by Don Vialoux, Timingthemarket.ca

Another Milestone

Yesterday another milestone was reached by our StockTwit followers. Previous milestone was reached on July 15th when EquityClock’s StockTwits were forwarded to over 25,000 followers. Yesterday, the 26,000 level was reached.

Observations

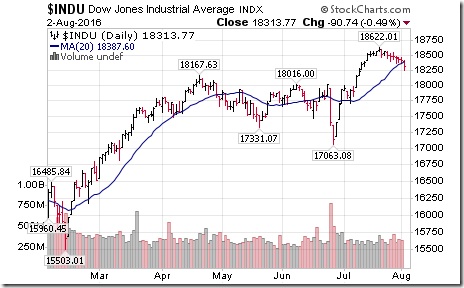

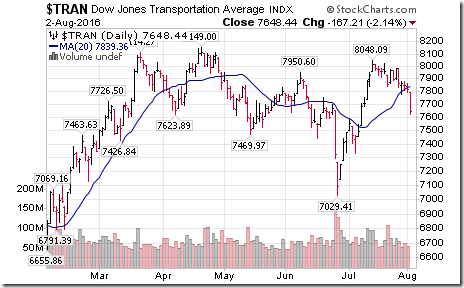

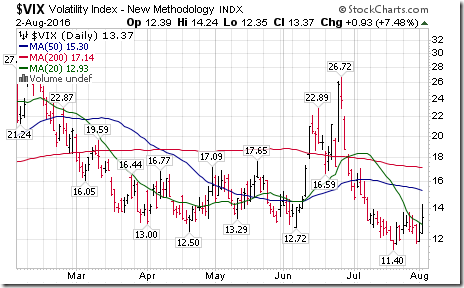

Significant deterioration in technical parameters for equity markets and economic sensitive sectors has occurred since the close on Friday. Momentum barometers for North American equity markets dropped significantly from intermediate overbought levels. The exception was precious metals. ‘Tis the season!

StockTwits Released Yesterday @EquityClock

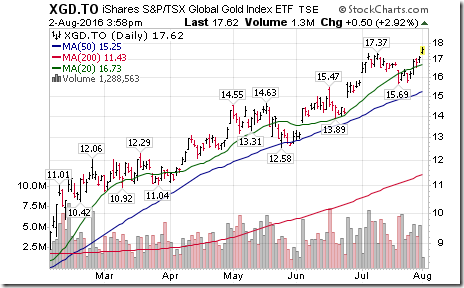

Nice breakout by $XGD.CA above resistance at $17.37 extending intermediate uptrend.

Technical action by S&P 500 stocks to 10:00: Mixed. Breakouts: $DISCA, $TDC. Breakdowns: $TGNA, $EMN, $CNP

Editor’s Note: After 10:00 AM EDT, six S&P 500 stocks broke support: PSA, LUV, HAL, TSS, OXY and CVX

U.S. Oil & Gas Exploration and Development ETF $XOP completed a Head & Shoulders pattern on a break below $32.41.

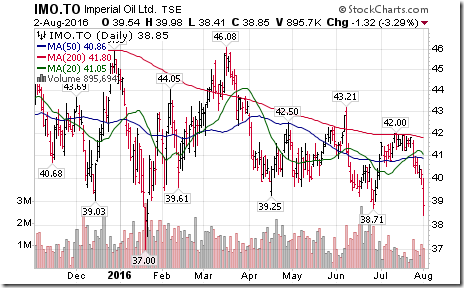

Cdn. oil stocks also breaking support. $IMO.CA broke support at $38.71 extending intermediate downtrend.

