by John West and Amie Ko, Research Affiliates

Key Points

- Investors with both a long horizon and the courage to stay the course during market downturns, often still fail to harvest the structural excess return offered by value strategies whose robustness is supported by both data and theory.

- An inherent desire to conform to conventional wisdom combined with the classic owner–agent conflict may help explain why an equity bias is deemed conventional wisdom and a value bias is no longer seen as a reliable source of excess return.

- To manifest the benefit of all long-term sources of structural excess return—such as value—let’s challenge conventional wisdom and open a candid conversation between owners and agents.

An equity bias is deemed conventional wisdom in its ability to generate a reliable source of excess return, but a value bias no longer is. Statistics and theory reinforce the robustness of value strategies as a structural source of excess return for those with a long horizon and the staying power to hold through periods of adversity. Yet value investing is increasingly overlooked as a meaningful contributor in portfolio construction, and for many investors, is actually viewed as a risk to be diversified away.

We owe it to investors to question why all long-term sources of excess return are not treated equally in their portfolios and to take steps to correct this longstanding and entrenched bias against value in the conventional wisdom of the collective investment community. We examine a possible explanation for why a value bias does not figure more prominently in investors’ conventional wisdom.

The Challenge

Welcome to the classic blind taste test—The Pepsi Challenge. You approach a table with two white cups, one Pepsi and the other Coke. You take a sip of each and select your preference. With an upward sweep, the Pepsi rep sitting behind the table lifts the yellow blind, revealing two glass bottles. Drum roll, please. The results: most Americans preferred Pepsi! The outcome of “The Challenge” was hardly a surprise, and it was deemed one of Madison Avenue’s greatest ad campaigns.1

We’ve got our own “challenge” for you! We compare two anonymous sources of excess return and their long-term characteristics. Both represent robust sources of return premia2 very likely present in your portfolio today. We invite you to take a swig, compare the characteristics, and decide: Which do you prefer?

Lifting the Blind on Value

Lifting the Blind on Value

We won’t keep you in suspense. You’ve made your selection. It’s time to lift the blind!

Strategy A is a buy-and-hold investment in the S&P 500 Index, measured relative to 20-year US Treasuries.3 It represents the excess return of stocks versus bonds, the “go-to” source for leveraging the long-term investment horizon of pensions into meaningfully higher returns. The conventional wisdom is that stocks deliver higher long-term returns than bonds: on average, stocks are more volatile, creating the rational expectation that equity investors will be compensated with higher returns. This notion is further supported by the inherent risk premium for stocks over bonds because stockholders are behind bondholders in the first lien on a company’s resources in bankruptcy.

Strategy B is a value investing approach relative to the S&P 500 and is represented by the Fundamental Index™. Compared to a traditional value strategy, the Fundamental Index more robustly harnesses a “value premium” by using a rebalancing process, which generates a dynamic exposure to value.4 Over 50 years of empirical evidence show that long-term value investors outperform. Why is that? Those who subscribe to efficient markets argue that value investors extract a risk premium. Others contend investors have preferences broader than risk and return,5 making them prone to behavior that results in a value anomaly.

Although we don’t know which strategy you chose, we do know most investors make a much bigger bet on Strategy A than on Strategy B. In a typical pension plan, equities represent 60% of aggregate stock and bond holdings, whereas value constitutes less than 20% of all equity holdings.6

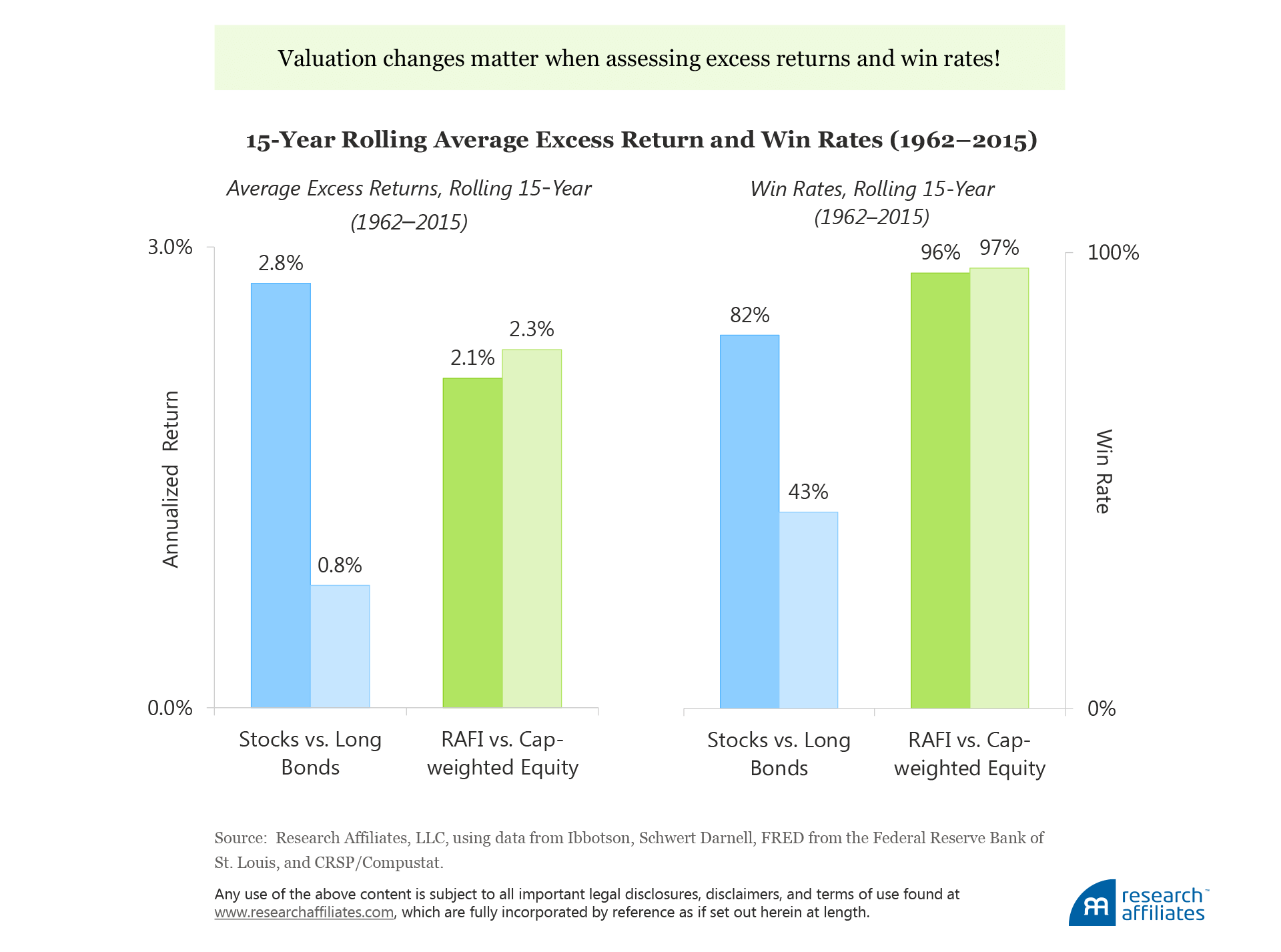

If the combined 15-year win rate7 of 82% and an average annualized excess return of 2.8% leads to a 2-to-1 allocation of stocks to bonds, why doesn’t the combination of a 96% win rate and an average annualized excess return of 2.1% over the same rolling 15-year span lead to a similar size bet on value? There seems to be a disconnect: Owners of capital should be demanding an overwhelming value bias8 in their portfolios.

What Puts the “Convention” in Conventional Wisdom?

Personal experience feeds into expectations, which in turn anchor the perception of what constitutes conventional wisdom. It then follows that the range of excess returns experienced by investment professionals over their careers must influence their investment decision making. For instance, a 65-year old who began a 40-year career in 1975 witnessed stocks soar by an annualized 7.8% net of inflation, beating the return of long bonds by 3.7% a year. That’s a heck of an equity return premium baked into her frame of reference.

When we repeat this exercise across current practitioners divided into five-year age cohorts from ages 25 to 70, the collective investment experience over the 1970–2015 period reveals that nearly 90% has lived through sustained periods of soaring stock prices. Collectively, these investors experienced stocks outperforming bonds by an average of 1.9% a year.9 Not surprisingly, the “stocks for the long run” mantra has dominated the conventional thinking around portfolio construction. The collective experience effectively “defaults” to a belief that this relationship should continue.

Indeed, all age cohorts, except for one, have experienced stocks outperforming bonds by at least 1.0% a year. The single cohort whose members over their careers have experienced stocks underperforming bonds is the now 35- to 40-year-old who began working at the peak of the tech bubble. From January 2000 to December 2015, equities delivered an annualized real return of 1.9%, underperforming long bonds by 2.9% a year. Understandably, this cohort may not be as enthusiastic about the stocks-for-the-long-run story.

During the same 45-year period ending 2015, investment practitioners’ personal experience with value investing has been far less buoyant, and the range of outcomes much more modest, than their experience with equities versus bonds. These investors have known value investing to deliver and average excess return of 1.1% a year, about half the annualized excess return generated by stocks over bonds. Although investors could not invest in the Fundamental Index—introduced only 12 years ago by Arnott, Hsu, and Moore (2005)—over the entire period, the principle of value investing has been well understood and practiced since Graham and Dodd (1934) first endorsed it. In the last decade, current practitioners have tangibly felt value investing’s severe disappointments alongside brilliant value-add generated by stocks versus bonds; not only are these recent events shared by nearly everyone in today’s investment community, they may also unconsciously and more heavily weigh on our memories and expectations, crowding out the wins experienced from value investing in earlier years.

Upon Closer Scrutiny…

Upon Closer Scrutiny…

Let’s look more closely at equities’ long-term outperformance. Particularly for the last 35 years, more than half of stocks’ real return came from rising valuations as dividend yields tumbled off their peak of 6.4% in August 1982 to rest at a meager 2.1% as of June 30, 2016. This drop is equivalent to the price-to-dividend multiple soaring from 16 to 48 times, a three-fold increase in the value assigned to each dollar of dividend.

Without the remarkable tailwind from rising valuations, the stocks-for-the-long-run conventional thinking loses much of its punch. From 1962 to 2015, the “true” average excess return—which excludes the impact of valuations on the returns of stocks and adjusts for the return impact of interest rate movements on bonds—fell from 2.8% to 0.8% on a rolling 15-year basis.10 The corresponding 15-year win rate was halved from 82% to 43%, odds not even as good as a coin toss! Value investing’s performance, after adjusting for valuation changes, actually improved slightly from 2.1% to 2.3%, and the 15-year win rate edged up from 96% to 97%, suggesting the presence of historical structural alpha, not at all reliant on becoming more expensive.11

Reconciling Owner’s Dream with Agent’s Sleepless Night

Reconciling Owner’s Dream with Agent’s Sleepless Night

Reverting to the challenge we posed earlier—the choice between Strategy A and Strategy B—we can see how selection is influenced by the decision maker’s experience.

The choice is also impacted by the decision-maker’s role: owner or agent. The misalignment between beneficiaries and their agents, fueled by the classic time-horizon conflict and an inherent desire to conform to conventional wisdom, may be factors in the lack of a prevalent value bias as well as to falling short of attaining the “owner’s dream”—that is, reaching the asset owner’s financial goal manifested over the long run by stacking multiple sources of risk premium. For example, a 60/40 portfolio is expected to produce a long-term real return of approximately 1.0% a year.12 If the 60% equity bucket holds value stocks, the value premium of 1.5–2.0% boosts the portfolio’s prospective long-term real return by another 1.2–1.5 times a year!

Principal–agent conflicts arise from contradictory motivations between the owner (the principal)13 and the person delegated to act on behalf of the owner (the agent). The time horizon for owners can span decades. For example, according to a 2015 study by Willis Towers Watson (McFarland, 2016), the average duration of pension plan obligations of more than 400 Fortune 1000 companies was approximately 13 years.14 Among defined contribution plans, for which lifecycle/target date funds are among the most popular investment vehicles, over 70% of all lifecycle/target date assets are invested in vintages of 2025 or later, with the largest amount of assets in the 2030 vintage (15-year horizon).15 The time horizon for agents is the span over which their own performance is judged—years or even shorter time periods. As such, agents face a powerful incentive to minimize short-term drawdowns relative to peers and benchmarks.

Long-term investors, by contrast, have time on their side to cushion short-term fluctuations in performance. For instance, during the global financial crisis from January 2007 to February 2009, an equity investor underperformed a bond investor (Strategy A) by 58%. Value investors (Strategy B) also experienced disappointment. From January 1994 to February 2002, a Fundamental Index investor underperformed an investor in the plain-vanilla S&P 500 by 22%.16 Investors who sold at the troughs of these drawdowns experienced pain, and then locked in their losses. Others benefited.

“Buy low, sell high” is easy to say and very, very hard to do because what’s cheap today has typically hurt us badly on the way down. Continuing to invest in this same asset, even if future returns are poised to be marvelous, takes a hardy soul. Courageous capital owners who hunker down and fight against the natural human instinct to eliminate whatever inflicts pain and loss (and to seek more of what gives joy and profit) are rewarded both by keeping current yield and regaining lost capital as prices rebound to fair value. Such resilient investors often reap handsome excess returns17 following bear-market troughs.

Conclusion

Investors appear to be conditioned to honor the virtue of some long-term sources of excess return, but not others. Can we learn from this seeming contradiction, and if so, how do we apply what we learn?

In the Pepsi Challenge, some of the tests used two cups arbitrarily labeled L and S. Studies of the Pepsi Challenge, such as McClure et al. (2014) and Woolfolk, Castellan, and Brooks (1983), have shown that labels, even if seemingly unrelated to the two sodas, can influence the decision of taste testers. The perceived preference creates a cognitive bias, or framing effect, which impacts a person’s decision.

Likewise, a framing effect may sway investor perceptions of long-term sources of excess return. For instance, the success of the stocks-for-the-long-run mantra over the last three decades leaves a refreshing aftertaste for investment practitioners. Investors’ past lukewarm encounters with value investing—especially during the recent difficult decade for value—may similarly unconsciously affect their assessment of a value strategy. Such experiences, in turn, frame what’s conventional and prudent, which agents prefer.

As a first step toward bucking the constraints of conventional wisdom, we should acknowledge that cognitive biases may surreptitiously influence our investment decision making. We owe it to ourselves to question why all long-term sources of excess return are not treated equally in our portfolios. A candid conversation between owners and agents should also help: Agents may need to justify to asset owners why value is de-emphasized in their portfolios, and owners have a responsibility to extend agents’ measurement horizon to be consistent with what’s required to harvest multiple sources of return premiums. It’s time to act: agents deserve restful nights, and beneficiaries deserve the “owner’s dream.”

Copyright © Research Affiliates