How to Help Younger Clients with Student Loan Debt

by Commonwealth Financial Network

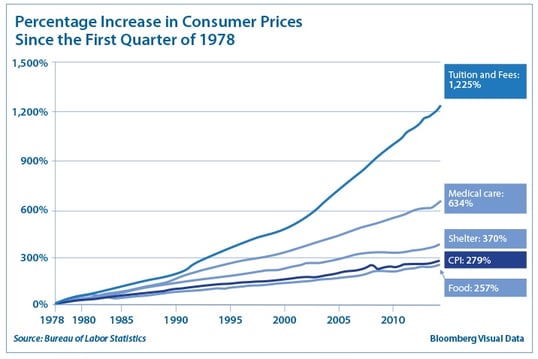

Consider this: The rate at which college tuition costs are rising has outpaced that of health care nearly twofold. The result is a generation of young people left with the giant burden of student loan debt. But as you have undoubtedly developed strategies to help your boomer clients meet the high cost of health care, there is now an opportunity for you to work with the next generation of clients trying to manage their debt while meeting their other financial goals.

Consider this: The rate at which college tuition costs are rising has outpaced that of health care nearly twofold. The result is a generation of young people left with the giant burden of student loan debt. But as you have undoubtedly developed strategies to help your boomer clients meet the high cost of health care, there is now an opportunity for you to work with the next generation of clients trying to manage their debt while meeting their other financial goals.

To start, let’s take a closer look at the numbers and then discuss some strategies to help younger clients with student loan debt.

The increase in college tuition compared with other costs (see chart below), combined with a higher total amount of loans taken by each student and tougher legislation on discharging student loans in bankruptcy, means that more and more people are feeling the burden of high student debt. In fact, the U.S. Department of Education recently announced that, for 2015, the student loan default rate was 11.8 percent, which is actually down from the previous year’s peak of 13.7 percent. For comparison, the single-family residential mortgage default rate in 2010, in the aftermath of the financial crisis, was 11.3%.

So, if you’re looking to capture the next generation of clients, you are bound to run into millennials with student loan issues. For some, it’s like having a second mortgage! Fortunately, there are ways to help your clients—and perhaps your client’s children—manage this debt.

The first step in assisting clients with their student loans is to determine whether or not they qualify for any loan forgiveness or cancellation based on their current employment. There are many programs available that will forgive loan debt for clients:

- Who are teachers

- Who work for the government or for a nonprofit

- Who are qualified medical professionals in underserved areas

Some of these programs will allow a client to have hundreds of thousands of dollars in debt forgiven. If you have clients who are considering one of these professions, making them aware of these programs may help them to decide on a career path. (For more information on these plans, visit the U.S. Department of Education website.)

Another strategy is to help your clients determine which type of repayment plan is best for them. High default rates were driven by borrowers who could not afford their repayment plans. The good news? Default rates are now declining due to the creation of new types of repayment plans that are based on income rather than loan balance.

Another benefit offered by these new programs is loan forgiveness at the end of the term. This can create a unique planning opportunity for your younger clients. They now have more options to manage their payments. For example, instead of the standard 10-year repayment plan, 25-year extended repayment, or 30-year consolidation loan, borrowers are now able to take advantage of the alternative program that best fits their situation.

Pay As You Earn. In 2011, the Department of Education created the Pay As You Earn (PAYE) plan, which allows qualifying borrowers to cap their monthly payments at 10 percent of their discretionary income for 20 years. Any remaining balance after the 20 years is forgiven; however, the amount that is written off is taxable income to the borrower in that year. This program is available only to borrowers who can demonstrate a financial hardship, with the broad test of financial hardship being the outstanding loan balance is higher than the borrower’s annual gross income.

Revised Pay As You Earn. For those borrowers who don’t qualify for the PAYE plan, the Revised Pay As You Earn (REPAYE) plan was established late last year. REPAYE does not require a financial hardship. This plan has allowed an additional 5 million borrowers who did not qualify under the previous plan to limit their payments to 10 percent of their discretionary income. The repayment period is 20 years for undergraduate loans and 25 years for graduate loans, with any remaining balance forgiven.

To help your clients calculate which of these plans will work for them, the Office of Federal Student Aid offers a Repayment Estimator for all repayment options available. The estimator will give clients an idea of what their payments will be and how much interest they will be charged (see example in chart below).

These calculations are based on: $100,000 loan balance, 7.9% interest, and $45,000 annual income.

These calculations are based on: $100,000 loan balance, 7.9% interest, and $45,000 annual income.

In this example, switching from a standard repayment to the PAYE plan could save the client nearly $40,000 over the term of the loan and lower his or her monthly payments (freeing up cash flow that can be used for retirement savings or other investments).

Once a repayment plan has been chosen, your clients will need to:

- Work with their student loan servicer to ensure that they are qualified

- Apply for the specific loan forgiveness program

- Stay current on all the necessary information

Be aware that there are many companies offering to help students apply for repayment plans and loan forgiveness—for a hefty fee. But these plans are free to enroll in and are easily applied for online through the client’s loan servicer website or over the phone.

An alternative option for clients with great credit and high income is to refinance their public loans through a private lender. This route may be worthwhile for those who want to pay off their loans as soon as possible and have loans with high rates. If they qualify, they can refinance with a fixed or variable rate for a select term. Here, one point that's important to note is that these borrowers may lose other options, such as government-funded forgiveness programs and income-based repayment options, if they decide to take their loans private.

As you and your clients discuss the various options for managing student loan debt, it’s important to be mindful of their goals. Do they want to pay the loan off as soon as possible? Are they hoping to resolve cash flow issues? By educating your clients on all the options available, you can help them manage their student loan debt while still meeting their other financial goals.

Have your younger clients taken advantage of the various repayment plans? Have they had success with private lenders? Please share your thoughts with us below.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network