by Don Vialoux, Timingthemarket.ca

Editor’s Note: Jon Vialoux is scheduled to appear on BNN’s Market Call today at 1:00 PM EDT

Pre-opening Comments for Wednesday August 10th

U.S. equity index futures were slightly higher this morning. S&P 500 futures were up 2 points in pre-opening trade.

Walt Disney slipped $1.27 to $95.40 despite reporting slightly higher quarterly earnings and revenues.

Michael Kors dropped $2.11 to $48.00 after lowering its fiscal second quarter sales guidance.

Gold gained US$11.40 to $1358.10 per ounce. Gold stocks are expected to open nicely higher.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/08/09/stock-market-outlook-for-august-10-2016/

Note seasonality charts on the VIX Index, Wholesale Inventories and the Japanese Yen

Observations

Quiet day on North American equity markets yesterday! The S&P 500 Index and NASDAQ Composite Index touched new all-time highs, but on declining volume. No follow through! Rotation away from economic sensitive sectors continued.

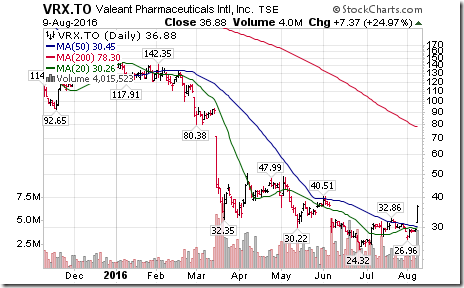

All of the gain recorded by the TSX Composite Index and TSX 60 Index yesterday came from the 25% gain by Valeant.

StockTwits Released Yesterday @EquityClock

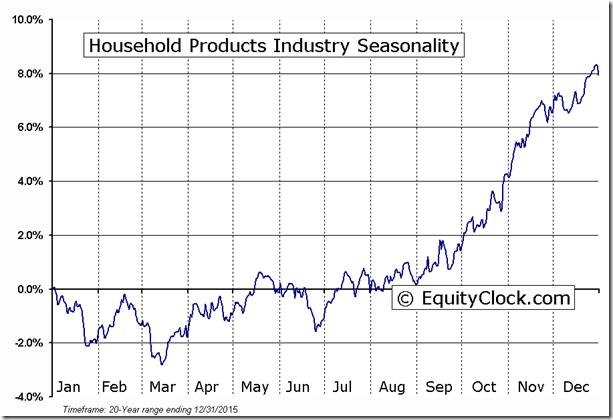

Average start to seasonal strength for Household Products Industry is today.

Technicals for S&P 500 stocks to 10:10: Quietly bearish. More utilities break support.

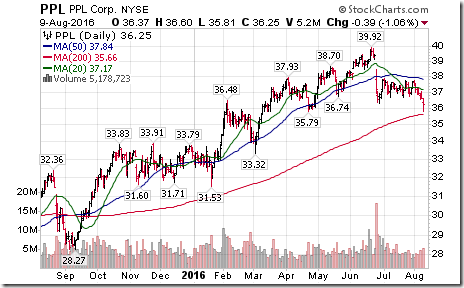

$PPL, $NRG, $DVA

Editor’s Note: After 10:10 AM EDT, Acuity Brands broke resistance and Public Service Enterprise broke support

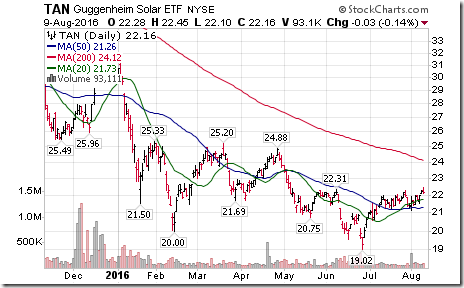

Nice breakout by $TAN above $22.31 completing reverse Head & Shoulders pattern.

Finally, technical signs of a bottoming pattern by $VRX on a break above resistance at $32.86,

More gold equities breaking! Nice breakout by $FNV.CA above $104.19 extending intermediate uptrend

Germany iShares $EWG breaks resistance at $26.25 completing a double bottom pattern.

Editor’s Note: The breakout by EWG was triggered by a breakout by the DAX Index above $10,747.38

Trader’s Corner

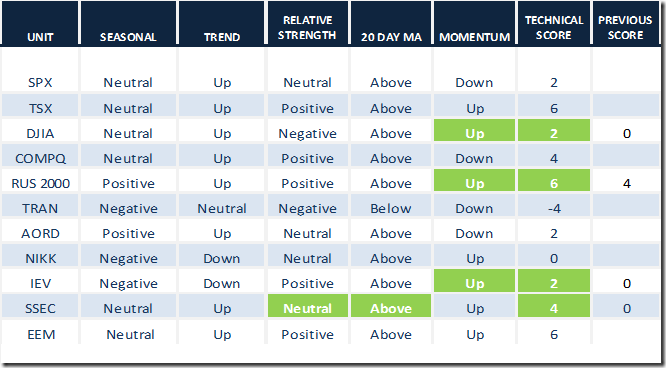

Daily Seasonal/Technical Equity Trends for August 9th 2016

Green: Increase from previous day

Red: Decrease from previous day

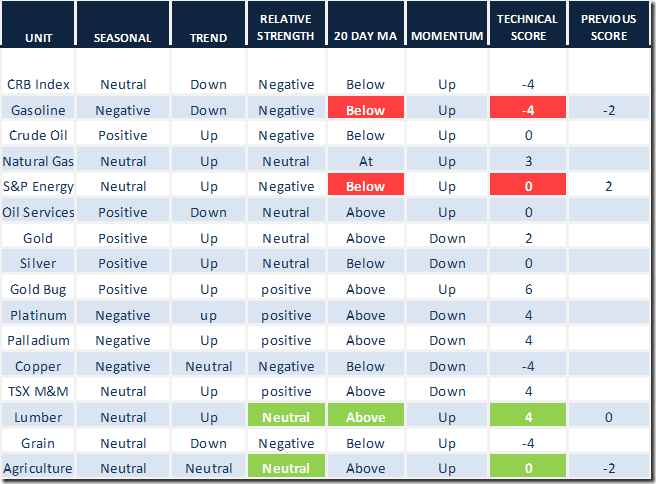

Daily Seasonal/Technical Commodities Trends for August 9th 2016

Green: Increase from previous day

Red: Decrease from previous day

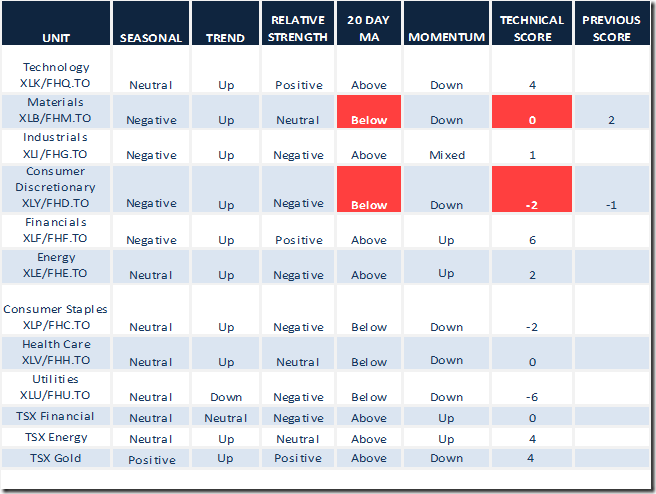

Daily Seasonal/Technical Sector Trends for August 9th 2016

Green: Increase from previous day

Red: Decrease from previous day

Adrianne Toghraie’s “Trader’s Coach” column

|

|

Executing Planned Exit Strategy

By Adrienne Toghraie, Trader’s Success Coach

It has been said by many top traders that knowing where to exit a trade is the art of trading. I know several people who have tested random entries with good money management who have proven that you can earn profits with good exit strategies.

Many traders have a good plan for their exit strategy, but talk themselves out of it.

Why do traders talk themselves out of a good strategy for exits when they have proven in testing that their plan would work if they just followed it?

Fear of loss

As you see profits slipping away, very often emotions start rising. When emotions get to a tipping point of too much psychological pain you pull the plug on the trade. If you avoid losses you set yourself up for not trusting in your rules. If you would have earned profits, you become angry at yourself and do not trust your ability as a trader. Either way, when you do not follow your rules, you set up negative anchors that condition inconsistency.

Solution:

1. Understand where you will start feeling uncomfortable about a trade going against you by revisiting it your mind’s eye.

2. Make it part of your rules to allow yourself to exit one beat after you start to feel uncomfortable, even though you know that for you to make money on the trade you must adhere to your ideal stop. At least you are following pre-determined rules of your making.

3. Keep a journal that shows what you would have earned had you stayed with your stop and what your decision to come out early has cost you. You might have to do this in simulation if you do not have the funds to train yourself for proper trading.

4. Each time you are in the same position of wanting to exit before the trade has run its full course, stretch one more notch.

5. If your trading works better by exiting too early, then you should go back to looking at the rules of your strategy. If you would have earned more money in following your rules, revisit each trade in your mind’s eye and play back a scenario where you do the right thing over and over. Notice if you feel comfortable in hindsight. If you do not, then you need deeper work with a trader’s coach.

Fear of being wrong

There are those traders who cannot allow themselves to have a trade go against them even if they are following their rules. They cannot accept the fact that part of the overall win in trading has to come from the acceptance of losses.

Solution:

1. Define being wrong as not following rules.

2. Reward yourself with external praise from yourself and others when you accept a loss that is a result of following your plan. You can start by going back to trades that were losses and see yourself on a movie screen patting yourself on the back and verbally out loud giving yourself praise and have others do the same. Then do the same thing internally feeling the associated emotions.

3. Now you’re ready for real time. Give yourself the same praise and instruct others to give you praise and add a physical reward.

4. If this self-induced conditioning still leaves you with the feeling of being wrong, then you need help, and I suggest my Trader’s Evaluation.

Fear of being right

There are those traders who do not allow themselves to be successful in trading because they have unresolved issues of the past that make them feel guilty or undeserving.

Solution:

1. Make an agreement to give a percentage of your winning trades to others. For some traders feeling the obligation to others makes them make better choices.

2. Choose to do activities that will make you feel good about yourself such as joining Toastmasters International or volunteering for service to others.

3. Repeat affirmations each day such as: “I am a worthy person who deserves profits in my trading as long as I follow my rules.”

4. Realize that you might have deep-seated issues that you should address with a trader’s coach.

Conclusion

When you have tested good results from following your exit strategy, the only thing between you and earning profits are issues within yourself that should be dealt with. If you let these issues continue, they will set up negative conditioning. Handle issues from the beginning so you can realize the profits you deserve.

Visit TradingOnTarget.com for Adrienne’s Free Newsletter

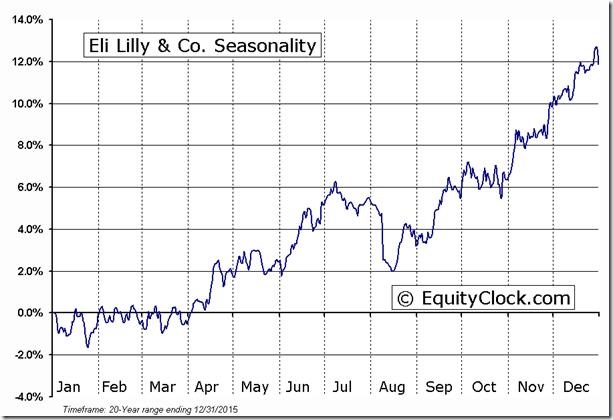

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

S&P 500 Momentum Barometer

The Barometer slipped 2.60 to 69.80 . It remains intermediate overbought and trending down

TSX Composite Momentum Barometer

The Barometer slipped 2.46 to 73.93. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca