How to get your portfolio to eat its duration

by Russ Koesterich, Head of Asset Allocation, Blackrock

Russ suggests an alternative approach to dealing with the current environment of low yield and rising duration.

When my son was a toddler, my wife’s “go-to” cookbook was Deceptively Delicious by Jessica Seinfeld. The premise of the book is simple: Finicky children won’t mind eating their vegetables if you can sneak the broccoli into their brownie. Our own experience is that it works. The caveat is that you need to resist the urge to brag to your child after the fact.

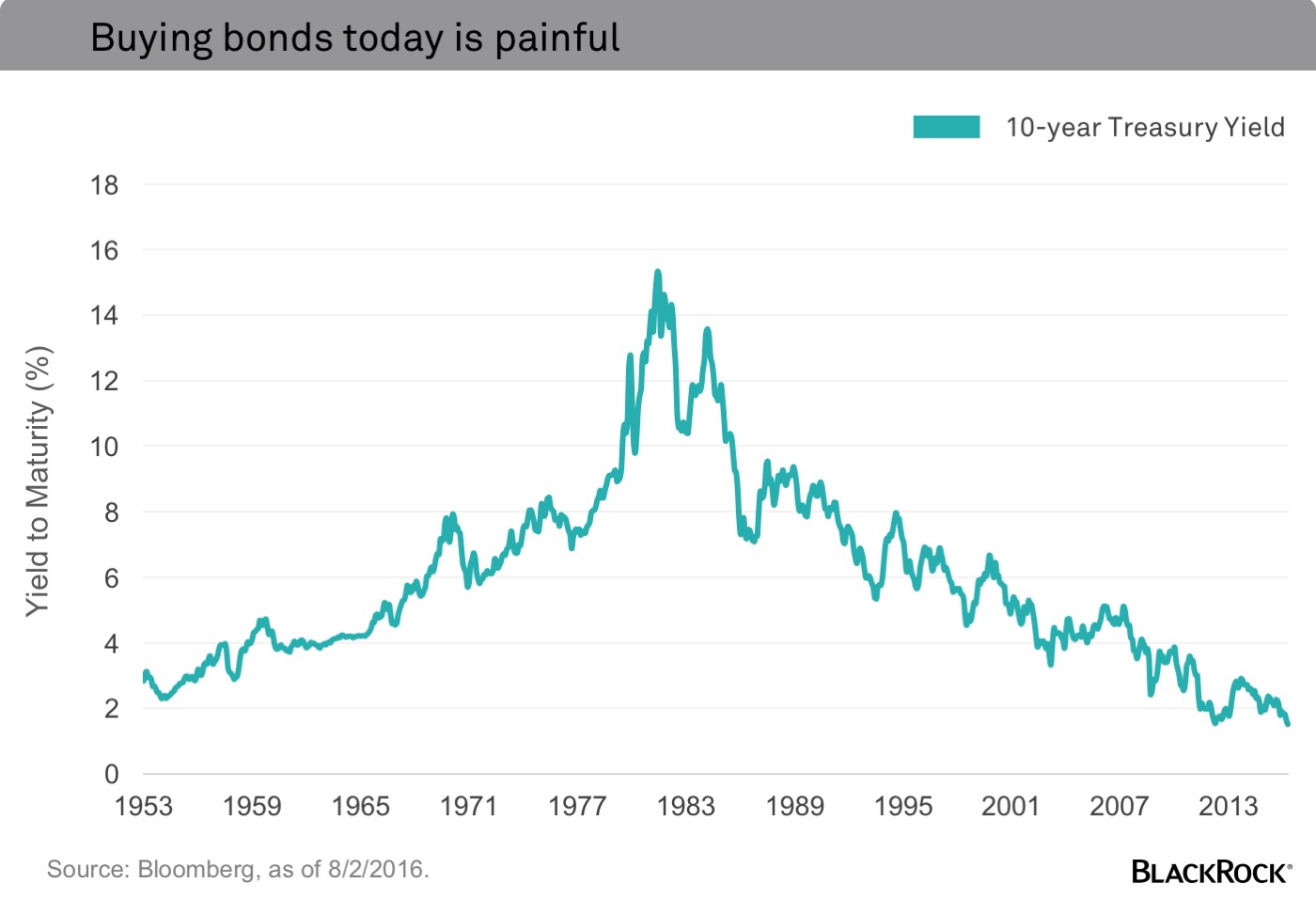

Recently I’ve been thinking about this strategy in a somewhat different context. Investors everywhere are trying to stomach something even more unpalatable than boiled cauliflower, namely buying a 10-year Treasury at a 1.50% yield. While most investors realize that traditional bonds dampen portfolio volatility, it’s hard to commit to an asset class unlikely to produce any real return (see the chart below). To add insult to injury, as yields have dropped, duration has risen. Even a small rise in rates will inflict real pain on a part of the portfolio designed to provide stability. Given this dynamic, is there an alternative strategy that allows investors to get their rate exposure in a more appetizing fashion?

Have you adjusted your asset allocation lately? Join in >

Portfolio tricks

Using BlackRock’s Aladdin Portfolio Builder I constructed two portfolios: a “plain vanilla” U.S. 60/40 portfolio and an “alternative” portfolio. The first portfolio consists of a 60% weight to the S&P 500 and a 40% weight to the Barclays Aggregate Bond Index. For the second portfolio, I left the bond exposure at 40%, but included a 10% allocation to high yield within that 40%. In order to balance the volatility I adjusted the equity position as well. I reduced the allocation to the S&P 500 from 60% to 40% and introduced two new positions: a 10% allocation to preferred stocks and a 10% allocation to a U.S. minimum volatility slice, as represented by the S&P U.S. Preferred Stock Index and the MSCI USA Minimum Volatility Index, respectively.

Deceptively 60/40

While the alternative portfolio is still technically 60/40, the characteristics are somewhat different. First, expected risk (in other words, standard deviation – the measure of how dispersed returns are around the average) is lower by around 100 basis points, 7.70% versus 8.65%. In addition, the expected yield on the alternative portfolio, which includes both interest from the bond portion of the portfolio as well as dividends, is roughly 65 basis points higher. Finally, despite a static 40% weight to bonds and the introduction of more “defensive” equity positions, the duration, or rate sensitivity, is lower. The result is a less volatile, higher yielding portfolio that should be somewhat less vulnerable to a rise in interest rates.

Time to revisit asset allocation

The drawback is less equity sensitivity. If stocks were to surge, the alternative portfolio is likely to underperform as a third of the equity positon is in low beta and preferred names. If you believe that the bull market has much further to go, you’d arguably be better off with the traditional portfolio. On the other hand, if you believe, as I do, that valuations are stretched and volatility is likely to rise, it may be worth revisiting your asset allocation. While there are various ways to structure this approach, the above illustration suggests there may be an alternative to having to choke down all of your duration in traditional bonds.

Russ Koesterich, CFA, is Head of Asset Allocation for BlackRock’s Global Allocation team and is a regular contributor to The Blog.

Copyright © Blackrock