What Do New Highs for the Nasdaq Mean?

by LPL Research

The Nasdaq joined the party of new all-time highs last week on Friday, making its first all-time high since July 20, 2015. With the S&P 500 and Dow both already making new highs, the tech-heavy Nasdaq is finally starting to lead. As we noted in this week’s Weekly Market Commentary, “Earnings Update: We Were Hoping for More,” technology has been one of the stars this earnings season. As a result, technology is the top performing sector so far this quarter.

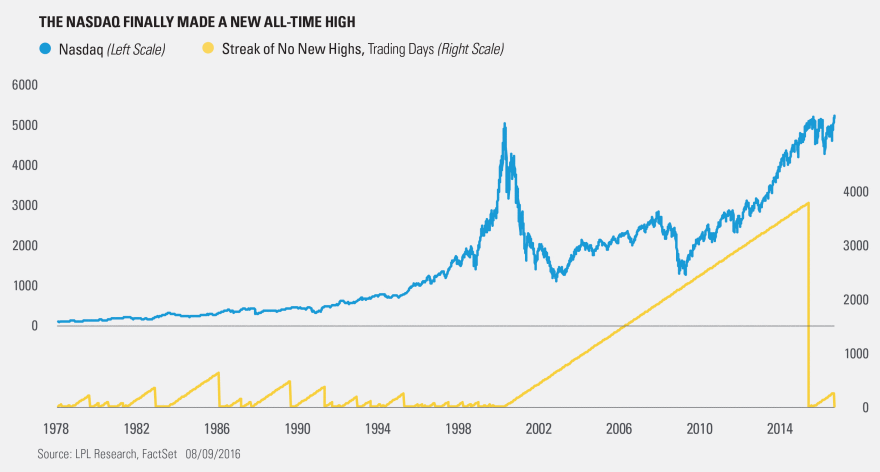

This chart shows how long the Nasdaq has gone without making new all-time highs. The recent streak of 264 days was the sixth-longest streak ever without a new all-time high. Of course, it was nowhere near the streak of 15 years from 2000–2015 without a new high.

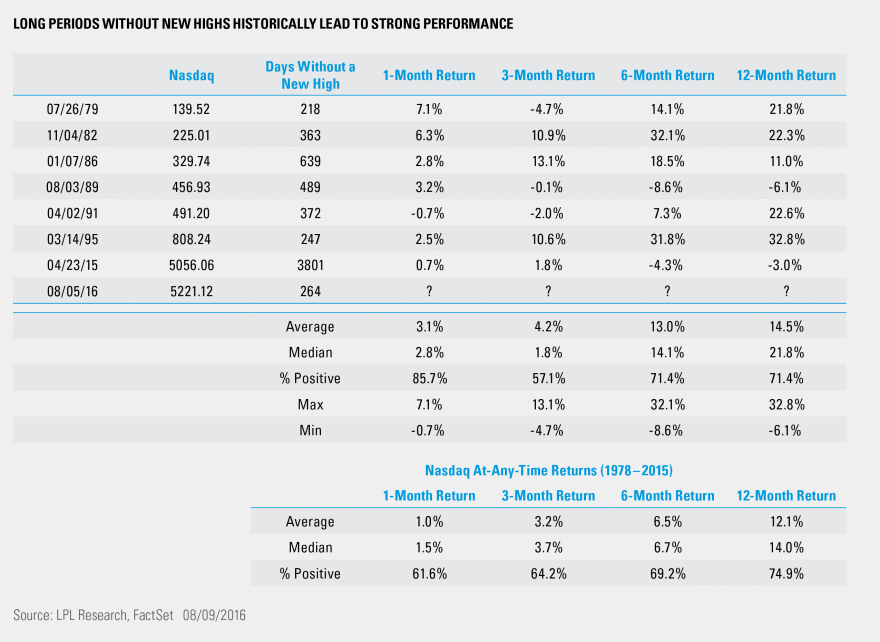

The big question now is: What happens after the Nasdaq goes a long time without a new high? There have been seven other times the Nasdaq has gone more than 200 days without a new all-time high and the results are rather strong going forward: up 3.1% on average a month later, 4.2% three months later, 13.0% six months later, and 14.5% a full year later. All of those returns are well above the average returns at any time.

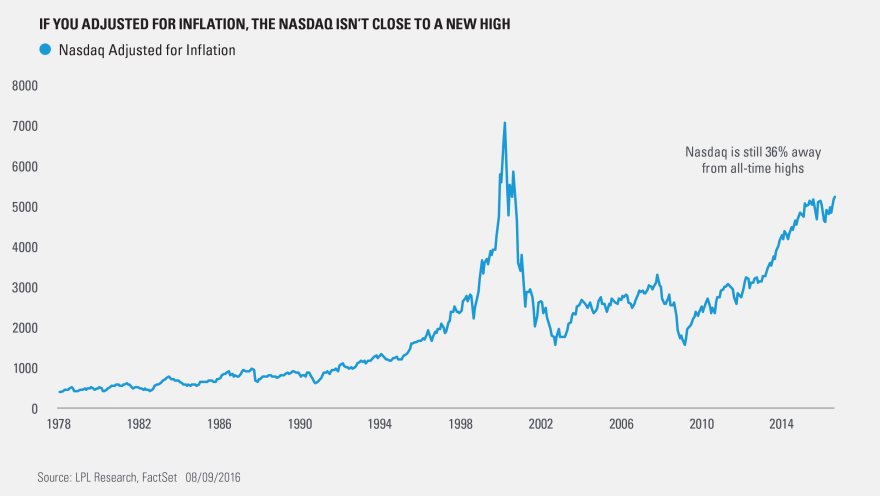

Lastly, the Nasdaq is making new highs, but this is on a nominal basis. If you adjust for inflation (or the real price), the Nasdaq peaked above 7,000 back in March 2000 and it is currently 36% below that real all-time high. So if you invested in March 2000, you are really down when factoring in the effects of inflation. This doesn’t sound like much of a positive, but it could be viewed as constructive, as it could mean there is plenty of room for the Nasdaq to run.

Although technology has lagged much of this year, it is finally turning the corner and leading, thanks to an improving earnings backdrop. Given tech is the largest component of the S&P 500, this is a very good sign overall for markets. Given the improving earnings outlook, coupled with a streak of more than 200 days without a new high, we would expect technology may continue to outperform for the remainder of this year.

***

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Stock investing involves risk including loss of principal.

Because of its narrow focus, specialty sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Nasdaq Composite Index measures all Nasdaq domestic and non-U.S.-based common stocks listed on the Nasdaq stock market. The index is market-value weighted. This means that each company’s security affects the index in proportion to its market value. The market value, the last sale price multiplied by total shares outstanding, is calculated throughout the trading day, and is related to the total value of the index. It is not possible to invest directly in an index.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking #1-524728 (Exp. 08/17)

Copyright © LPL Research