Why Global Bonds? This.

by Fixed Income AllianceBernstein

August 29, 2016

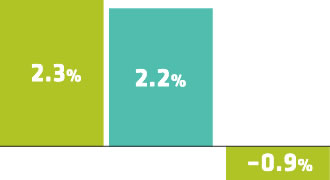

Hedged global bonds captured 96% of US bonds’ positive returns over the last 25 years. And, they preserved more capital during down periods, with a down capture of just 65%. Worried about negative rates abroad? Hedging into dollars boosts low and negative yields into competitively positive ones.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein