Gained in Translation: How to Turn Negative Yields Positive

by Erin Bigley, Senior Portfolio Manager, Fixed Income AllianceBernstein

In today’s environment of heightened market volatility, it’s important to maintain interest rate exposure. But we like to take interest rate exposure through the global bond market as opposed to just the US bond market.

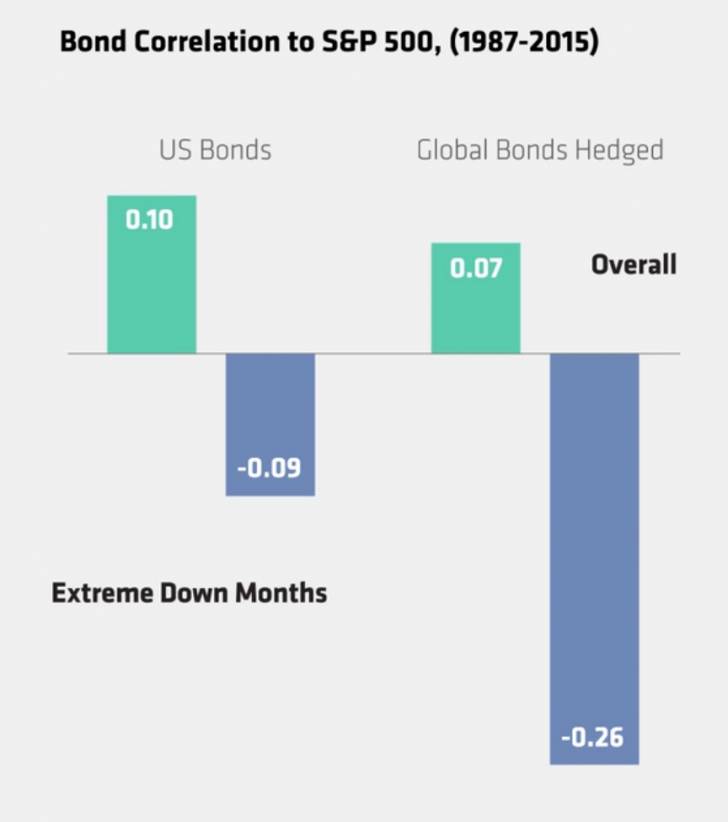

Both markets provide a nice offset to US stocks. You can see that in normal environments, they both have very low correlation to the US stock market. But the real power in global bonds comes from extreme downside environments for stocks. When stocks are off more than one standard deviation, global hedged bonds tend to provide an even more negative correlation to stocks than US bonds alone. But global bonds provide not just a defense against US stock market volatility, but they also provide a defense against US rising interest rates. You can see that in the up capture and down capture statistics.

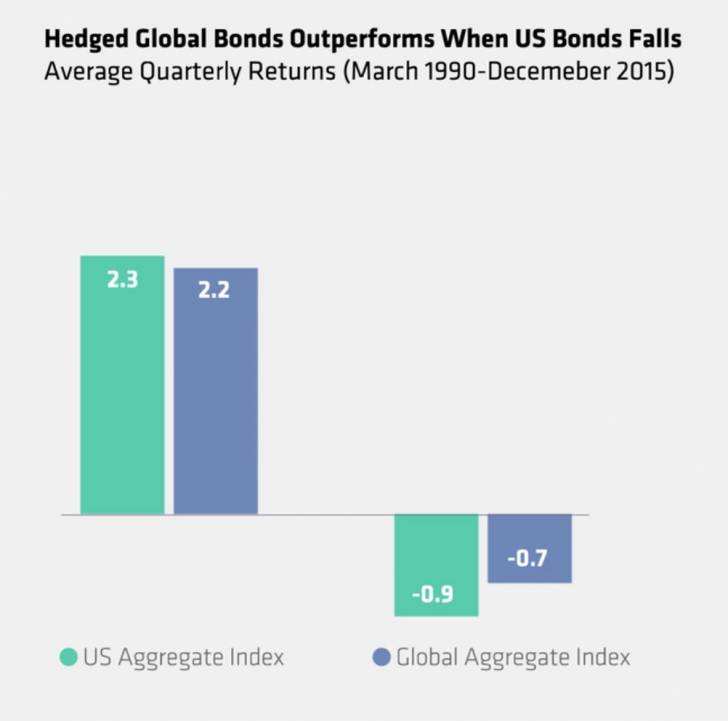

Here we’re showing that when US bonds rally, when they’re up, global bonds tend to rally just as much. You get about 90 percent of the up capture. Yet when US bonds sell off when US interest rates rise, you find that global bonds tend to sell off not quite as much. You only get about two thirds of the down capture.

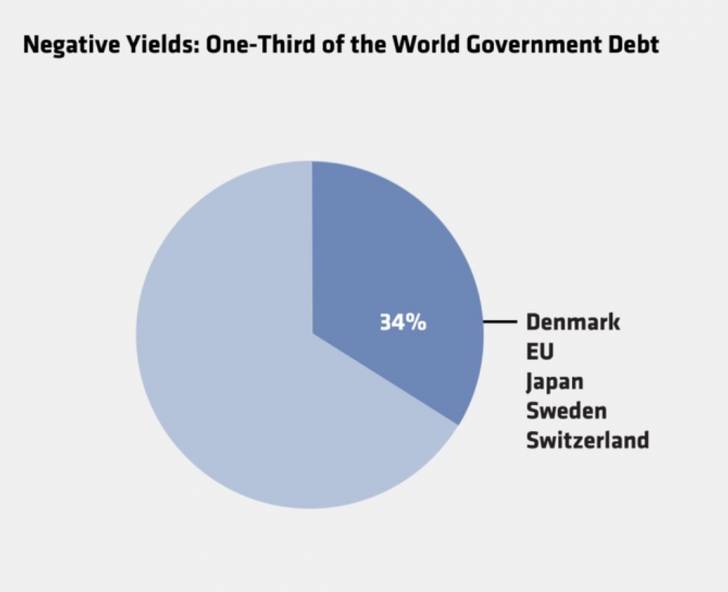

Now you might be asking yourself, why would I want to invest globally when about a third of the global government bond market is trading with negative yields? And here’s where I would advise if you are thinking globally, make sure you are hedging your currency exposure back to US dollars. Hedging that currency back to US dollars does two things. First, it removes a lot of the market volatility. Currencies are very volatile, when you hedge the foreign currency exposure back to US dollars you bring the volatility down. But secondly, in today’s markets, the currency hedge can actually provide a benefit in terms of increasing the yield.

For example, in the Euro area, it increases your yield by almost a percent and a half. That can take a German bund that’s trading with a negative yield up to yields almost approaching that of an US 10-year. Even better, it takes a Portuguese 10-year bond trading at three percent towards levels like four and a half.

But the key is you must actively manage these exposures because the hedging relationships change. And so you must actively manage the global portfolio so as to optimize these relationships.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein