World Inflation and US Treasuries

By Benjamin Streed, CFA, Raymond James

May 31, 2016

The Federal Open Market Committee (FOMC) aka “the Fed” appears itching to raise rates in June, thereby marking their second rate hike in the post-recessionary economy. Although the committee remains focused on economic data including wages and job creation the group finds itself once again chasing sub-par inflation. Speaking of inflation problems; the Eurozone continues to struggle with deflationary pressures despite recent and record-breaking amounts of stimulus being pumped into the region by the European Central Bank (ECB). Consumer prices in the area have declined or been flat in the last four readings. Expectations remain intact for the region’s central bank to continue to provide ample stimulus but some market participants are skeptical to if/when this will finally take hold. For comparison, the United States has shown meaningful (albeit still below the 2% Fed target) inflation growth of >1% in three of the last four readings after being as low as zero percent in September. Clearly, the divergence between the US and many other developed economies continues. For some perspective, rough calculations from 2015 IMF data have the Eurozone at ~22% of global GDP, the UK is ~4% and Japan is another ~5%. These economies are facing deflation or disinflation (a slowing rate of inflation) and represent over 30% of global economic activity. In other words, a third of the world is fighting against lower inflation or even declining prices.

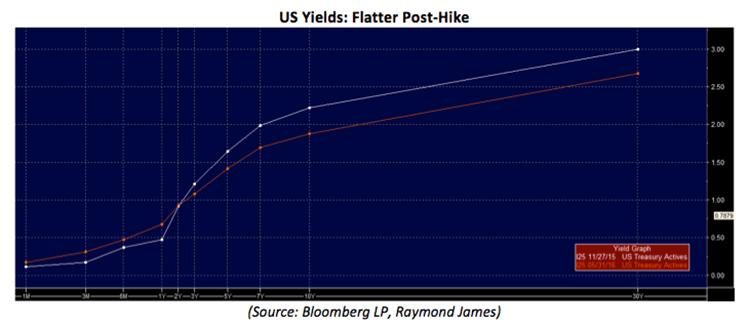

If the Fed is geared to potentially raise rates in June, why aren’t bonds moving significantly higher in yield? Remember, after December’s move the yield curve flattened (short-term rates up, longer-term rates down).

A number of reasons come to mind, but the big two are as follows: first, the US continues to have higher yields across the yield curve than other developed economies, many of which have negative yields out to 5 or even 10 year maturities. Second, US Treasuries remains a safe haven asset and enjoy twofold benefits of being highly liquid and denominated in the world’s reserve currency (the US dollar). Since we learned of the Fed’s inclination to raise rates this summer, recent Treasury auctions have seen record, or near-record, demand mostly from overseas investors seeking yield and safety. Is it any surprise? As we move closer to June’s meeting it will be interesting to see how the markets react to upcoming Treasury auctions and what happens to the shape of the yield curve, will we get more flat, or something else entirely?