by Don Vialoux, Timingthemarket.ca

Economic News This Week

August Empire State Manufacturing Index to be released at 8:30 AM EDT on Monday are expected to increase to 4.00 from 0.55 in July

July Housing Starts to be released at 8:30 AM EDT on Tuesday are expected to slip to 1.180 million units from 1.189 million units in June.

July Consumer Prices to be released at 8:30 AM EDT on Tuesday are expected to be unchanged versus a gain of 0.2% in June. Excluding food and energy, July Consumer Prices are expected to increase 0.2% versus a gain of 0.2% in June.

July Capacity Utilization to be released at 9:15 AM EDT on Tuesday is expected to increase to 75.6% from 75.4% in June. July Industrial Production is expected to increase 0.3% versus a gain of 0.6% in June.

FOMC Minutes for the July 27th meeting are released at 2:00 PM EDT on Wednesday

Weekly Initial Jobless Claims to be released at 8:30 AM EDT on Thursday are expected to slip to 265,000 from 266,000 last week.

August Philadelphia Fed Index to be released at 8:30 AM EDT on Thursday is expected to improve to 0.5 from -2.9 in July

July Leading Economic Indicators to be released at 10:00 AM EDT on Thursday are expected to increase 0.4% versus a gain of 0.3% in June.

Canadian July Consumer Prices to be released at 8:30 AM EDT on Friday are expected to be unchanged versus a gain of 0.2% in June. On a year-over-year basis, CPI is expected to gain 1.5%. Excluding food and energy, July CPI is expected to remain unchanged versus unchanged in June.

Canadian June Retail Sales to be released at 8:30 AM EDT on Friday are expected to increase 0.6% versus a gain of 0.2% in May.

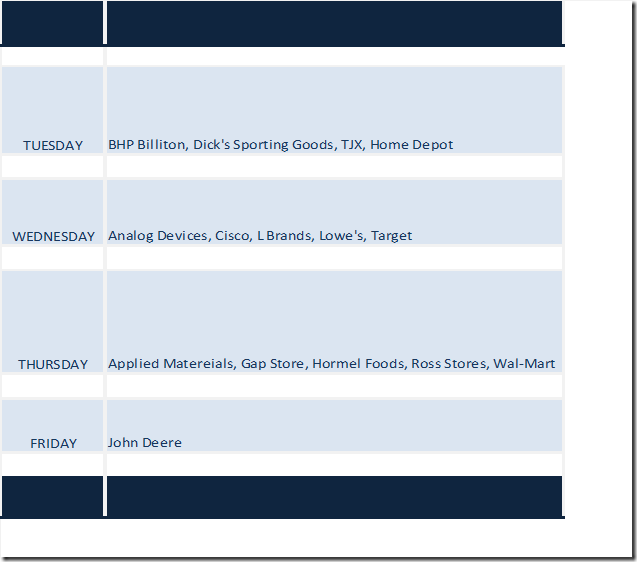

Earnings News This Week

The Bottom Line

Technical, seasonal and fundamental factors point to start of an intermediate correction by equity markets and economic sensitive this month and into September. Traders and seasonal investors should respond accordingly.

Observations

North American equity indices were virtually unchanged last week. Intermediate upside momentum, started in late June, has dissipated. Short term momentum indicators are overbought and showing early signs of rolling over despite U.S. equity indices reaching all-time highs and the TSX Composite Index reaching a one year high.

Volatility in equity markets remains low. Technical signs of an unusual event, that could trigger a spike in volatility, have yet to surface.

Economic news this week (CPI, Empire, Philly Fed, LEI) is expected to be neutral/slightly positive for equity markets. Traders will watch for comments from FOMC meeting minutes on Wednesday to examine if and when the Federal Reserve will raise its Fed Fund rate. More input on U.S. interest rates will be offered next week at the annual Jackson Hold Economic Conference.

Second quarter reports on both sides of the border are winding down. 91% of S&P 500 companies have reported to date. Reporting companies recorded a year-over-year decline of 3.5% for earnings and 0.2% decline for revenues.

Prospects for the third and fourth quarter earnings and revenues continue to trend lower: 62 S&P 500 companies have issued negative third quarter guidance while 28 companies have issued positive guidance. According to FactSet, third quarter earnings by S&P 500 companies are expected to decline 2.0% (versus a decline of 1.7% estimated last week) and fourth quarter earnings are expected to increase 5.5% (versus a gain of 5.7% estimated last week)

Earnings reports this week will focus on retail companies: 21 S&P 500 companies are scheduled to report (including 3 Dow Jones Industrial Average companies: Cisco, Home Depot and Wal-Mart).

