by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Thursday June 2nd

U.S. equity index futures were slightly lower this morning. S&P 500 futures were down 2 points in pre-opening trade.

Index futures were virtually unchanged following release of economic news. Consensus for May ADP Private Employment was 170,000 versus 156,000 in April. Actual was 173,000. Consensus for Weekly Jobless Claims was 268,000 versus 268,000 last week. Actual was 267,000.

The European Central Bank held monetary policy steady. Overnight lending and deposit rates were unchanged.

Crude oil slipped $0.17 to $48.84 per barrel prior to news from OPEC’s meeting in Vienna about production quotas.

Michael Kors added $0.37 to $45.92 after Wedbush raised its target to $46 from $43. RBC Capital also reduced its target price to $51 from $57.

Ciena added $1.69 to $19.45 after reporting higher than consensus second quarter earnings and revenues.

Joy Global added $1.61 to $18.31after reporting higher than consensus quarterly earnings.

Apple slipped $0.69 to $97.77 after Goldman Sachs lowered its earnings estimate and dropped its target to $124 from $136.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/06/01/stock-market-outlook-for-june-2-2016/

Note seasonality chart on Construction Spending

Jon Vialoux is scheduled to appear on BNN’s Market Call Tonight on Friday at 6:00 PM EDT

StockTwits Released Yesterday

Stocks typically positive in the first half of June, negative in the second half. See study at:

http://www.equityclock.com/2016/05/31/stock-market-outlook-for-june-1-2016/

Technical action by S&P 500 stocks to 10:15: Bullish. Breakouts: $DRI, $WDC, $WEC

Editor’s Note: After 10:15 AM EDT, S&P 500 stock breakouts included ITW, LEG, QRVO and HOLX. Breakdowns included AVB and EQR.

Saputo $SAP.CA broke support at $39.09 completing double top following Bernier’s supply management comment.

Nice breakout by Zinc ETF $LZIC.L above $4.70 completing a reverse head & shoulders pattern. Zinc inventories are low.

Zinc stocks have yet to move: $HBM.CA, $TCK, $FM.CA, $LUN.CA.

Editor’s Note: After release of the above comments, Teck notable recovered from a 2% decline in early markets

Technical buyers bought into $FCO.CA on a move above $0.47. Cobalt stock.

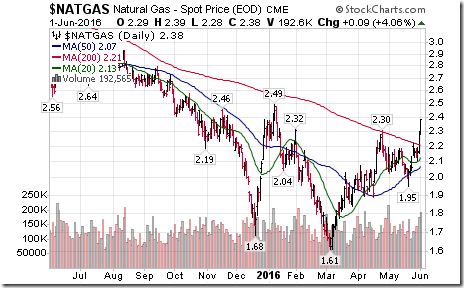

Interesting Chart

Natural gas prices continued to surge. Nice breakout!