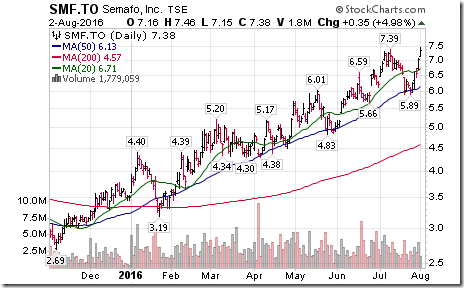

More Canadian gold stocks breaking resistance extending intermediate uptrends: $SMF.CA

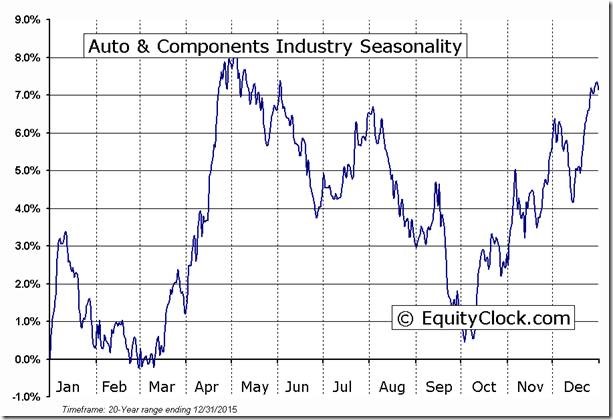

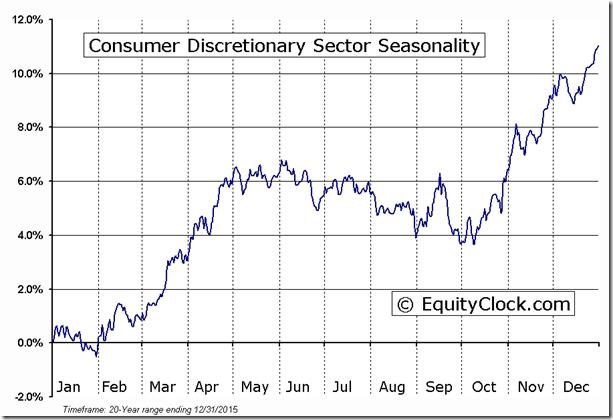

Auto stocks under pressure $GM $F after reporting lower than expected July sales. ’Tis the season for weakness!

Editor’s Note: North American auto component stocks also came under pressure. Seasonal influences are negative until early October.

$BIIB spiked on rumors of a possible takeout. Suitors include $AGN and $MRK. Good for Biotech: $IBB, $BBH, $FBT.

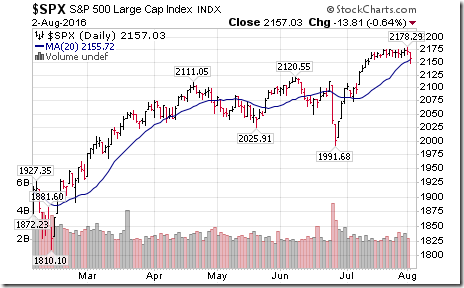

Dow Jones Industrials, S&P 500 Index and Dow Jones Transportation Average fall below their 20 day moving average. $SPX, $DIA, $IYT

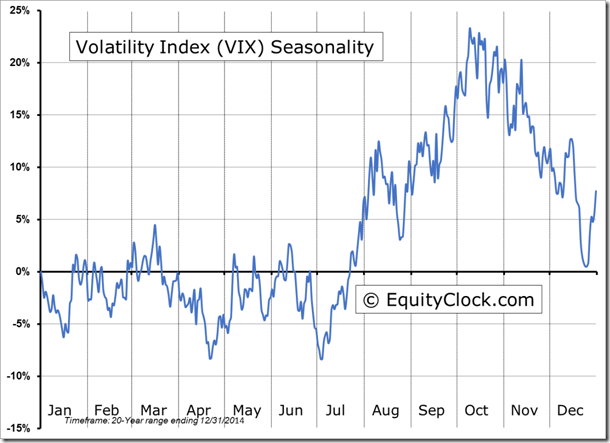

$VIX spikes to a 3 week high. ‘Tis the season for strength to mid-October!

Nice breakout by $GLD in Canadian Dollars extending an intermediate uptrend!

Continuing weakness in the U.S. Dollar Index contributed to the gain.

Trader’s Corner

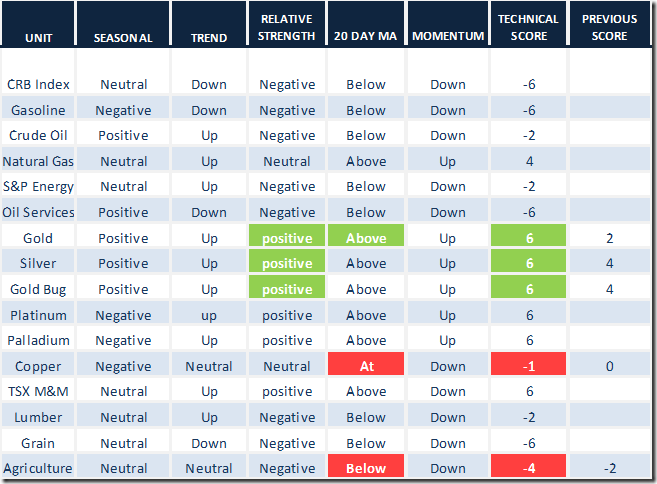

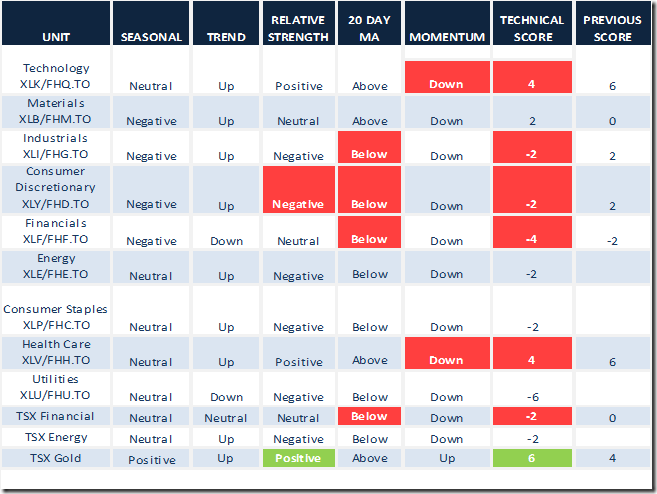

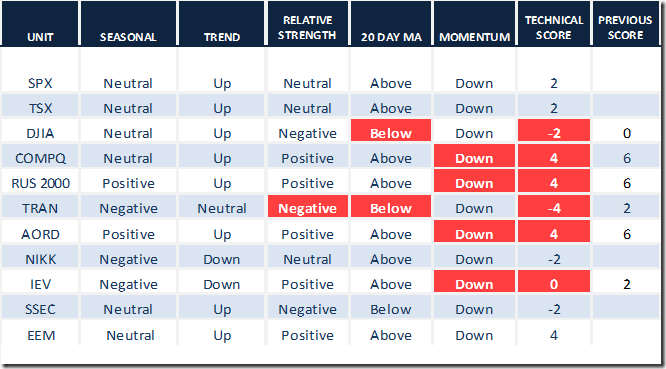

Technical scores for equity markets, commodities and sectors dropped significantly yesterday with the exception of precious metals. Most of the declines were recorded by drops below 20 day moving averages and new downtrends in momentum

Daily Seasonal/Technical Equity Trends for August 2nd 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Commodities Trends for August 2nd 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for August 2nd 2016

Green: Increase from previous day

Red: Decrease from previous day

CSTA Event

KWGC Chapter Meeting (Kitchener Waterloo Guelph Cambridge) meeting

7:30 PM EDT on Thursday August 4th

Location: Heuther Hotel

59 King St. N

Waterloo

Everyone is welcome.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

S&P 500 Momentum Barometer

The Barometer dropped to 65.40 from 75.60 on Friday. It remains intermediate overbought and trending down.

TSX Composite Momentum Barometer

The Barometer dropped to 61.37 from 69.52 on Friday. It remains intermediate overbought and trending down.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca