by Don Vialoux, Timingthemarket.ca

Observations

The Beige report released at 2:00 PM EDT yesterday virtually confirmed that the FOMC will not change the Fed Fund rate at its next meeting on July 26-27th .

Second quarter reports released late yesterday by CSX (before the close) and Yum Brands (after the close) moved their stock prices higher following the news.

Both the TSX Composite Index and TSX 60 Index broke above resistance reaching an 11 month high and extending intermediate uptrends.

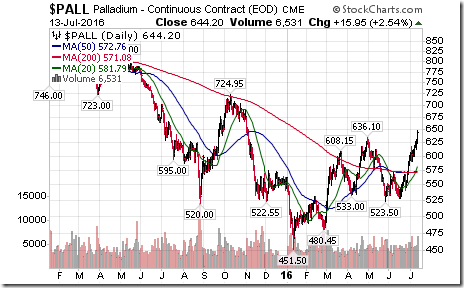

Nice breakout by Palladium above $636.10 per ounce reaching an 8 month high and extending an intermediate uptrend!

StockTwits Released Yesterday @EquityClock

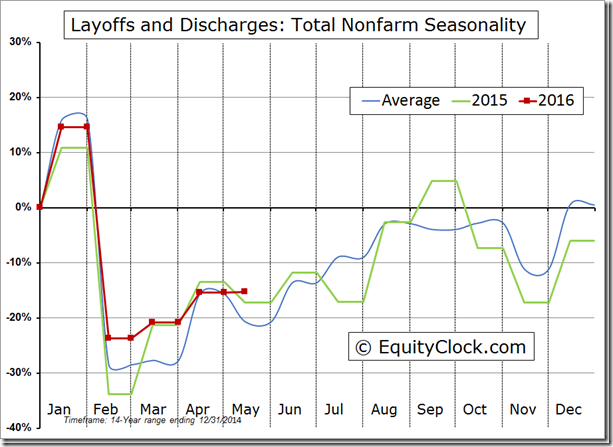

Layoffs trending above average this year while job openings, hires and quits lag the seasonal trend.

Technical action by S&P 500 stocks to 10:00: Bullish. Breakouts: $CMG, $NWSA, $OMC, $ENDP, $ZTS, $CAT, $TSS, $SEE. No breakdowns.

Editor’s Note: After 10:00 AM EDT, another six S&P 500 stocks broke above resistance: IR, ADI, EXPE, MCO, CSX and VIAB.

Canadian Dollar adds U.S. 0.47 to 77.14 cents after Bank of Canada maintains overnight rate at 0.5%.

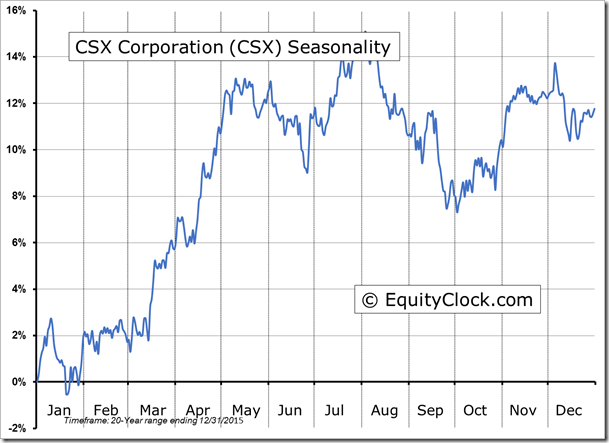

Nice breakout by $CSX above $27.78 extending intermediate uptrend after Q2 report prematurely released.

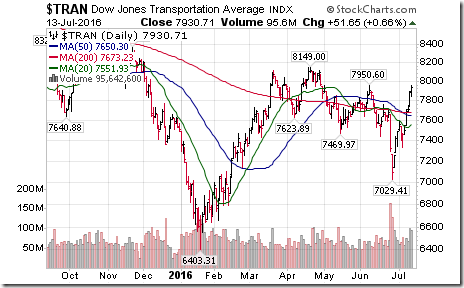

Editor’s Note: Strength in CSX briefly triggered a move by the Dow Jones Transportation Average above resistance at 7,950.60

Trader’s Corner

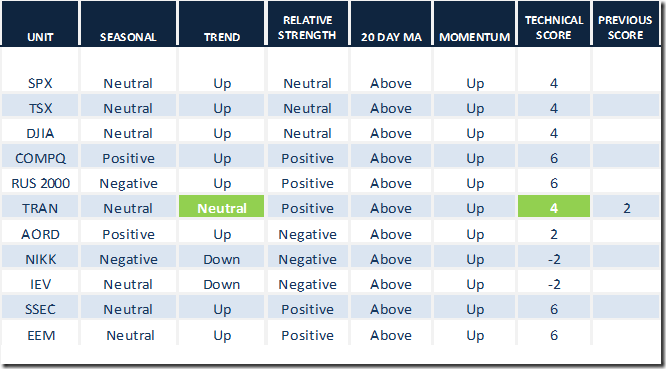

Daily Seasonal/Technical Equity Trends for July 13th 2016

Green: Increase from previous day

Red: Decrease from previous day

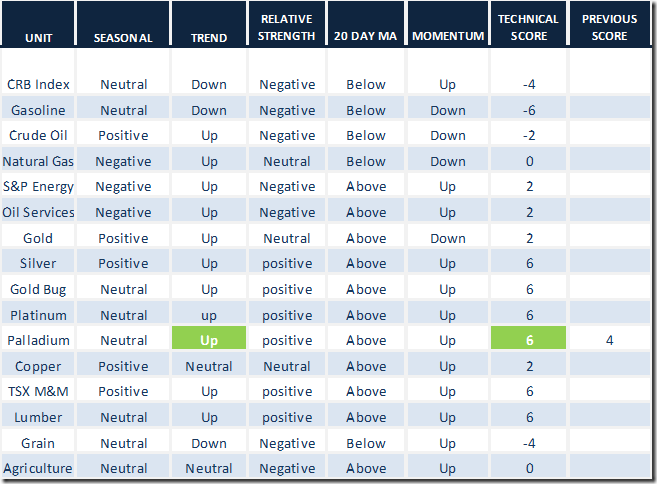

Daily Seasonal/Technical Commodities Trends for July 13th 2016

Green: Increase from previous day

Red: Decrease from previous day

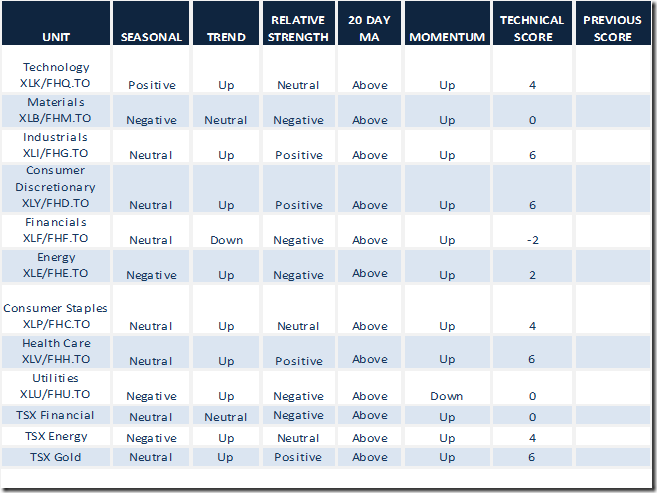

Daily Seasonal/Technical Sector Trends for March July 13th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following is an example:

S&P 500 Momentum Barometer

The Barometer slipped 0.40 (0.48%) to 83.77 yesterday. It remains intermediate overbought.

TSX Composite Momentum Barometer

The Barometer slipped 0.98 (1.33%) to 72.41 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca