Why Gold? Why Now?

by Frank Holmes, CEO, CIO, U.S. Global Investors

During my most recent webcast a couple of weeks ago, I had the pleasure of being joined by the CEO of the World Gold Council (WGC), Aram Shishmanian. As expected of someone of his stature, Aram brought another level of insight and expertise to our discussion of gold’s Love Trade and Fear Trade.

You might wonder what the WGC does exactly. In Aram’s words, it focuses on “innovation and integration to create the gold market” around the world. Among other important endeavors, the group “lobbies governments to make their countries appropriately pro-gold” and is the only agency in the world to “train central bankers in the use of gold.”

Below, I’ve selected a few key moments from the webcast to share with you. You can hear the full replay and follow along with the slide deck at usfunds.com.

A Stellar First Quarter

Aram: It’s an understatement to say that gold had a good quarter. It increased over 16 percent in the first quarter, the fastest it’s done so in 30 years, overtaken only by the Iranian oil crisis in the 80s.

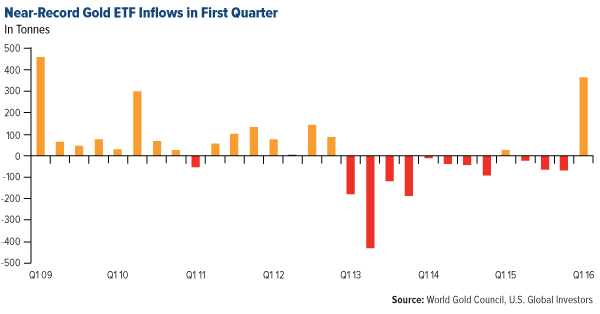

The story is not just about the gold price. The gold ETF industry has increased by over 50 percent worldwide. In addition to that, we’ve seen the market capitalization of members of the World Gold Council—which represents the majority of the gold mining companies in the world—increase 70 to 80 percent in the past four months alone.

Rise of the Global Middle Class

Frank: The growth of gold’s Love Trade depends on rising global GDP per capita, and last year there was a tipping point in China. For the first time, the size of China’s middle class reached 109 million people, overtaking the U.S. middle class. This group gets lost in the sea of 1.4 billion people, but these 109 million people—a third the size of America—want to travel and buy higher quantities of gold for gift giving.

The same goes for India, where 600 million people are under the age of 25. That’s two times the size of the population in the U.S. They’re all wired. They’re all connected. They’re driven for education. Their affinity for gold is not going away.

If you look at China, the U.S. and India, there’s a significant portion of GDP growth, which is so important for the gold market.

China to Become a Gold Price-Maker

Aram: Today, China and India represent over 70 percent of world demand, driven by hundreds of millions of people and supported by pro-gold government policy. The U.S., by comparison, is 6 percent of world demand, yet price discovery on the COMEX (Commodity Exchange) in London is somewhat overweight because it is U.S. or Western economy-centric.

The Shanghai Gold Exchange was established 13 years ago and today is the largest gold exchange in the world, not to mention the most sophisticated. In April this year, it launched the Shanghai gold benchmark, which parallels that of the London benchmark price of physical gold. Last year, trading volumes in Shanghai were over 10 trillion renminbi.

I think for those who haven’t had the opportunity to visit China, you have to go to understand that China is the biggest producer and consumer of gold. It imports over 600 tonnes a year and is driven by highly diverse demands by hundreds of millions of people. Three hundred million Chinese households will become middle class in the next two years, and they have a higher savings ratio than anyone in the world.

Gold Jewelry and Financial Security

Frank: Jewelry ends up becoming money whenever there’s a crisis in a country’s currency. Right now, it’s not so much a crisis as gold is an important asset class, in a world where we have zero interest rates.

Aram: Jewelry demand is still 45 percent of the gold market, and in Asian societies—India, China, Southwest Asia—it’s about wealth preservation. In India, a marriage is not a marriage without gold. It’s crucial to their belief system. The husband owns the land and the farm and other assets, but the wife owns the gold. It’s her security blanket. It’s not just about adornment, it is about financial security. That’s quite often misunderstood in the West where we think of jewelry as discretionary adornment.

Frank: You can buy the most incredible gold jewelry, but it is 24 carat.

Aram: Yes, Chinese gold demand is purely 24 carat gold, which is 100 percent. In North America, 18 carats is the norm, but in India it’s 22 carats. During Diwali, it is auspicious to buy gold, and at certain festivals in India throughout the year, it is an auspicious time to marry and then you see peaks that are highly predictable.

Strong Gold Positions in Global Pension Funds

Frank: It’s unprecedented that a third of all global government debt has negative yields.

Aram: Which drives gold demand. Effectively what we’re seeing is people’s pensions being decimated because the policymakers have had very few if any alternatives left. It is in this environment that gold will help satisfy need.

Take the Japanese economy. Today, over 200 pension funds allocated about 2 percent to gold. It’s not only about wealth creation like the model in the Western world, where we generated 7 percent returns on investment for pension funds. That is gone in Japan, and therefore it’s more about protection of wealth rather than creation. That’s where gold plays.

Frank: In the state of Texas, where we’re based, Shayne McGuire, portfolio manager of the Gold Fund for the Teacher Retirement System (TRS) of Texas, is doing a great job. They’ve taken up a real strong position.

Aram: They took a strong position quite a few years ago. The TRS has been one of the forerunners of U.S. pension funds holding gold.

The Power of Scarcity

Aram: An important aspect of gold is its scarcity value. The total amount of gold produced in the history of mankind is about 170,000 tonnes. That’s the size of two Olympic-size swimming pools and it is still in use.

The amount of gold discoveries are very, very few now. Gold production at the moment is pretty constant. As you’ve seen with mining equities, huge capital investments were made in the last few years, but very little new supply came forward because the mining companies had to invest huge amounts of money to get licenses to operate and to find new discoveries and increasingly more complex mining conditions. In terms of supply, it is virtually constant. It goes up and down 1 or 2 percent per year, but it is constant.

Gold’s Timeless Allure

Aram: Producing gold iPhones has increased sales dramatically. It goes back to the idea that gold is integral to our belief system. It’s integral to our language. Not just in the DNA of far-flung countries but in our Western society.

Frank: And then talk about extravagant wealth in the Middle East, where some of these princes have their cars gold-plated. It’s extravagant, but I’m trying to highlight the allure of gold, which can be found everywhere, from the iPhone to buying 24 carat gold jewelry. I think this is important for investors to realize.

Copyright © U.S. Global Investors