Technical action by individual S&P 500 stocks last week was quietly bullish: 22 stocks broke above resistance and 8 broke below support. Energy stocks were notably on the list of stocks breaking resistance. Material and Financial stocks were notably on the list of stocks breaking support. Number of S&P 500 stocks in an intermediate uptrend: 335 (up 1 last week), number in an intermediate neutral trend: 60 (Up 3) and number in an intermediate downtrend: 115.

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 12th 2016

Green: Increase from previous day

Red: Decrease from previous day

Calculating Technical Scores

Technical scores are calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

Higher highs and higher lows

Intermediate Neutral trend: Score 0

Not up or down

Intermediate Downtrend: Score -2

Lower highs and lower lows

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

The S&P 500 Index gained 1.18 points (0.05%) last week. The Index reached an all-time high on Thursday. Intermediate trend remains up. The Index remains above its 20 day moving average. Short term momentum indicators are trending down.

Percent of S&P 500 stocks trading above their 50 day moving average (Also known as the S&P 500 Momentum Barometer) dropped last week to 71.00% from 73.40%. Percent remains intermediate overbought and trending down.

Percent of S&P 500 stocks trading above their 200 day moving average. increased last week to 79.80% from 78.80%. Percent remains intermediate overbought.

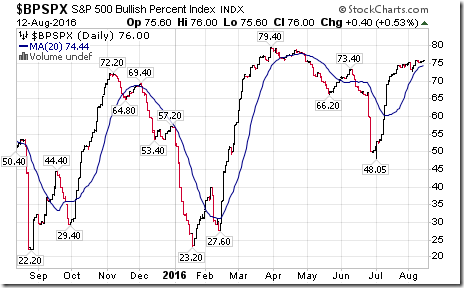

Bullish Percent Index for S&P 500 stocks increased last week to 76.00% from 75.80% and remained above its 20 day moving average. The Index remains intermediate overbought.

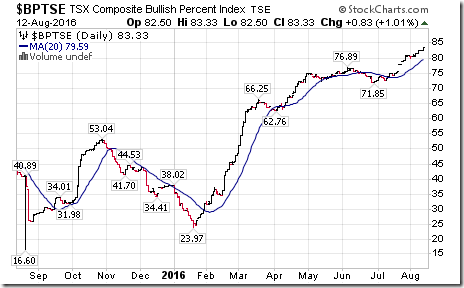

Bullish Percent Index for TSX Composite stocks increased last week to 83.33% from 81.67% and remained above its 20 day moving average. The Index remains intermediate overbought.

The TSX Composite Index added 98.68 points (0.67%) last week. Intermediate trend remains up (Score: 2). Strength relative to the S&P 500 Index changed to Positive from Neutral (Score: 2). The Index remained above its 20 day moving average (Score: 1). Short term momentum indicators are trending up (Score: 1). Technical score improved last week to 6 from 2.

Percent of TSX stocks trading above their 50 day moving average (also known as the TSX Composite Momentum Barometer) increased last week to 71.79 from 69.53. Percent remains intermediate overbought and rolling over.

Percent of TSX stocks trading above their 200 day moving average slipped last week to 79.91% from 83.26%. Percent remains intermediate overbought and showing early signs of rolling over.

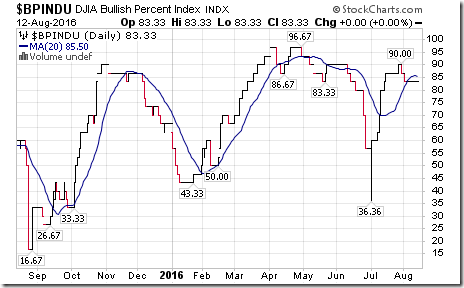

The Dow Jones Industrial Average gained 32.94 points (0.18%) last week. The Average reached an all-time high on Thursday. Intermediate trend remains up. Strength relative to the S&P 500 Index remains negative. The Average remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score increased last week to 2 from 0.

Bullish Percent Index for Dow Jones Industrial Average stocks was unchanged last week at 83.33% and remained below its 20 day moving average. The Index remains intermediate overbought and showing signs of rolling over.

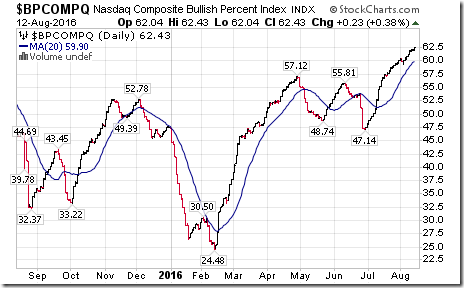

Bullish Percent Index for NASDAQ Composite stocks increased last week to 62.43% from 60.84% and remained above its 20 day moving average. The Index remains intermediate overbought.

The NASDAQ Composite Index added 11.78 points (0.23%) last week. The Index reached an all-time high on Tuesday. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. The Index remains above its 20 day moving average. Short term momentum indicators continue to trend down. Technical score remained last week at 4.

The Russell 2000 Index slipped 1.48 points (0.12%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained positive. The Index remained above its 20 day moving average. Short term momentum indicators returned to down. Technical score last week remained at 4.

The Dow Jones Transportation Average dropped 59.39 points (0.75%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index remained negative. The Average remained below its 20 day moving average. Short term momentum indicators are trending down. Technical score remained last week at -4.

The Australia All Ordinaries Composite Index added 40.70 points (0.73%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remains neutral. The Index remains above its 20 day moving average. Short term momentum indicators are trending down. Technical score remained last week at 2.

The Nikkei Average gained 665.47 points (4.09%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remained neutral. The Average moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 0 from -4.

Europe iShares gained $0.84 (2.18%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index improved to Positive from Neutral. Units remain above their 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from 0.

The Shanghai Composite Index added 73.97 points (2.48%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index improved to neutral from negative. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from -2.

Emerging Markets iShares gained $0.86 (2.35%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. Units remain above their 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 6 from 4.

Currencies

The U.S. Dollar Index slipped 0.50 (0.52%) last week. Intermediate trend remains up. The Index remains below its 20 day moving average. Short term momentum indicators remain mixed.

The Euro added 0.78 (0.70%) last week. Intermediate trend remains neutral. The Euro remains above its 20 day moving average. Short term momentum indicators are mixed.

The Canadian Dollar added US 1.25 cents (1.65%) last week. Intermediate trend remains down. The Canuck Buck moved above its 20 day moving average. Short term momentum indicators are trending up.

The Japanese Yen added 0.54 (0.55%) last week. Intermediate trend remains up. The Yen remains above its 20 day moving average. Short term momentum indicators are trending up, but are overbought and showing early signs of rolling over.

The British Pound dropped 1.62 (1.24%) last week. Intermediate trend remains down. The Pound remained below its 20 day moving average. Short term momentum indicators are trending down.

Commodities

Daily Seasonal/Technical Commodities Trends for August 12th 2016

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index added 0.88 (0.48%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index moved back above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical improved last week to -2 from -4.

Gasoline dropped $0.01 per gallon (0.72%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. Gas remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at -2.

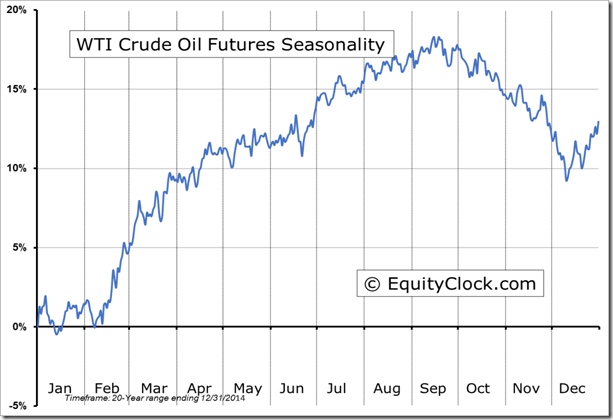

Crude Oil added $2.69 per barrel (6.44%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index turned positive on Friday. Crude moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 6 from 0.

Natural Gas dropped $0.18 per MBtu (6.50%) last week. Intermediate trend changed last week to down from up on a move below $2.59. Strength relative to the S&P 500 Index changed to negative from neutral. “Natty” dropped below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week to -6 from 4.

The S&P Energy Index added 6.24 points (1.24%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index changed to neutral from negative. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score increased last week to 2 from 0.