Trader’s Corner

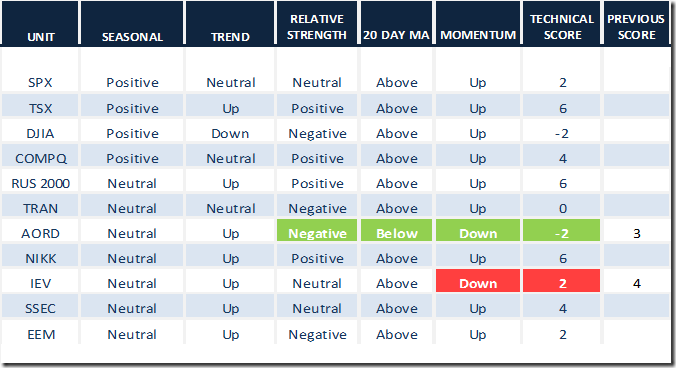

Daily Seasonal/Technical Equity Trends for June 1st 2016

Green: Increase from previous day

Red: Decrease from previous day

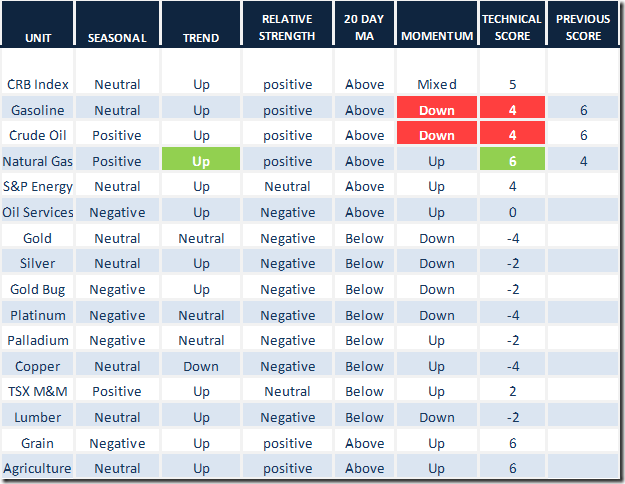

Daily Seasonal/Technical Commodities Trends for June 1st 2016

Green: Increase from previous day

Red: Decrease from previous day

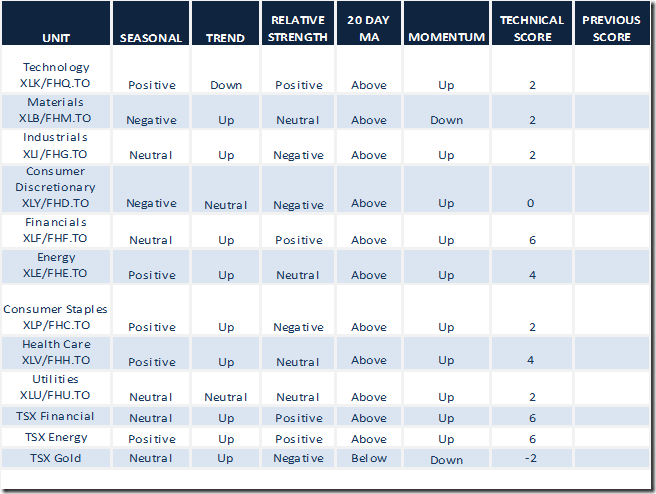

Daily Seasonal/Technical Sector Trends for March June 1st 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

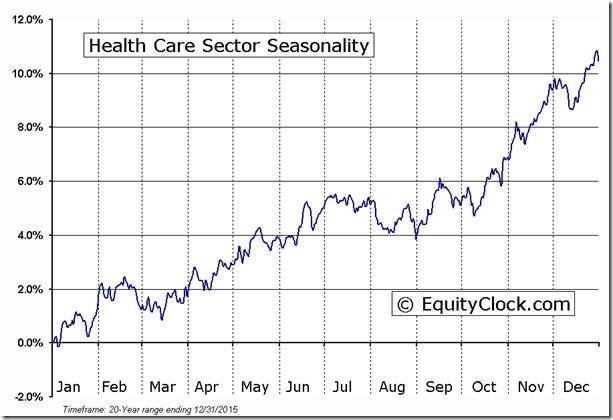

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following are examples:

An Update on our Accountability Services

Tech Talk feels responsible for follow up to suggestions offered on this site based on a combination of simultaneous seasonal and technical trading opportunities (long and sell/short). All suggestions have been offered either as StockTwits (and re-affirmed in the next edition of Tech Talk) or on BNN appearances.

All suggestions have specific requirements:

· A supporting seasonality chart from EquityClock

· A technical chart showing an intermediate uptrend (for buys) or an intermediate downtrend (for sales/shorts)

· Positive strength relative to the S&P 500 Index (for buys) or negative relative strength (for sells/short sells).

This service was initiated early in February. The approximate 65 suggestions from early February to mid-March were followed up with Accountability reports suggesting liquidation of positions. Most were nicely profitable, but about 25% of suggestions recorded a small loss or a small gain (effectively break-even). The intention of the service is to realize a seasonal trading profit, but also to minimize losses.

A new series of suggestions were offered beginning in mid-April. Another 14 suggestions were offered. Accountability reports showing discontinuation of support were issued earlier this week on two sell/short ideas: ITB and IYT. Both effectively were stopped out near break-even. Following is a list of the remaining 12 suggestions that currently are monitored on a daily basis:

XEG. TO($11.94) on BNN on April 12th at $10.92 and re-iterated on BNN on May 17 at $11.82

FBT ($96.03) on BNN on April 12th at $91.69 and re-iterated on BNN on May 17th at $88.25

FHQ.TO ($22.07) on BNN on April 12th at $21.17 and re-iterated on BNN on May 17th at $20.32

FTS.TO ($41.09) in StockTwits on May 12th at $41.05 and again on BNN on May 17th at $40.40

FFIV ($109.49) in StockTwits on May 16th at $106.80

FDY.TO ($18.22) on BNN on May 17th at $18.06

FXL($33.60) on BNN on May 17th at $31.06

CRM ($83.45) in StockTwits on May 18th at $77.62

BCE.TO ($60.43) in StockTwits on May 20th at $60.36

QCOM ($54.79) in StockTwits on May 20th at $53.88

IBB (281.18) on StockTwits on May 31st at $278.97

BIIB ($286.82) on StockTwits on May 31st at $290.11

Note the frequency of ETFs on the list starting with “F”. They are “smart ETFs” sponsored by First Trust that were chosen partially because of their outperformance relative to the underlying index/sector.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca