by Don Vialoux, Timingthemarket.ca

Another Milestone

Yesterday, another milestone for EquityClock was reached on Stocktwits by EquityClock. Number of follows increased to 23,000. Previous milestone was reached on May 18th at 22,000.

Observations

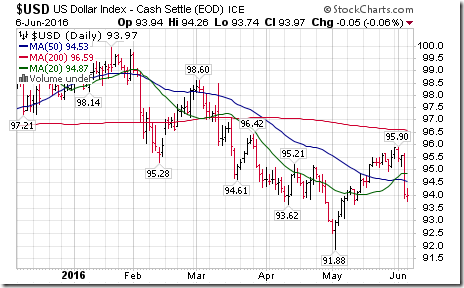

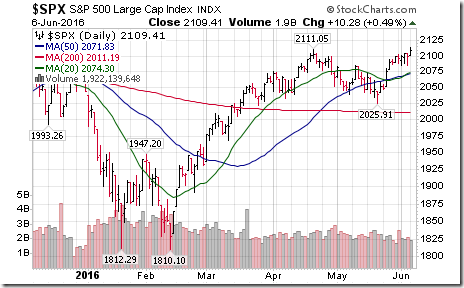

North American equity markets moved higher prior to Janet Yellen’s presentation on monetary policy released at 12:30 PM EDT yesterday. North American equity indices moved sideways thereafter. Her presentation implied that the Fed will defer an increase in the Fed Fund rate beyond the next FOMC meeting on June 14-15. Greatest impact was continuing weakness by the U.S. Dollar Index. Additional weakness in the U.S. Dollar Index triggered a surge in commodity and commodity stock prices.

Interesting Charts

The S&P 500 Index briefly moved above 2,111.05 to re-establish an intermediate uptrend.

Grain prices have “gone parabolic”

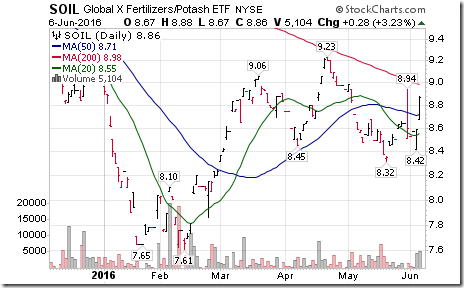

Higher grain prices had a direct positive impact on fertilizer stocks.

StockTwits Released Yesterday @EquityClock

Stocks and bonds close around resistance following a shocking employment report.

Technical action by S&P 500 stocks to 10:15: Bullish. Breakouts: $MO,$WFM,$HUM,$SYK,$FLS,$PH,$RSG,$OI,$ETR. Breakdowns: $HD,$COL

Editor’s Note: After 10:15 AM EDT, another four S&P 500 stocks broke resistance: Devon Energy, Harris Corp., Moody’s, and Joy Global.

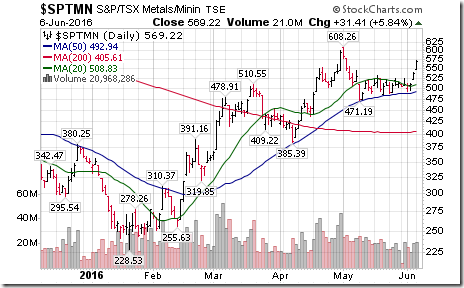

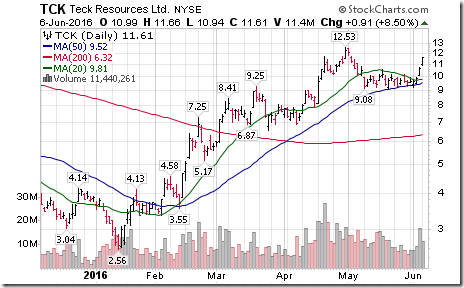

TSX Metals & Mining Index continues to surge on higher copper and zinc prices. $TCK, $HBM.CA, $FCX

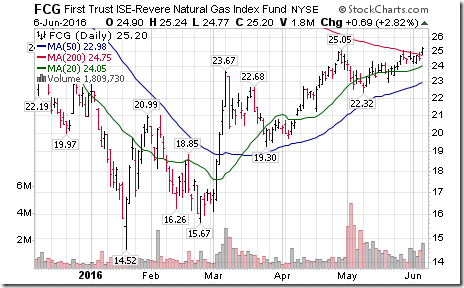

“Gassy” stocks e.g. $DVN and gassy ETF $FCG breaking resistance extending intermediate uptrends.

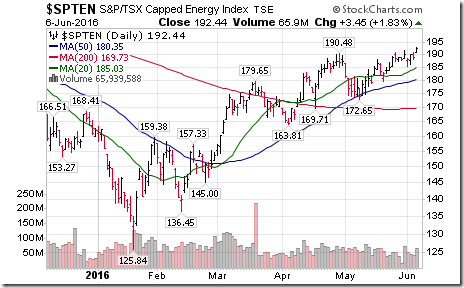

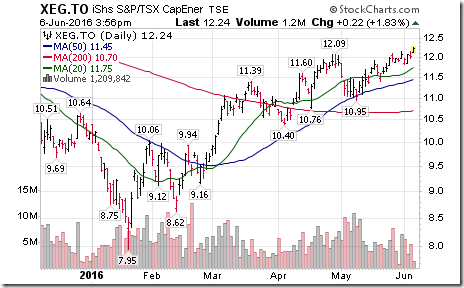

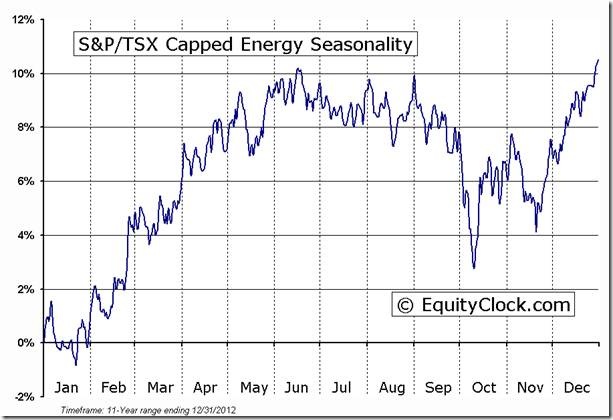

Nice breakout by the “gassy oriented” TSX Energy Index above 190.48 to extend an intermediate uptrend. ‘Tis the season!

‘Tis the season for the TSX Energy Index to move higher to mid-June! $XEG.CA $SPTEN.CA

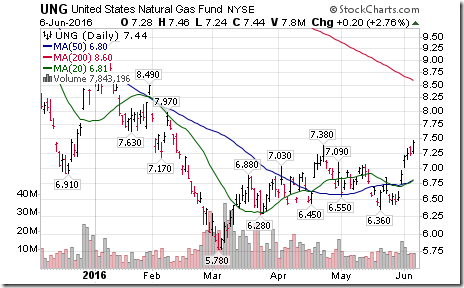

Nice breakout by Natural Gas ETF $UNG above $7.38 to extend an intermediate uptrend!

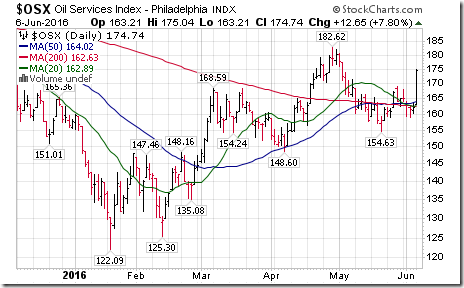

Editor’s Note: Greatest impact of the breakout by natural gas prices was a momentum boost into the oil services sector. Higher natural gas prices = more drilling for natural gas!

Nice breakout by $BNS.CA above $65.97 to reach a 19 month high extending an intermediate uptrend!

Trader’s Corner

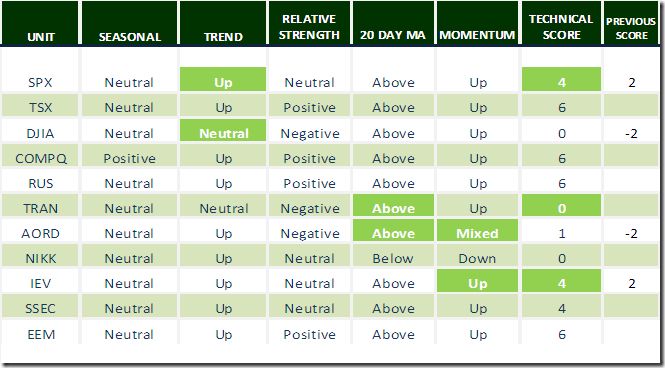

Daily Seasonal/Technical Equity Trends for June 6th 2016

Green: Increase from previous day

Red: Decrease from previous day

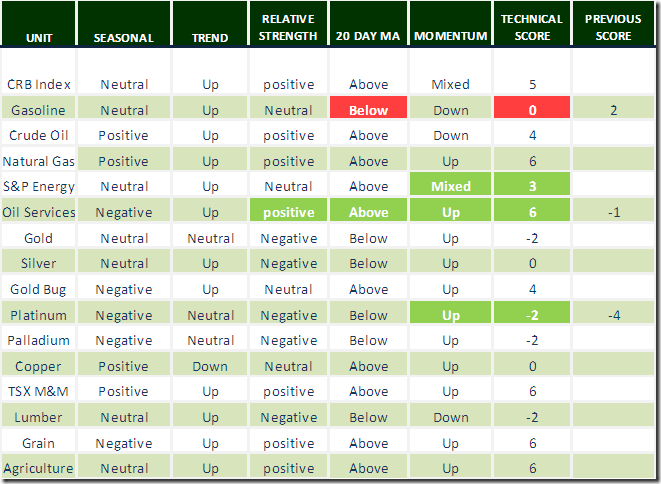

Daily Seasonal/Technical Commodities Trends for June 6th 2016

Green: Increase from previous day

Red: Decrease from previous day

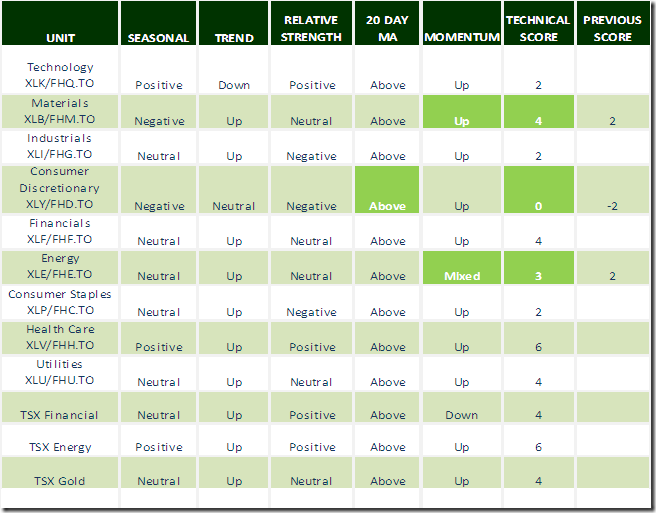

Daily Seasonal/Technical Sector Trends for March June 6th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

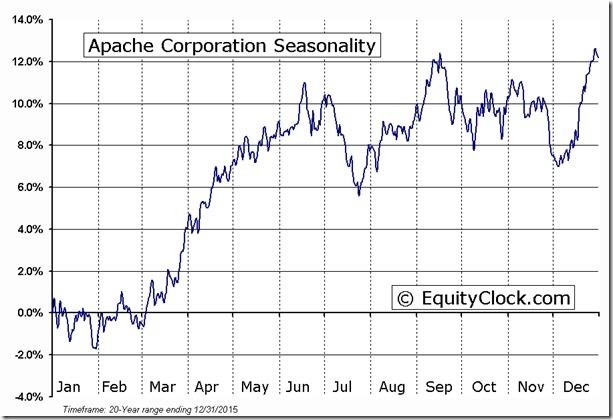

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Keith Richards’ Blog

Preferred shares in Canada fell on declining interest rates over the past two years. My newest blog examines whether now is the time to buy these potentially oversold securities.

http://www.valuetrend.ca/preferred-shares-building-a-base/

CSTA Events

Oakville Chapter Meeting

June 8th at 7:00 PM

Location: QEPCCC Program Room 3

Speaker: Dr. Ernie Chan

Topic: The Peculiarities of Volatility

Register at www.csta.org

Durham Chapter Meeting

June 14th at 6:00 PM

304 Brock St.S

Whitby

Topic: Continuation of education series on construction of charts

Register at www.csta.org

Victoria Chapter Meeting

June 15th at 2:30 PM

Scotia McLeod offices

Suite 400

1803 Douglas Street

Register at www.csta.org

Annual CSTA Meeting

June 22nd at Noon

Sheridan Hotel

Speaker: Don Vialoux

Register at www.csta.org

S&P 500 Momentum Barometer

The Barometer added another 1.60 to 70.60. The Barometer remains intermediate overbought, but has yet to show significant technical signs of peaking.

TSX Composite Momentum Barometer

The Barometer added another 0.43 to 84.85. The Barometer remains intermediate overbought, but has yet to show significant technical signs of peaking.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca