by Don Vialoux, Timingthemarket.ca

StockTwits released yesterday @EquityClock

Technical action by S&P 500 stocks to 10:00: Quiet. $TSN broke resistance. $HAS broke support following released of Q2 results.

Editor’s Note: After 10:00 AM EDT, 2 more stocks broke intermediate resistance: Whirlpool and Google.

Seasonal influences for $HAS are negative until the end of September.

Trader’s Corner

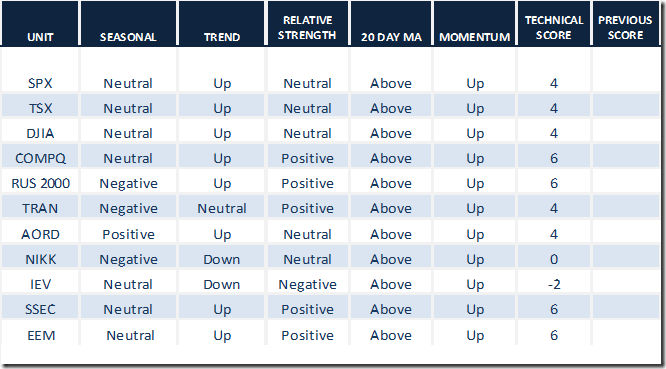

Daily Seasonal/Technical Equity Trends for July 18th 2016

Green: Increase from previous day

Red: Decrease from previous day

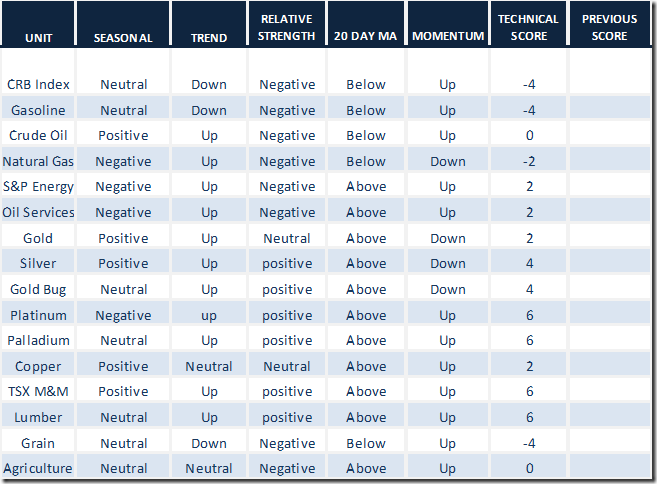

Daily Seasonal/Technical Commodities Trends for July 18th 2016

Green: Increase from previous day

Red: Decrease from previous day

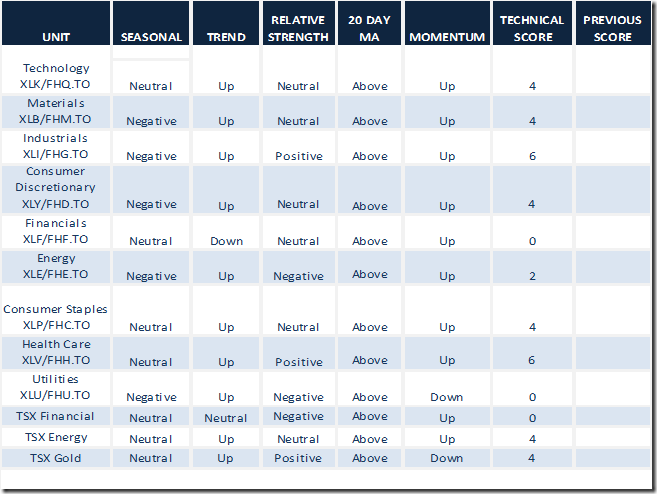

Daily Seasonal/Technical Sector Trends for March July 18th 2016

Green: Increase from previous day

Red: Decrease from previous day

Changes in Seasonality starting in mid-July

The following changes were recorded in yesterday’s Tech Talk report:

