by James Picerno, The Capital Spectator

Is the US stock market inspired by expectations that the Fed will delay interest rate hikes? Or perhaps the crowd anticipates that economic growth will chug along at a healthy rate, despite last week’s news that employment suffered a sharp slowdown in May. Maybe both factors are in play. Whatever the source of the renewed optimism that’s driving equities higher, the revival of animal spirits in the stock market conflicts with the ongoing and arguably firmer appetite for the risk-off trade in Treasuries.

Let’s start with the 2-year Treasury yield, which is widely followed as the most-sensitive point on the yield curve for rate expectations. Yesterday’s trading left the 2-year at 0.78% (June 8), well below the 0.90%-plus range that prevailed for much of last month, when expectations were widespread that a rate hike was likely at next week’s FOMC meeting. But last week’s disappointing numbers on payrolls for May threw cold water on that idea.

Meanwhile, the benchmark 10-year yield continues to hold at just above 1.70% rate, which is close to the lowest levels so far this year. In other words, the current yield is close to matching the 10-year’s low rate during the height of pessimism about the US economy’s prospects in February. Four months later, the stock market is bubbling but the 10-year Note seems to be priced for something less-enthralling future.

Reuters reports that there was “strong demand” for yesterday’s auction of new 10-year Treasuries, in part because

Traders have pushed back rate-hike expectations to September at the earliest, after Friday’s jobs report for May showed that employers added only 38,000 positions in the month, the smallest gain since September 2010…

Investment funds, foreign central banks and other indirect bidders on Wednesday purchased a record 74 percent share of the notes, Treasury data showed.

“It was strong… there’s definitely buyers out there. When you look at yields across the globe the U.S. looks attractive,” said Justin Lederer, an interest rate strategist at Cantor Fitzgerald in New York.

As for stocks, it’s difficult if not impossible to tell if the revival of demand for US equities is a function that interest rates will continue to stay lower for longer vs. brighter economic prospects, despite the latest numbers on payrolls. As The Wall Street Journal notes

Now that investor expectations have been reset, the Treasury market is “generally in a wait-and-see mode,” with the next major economic report coming next week with the release of new retail sales data, said Thomas Simons, vice president and money-market economist in the Fixed Income Group at Jefferies LLC.

A lackluster report would further undermine the case for any near-term action by the Fed, he added.

Now that investor expectations have been reset, the Treasury market is “generally in a wait-and-see mode,” with the next major economic report coming next week with the release of new retail sales data, said Thomas Simons, vice president and money-market economist in the Fixed Income Group at Jefferies LLC.

A lackluster report would further undermine the case for any near-term action by the Fed, he added.

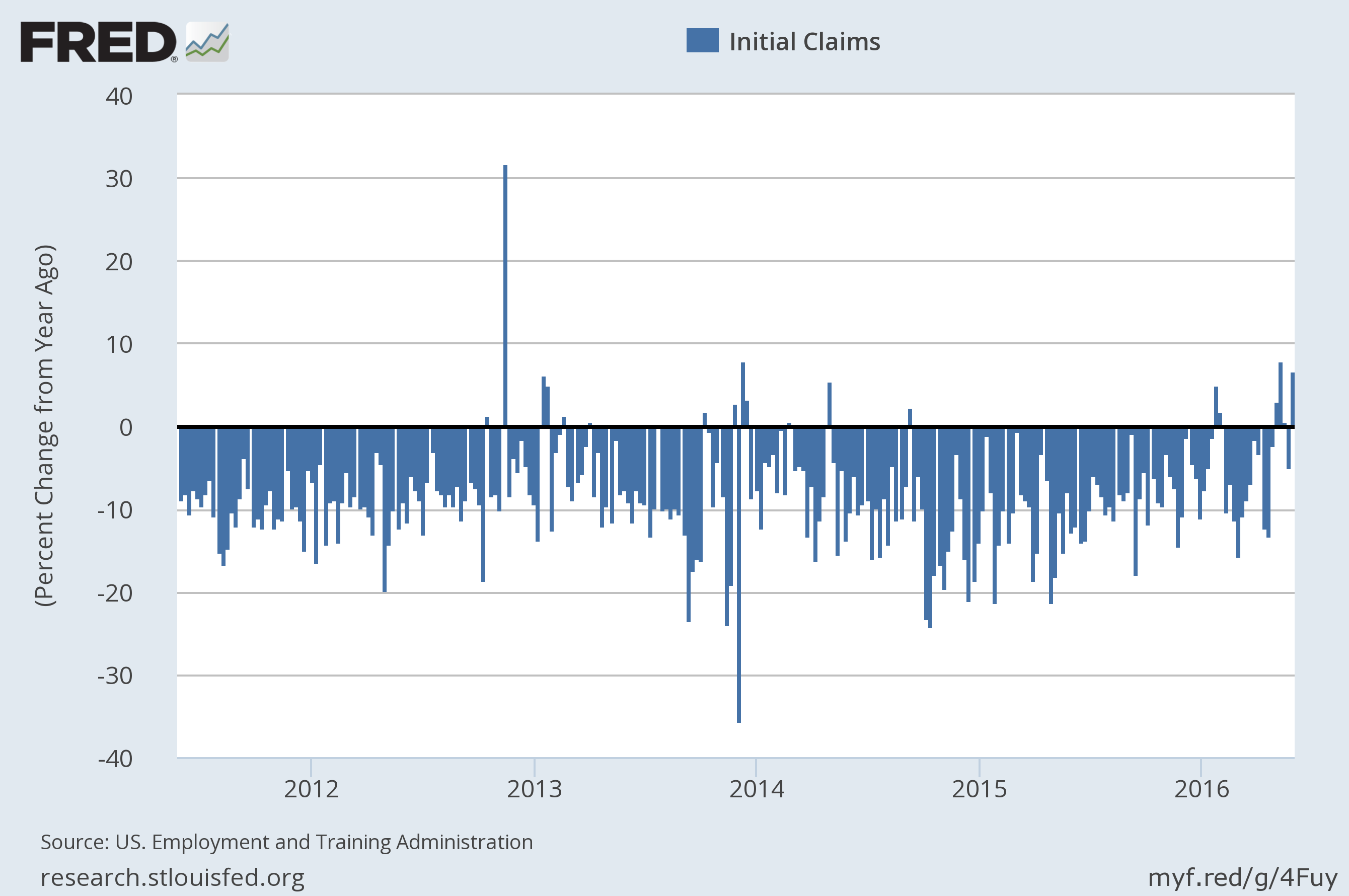

Meanwhile, today’s agenda includes the weekly update on jobless claims. The crowd’s expecting only a slight rise to 270,000, which will be treated as good news since this number is still close to multi-decade lows. But if you’re inclined to look for cracks in the bullish façade, pay close attention to the year-over-year change in new filings for unemployment benefits, including the unadjusted data. The latter data set has been rising vs. its year-earlier level in four out of the last five weekly updates, as shown in the chart below. When and if this series runs higher on a sustained basis, the implied forecast (if history’s a guide) will signal trouble for the US business cycle.

The good news is that there’s a ways to go before we reach that tipping point in a convincing degree. As such, it’s premature to draw any conclusions from what could turn out to be another run of noisy claims data. But a steady stream of year-over-year increases in new filings for unemployment benefits in the weeks ahead will be hard to dismiss in the wake of the worrisome jobs data for May.

Judging by the US stock market of late, however, the odds are low that jobless claims will continue to flirt with the dark side. Now all we need is a convincing round of hard data to confirm Mr. Market’s implied counsel that all’s well.

Copyright © The Capital Spectator