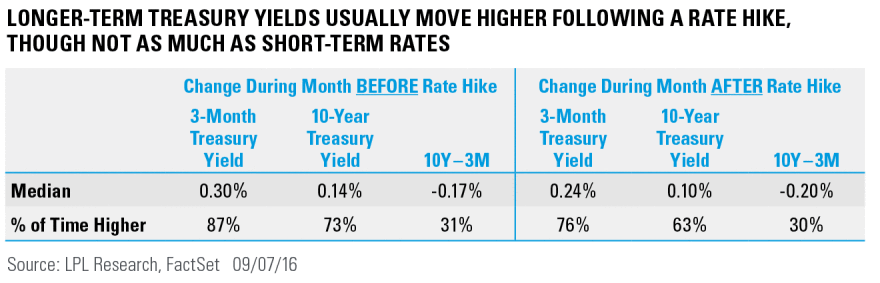

Using history as a guide (see the table below), we can see that the 10-year Treasury does typically increase, but at a slower pace than short-term rates, which results in a flatter yield curve. The majority of the move in both short- and long-term yields tends to come in the lead-up to the hike, though the curve continues to flatten after as well.

A Fed rate hike is not necessarily a positive for investors holding intermediate- and long-term bonds, but investors can take at least some heart in the fact that the full rate hike isn’t likely to carry through to the long end of the curve, and that relatively higher yields (versus short-term bonds) may help offset the impact of potential principal losses over time. Changes in growth and inflation expectations, which continue to be relatively benign, are the major drivers of long-term yields; thus, they are likely of more consequence to intermediate- and long-term bondholders than a Fed rate hike.

Copyright © LPL Research

****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking #1-533609 (Exp. 09/17)