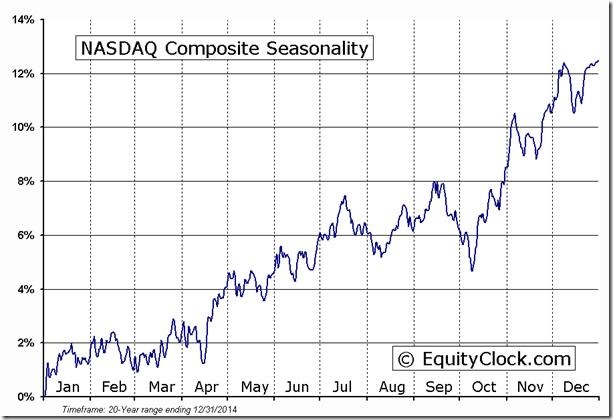

NASDAQ Composite: positive to neutral

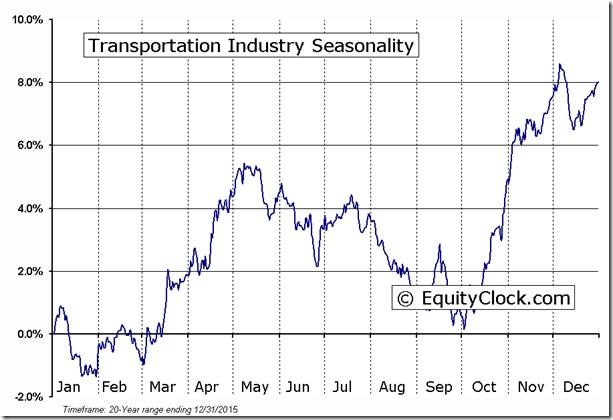

Dow Jones Transportation: neutral to negative

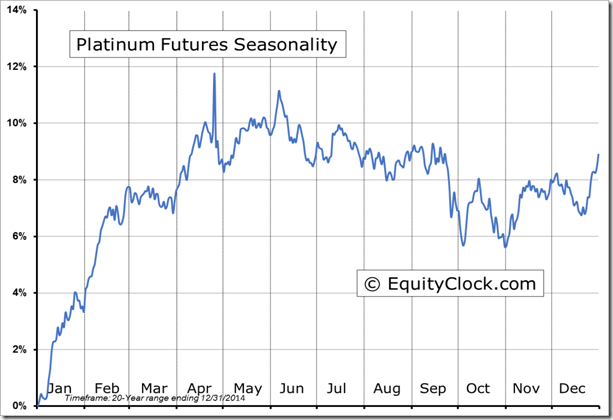

Platinum: neutral to negative

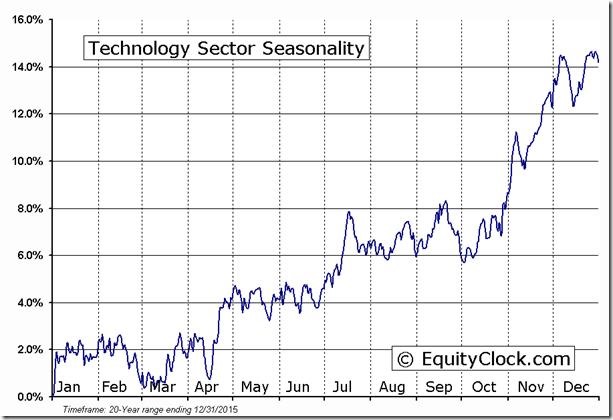

Technology: positive to neutral

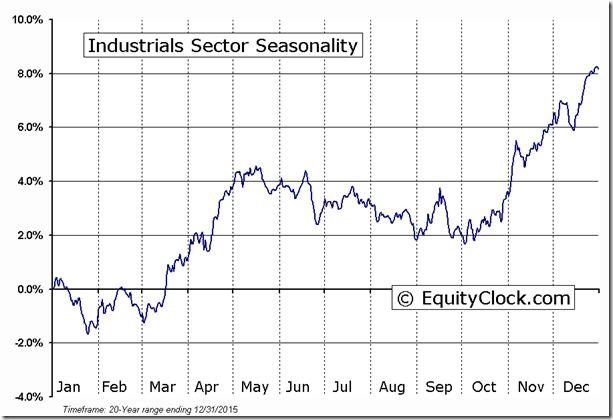

Industrials: neutral to negative

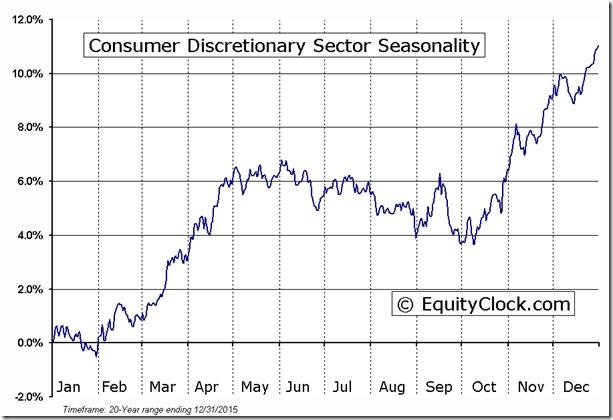

Consumer Discretionary: neutral to negative

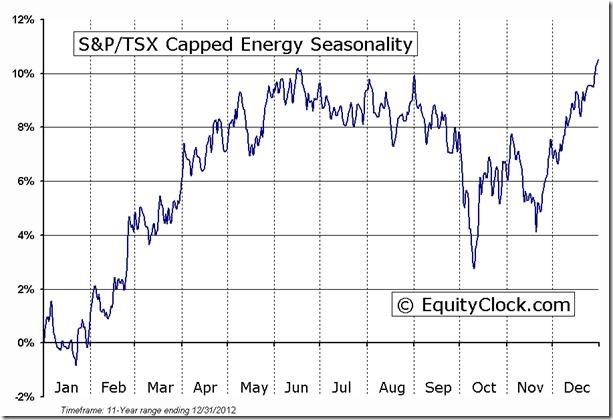

TSX Energy: Negative to neutral

CSTA Events

Toronto Chapter Special Event

Topic: How Price Moves

Date and Time: July 19th at 7:00 PM

Location: North York Central Library, 5120 Yonge Street

CSTA annual meeting key note speech

To view Don Vialoux’s Key note speech click here

CSTA Award Presentations

Full video of Awards Presentation can be viewed here

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

The Philosopher Trader

By Adrienne Toghraie, Trader’s Success Coach

So, you are thinking, what in the world does philosophy have to do with making money in the market? If your answer is, “Nothing,” think again!

Why have a philosophy of life for traders?

Traders cannot trade successfully without having a set of rules by which they come in and out of the markets. Having a philosophy for a trader is like having a larger set of rules, in which his trading rules are merely a subset. Just like a ship, a trader needs a rudder to guide him through untested or turbulent waters. That rudder is a trader’s philosophy of life, and it is essential to providing stability and direction in a very stressful, high-risk

occupation.

A trader’s philosophy on life will allow him to better handle the losses and wins he experiences during the day, the mistakes he makes, and helps him to put everything into perspective. It can answer the hard and the simple questions that come up for him, making his life easier and creating meaning to the randomness of his work. Having a philosophy is not the same thing as performing a daily meditation or subscribing to a particular religious practice or having a set of goals. A philosophy encompasses all aspects of a trader’s universe, and provides a way of framing the unanswerable questions and thorny issues that arise from moment to moment in a trading day.

A short list

Let me give you an example of what I mean. My own philosophy of life can be boiled down to three statements. They may seem simple on the surface, but they are as profound as I choose to make them. And, more importantly, they answer all questions, resolve all issues, give me guidance when I need it, provide me with my rules of conduct, and prepare me for all contingencies. They also provide a way to resolve and frame issues and

questions that a trader deals with, as well. In order, they are:

1. Life is precious

In a world where all things seem to become increasingly relative, (including values, morality, standards of conduct, agreements, promises, rules, laws, etc.) the one constant in our lives is that life is precious and that every moment of it can either mean something or be squandered. Thus, whenever I am faced with a decision, I apply this principle and act accordingly. I take that trip, call that friend, make that decision, and embrace as much joy from life as I can. I see the sand falling more and more rapidly from the top of the hourglass.

For you as a trader, it means that you must look at your personal life as well. Your children are growing up, and you need to spend time with them. Your health has its own hourglass and cannot be squandered, so handle stress and take good care of your physical and emotional health. It means that to waste that precious time on mediocrity in any form is just that: a waste. So, if you are going to read and learn, then read books by and learn from great minds; if you are going to watch television and movies, spend time with wonderful, uplifting artists; if you are going to socialize, do so with people you love and not with people you have nothing in common with and who do not care about you. Make your mark now. The future may not be there. Here’s the usual question to

which I apply this principle: Should I do that? The answer is, life is precious. And that understanding always provides me the impetus to act (or not) accordingly.

2. We are all connected

Life may be short, but we are in it with everyone else. We are all connected. What you do affects others. The decisions you make and the actions you take do not end with yourself. If Columbia University’s physicist, Dr. Brian Greene, is correct and the String Theory is real, then this philosophical principle that we are all connected is more than a cloyingly annoying statement on a Hallmark card, and we truly are, actually, connected to each other. This notion provides a balance to rule number one. If I decide that life is precious, and I should utilize each moment to its fullest, I must also do so in a way that takes into account the effect my decisions and actions have on others. For traders, this adds an ethical component to their lives. Like rule number one, it also strengthens the relationships in his life that provide him with support and sustainability. For example, it is difficult to conduct your business in a way that detracts from the happiness and wellbeing of your family members if you stay conscious of the fact that you are actually connected to them.

3. People are unique

This simple philosophy actually distills for me a lifetime of observing the most remarkable, irrational, saintly/evil and random behavior of humanity. Why did that driver in the far left lane just exit off the highway in front of me at 80 miles an hour across four lanes of traffic? Madness of that sort no longer bothers me because I simply remind myself that people are unique. This philosophy allows me to expect the best, the worst, the most irrational, and the most unanticipated from those around me. For traders, it is the perfect insulation from the unpredictability and irrationality of their business associates, family, and friends, as well as the market.

Your philosophy to-do list

So, now that you have my own set of philosophical principles, what about your own? Here is a to a to-do list to help you put together your own guiding principles:

1. Ask yourself – What do I believe about life?

2. Ask yourself – What are my own guiding principles? Do not worry if the answer does not come immediately. It will. Just keep asking and over time, the answer will come to you.

3. Write down your thoughts.

4. Distill them into a set of principles.

5. Write down a set of actions that will support your principles.

6. Put them on a card that you carry with you and on a note that you can see from your workplace.

7. Set them to memory by reading them every day.

8. Let them guide your decisions and actions.

9. Now, enjoy the peace they will give you and the support they will offer your trading.

Adrienne’s Free Webinars

Adrienne presents free webinars on the discipline of trading

Email Adrienne@TradingOnTarget.com

S&P 500 Momentum Barometer

The Barometer added 0.80 (0.92%) to 87.40 yesterday. The Barometer remains intermediate overbought, but has yet to show signs of rolling over.

TSX Composite Momentum Barometer

The Barometer added 1.18 (1.61%) to 74.89 yesterday. It remains intermediate overbought, but has yet to show signs of rolling over.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/a26ef369a297d5e855b409e9c6d616fd.png)