The Philadelphia Oil Services Index slipped 0.93 (0.58%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index improved to neutral from negative. The Index remained below its 20 day moving average/ Short term momentum indicators are trending up. Technical score improved last week to -2 from -4.

Gold slipped $1.20 per ounce (0.09%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained neutral. Gold remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score last week remained at 2.

Silver fell $0.12 per ounce (0.61%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained neutral. Silver remained below its 20 day moving average. Short term momentum indicators are trending down. Technical score remained last week at 0. Strength relative to Gold is neutral.

The AMEX Gold Bug Index added 4.13 points (1.50%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained positive. The Index remained above its 20 day moving average. Short term momentum indicators have turned down. Technical score slipped last week to 4 from 6.

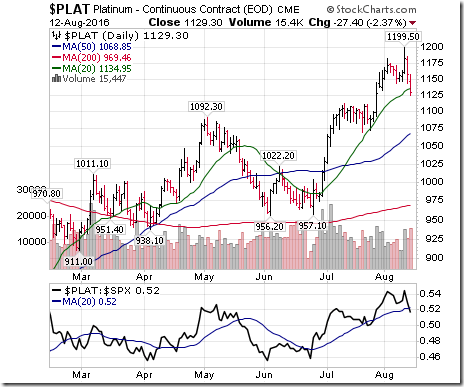

Platinum dropped $22.20 per ounce (1.93%) last week. Trend remains up. Relative strength changed to neutral from positive. PLAT fell below its 20 day MA. Momentum: down.

Palladium dropped 5.50 per ounce (0.79%) last week. Intermediate trend remains up. Relative strength changed to neutral from positive. PALL dropped below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped to 0 from 4.

Copper slipped 0.014 cents per lb. (0.65%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index remains negative. Copper remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score remained last week at -4.

S&P Metals & Mining Index slipped 1.12 points (0.17%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. The Index remains above its 20 day moving average. Short term momentum indicators are trending down. Technical score remained last week at 4

Lumber added 1.50 (0.46%) last week. Trend remains up. Relative strength improved to neutral from negative. Lumber remained below its 20 day MA. Momentum has turned down.

The Grain ETN added $0.17 (0.60%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. Units remain below their 20 day moving average. Short term momentum indicators are trending up. Technical score remained at -4

The Agriculture ETF added $0.42 (0.86%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index improved to neutral from negative. Units remained above their 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 0 from -2.

Interest Rates

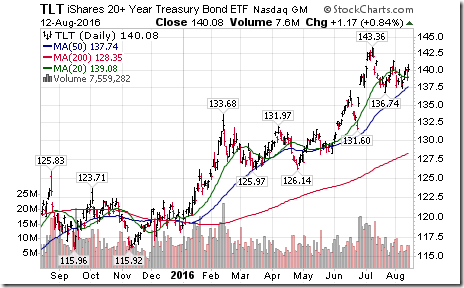

Yield on 10 year Treasuries dropped 6.7 basis points (4.24%) last week. Intermediate trend remains down. Yield dropped below its 20 day moving average. Short term momentum indicators are trending down.

Conversely, price of the long term Treasury ETF gained $2.08 (1.51%) last week. Intermediate trend remains up. Units moved above their 20 day moving average.

Volatility

The VIX Index added 0.16 (1.40%) last week. Intermediate trend remains down. The Index remains below its 20 day moving average.

Sectors

Daily Seasonal/Technical Sector Trends for August 12th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

StockTwits Released on Friday @EquityClock

Price of oil surges, starting to carve out the right shoulder of an inverse H&S pattern.

Technical action by S&P 500 stocks to 10:00: Quiet. Breakouts: $BBBY, $HRB. Breakdown: $NAVI.

Editor’s Note: After 10:00 AM EDT, one more stock broke resistance to extend an intermediate uptrend: Yum Brands

WALL STREET RAW RADIO WITH MARK LEIBOVIT

AND SPECIAL GUEST DINESH D’SOUZA – AUGUST 13, 2016

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/c80c1b8bbec605894923cd7df070d846.png)

![clip_image002[7] clip_image002[7]](https://advisoranalyst.com/wp-content/uploads/2019/08/e8e471154f9fe4738006561dec8ad828.png)

![clip_image002[9] clip_image002[9]](https://advisoranalyst.com/wp-content/uploads/2019/08/8ae5f8201800338b026b3e8d93cb4c67.png)