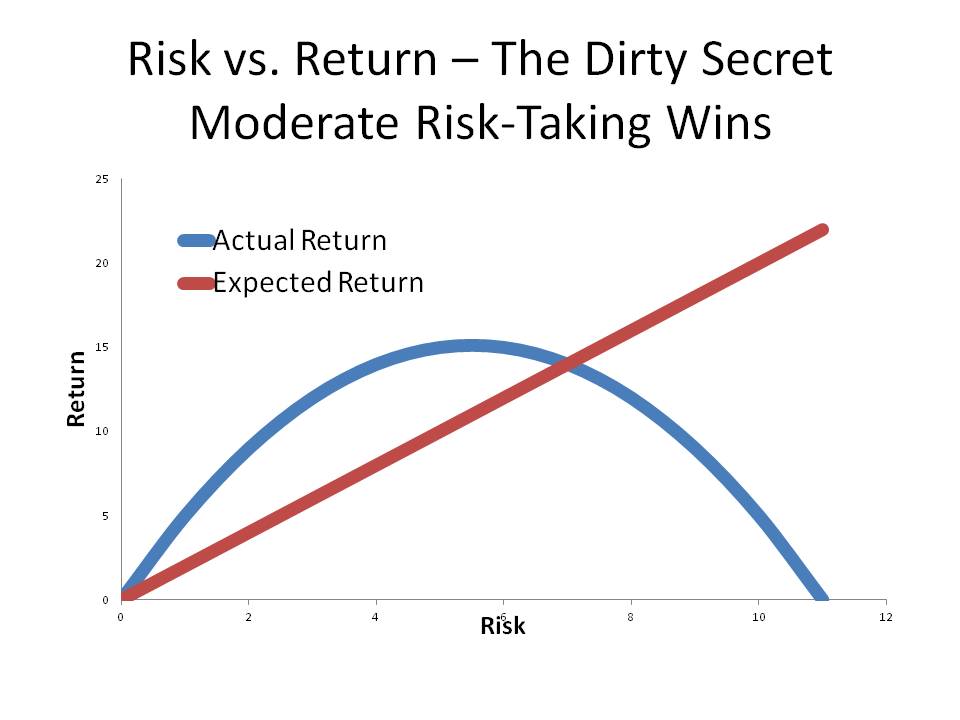

Risk vs Return — The Dirty Secret

Moderate Risk Taking Wins

by David Merkel, Aleph Blog

I’m thinking of starting a limited series called “dirty secrets” of finance and investing. If anyone wants to toss me some ideas you can contact me here. I know that since starting this blog, I have used the phrase “dirty secret” at least ten times.

Tonight’s dirty secret is a simple one, and it derives mostly from investor behavior. You don’t always get more return on average if you take more risk. The amount of added return declines with each unit of additional risk, and eventually turns negative at high levels of risk. The graph above is a vague approximate representation of how this process works.

Why is this so? Two related reasons:

- People are not very good at estimating the probability of success for ventures, and it gets worse as the probability of success gets lower. People overpay for chancy lottery ticket-like investments, because they would like to strike it rich. This malady affect men more than women, on average.

- People get to investment ideas late. They buy closer to tops than bottoms, and they sell closer to bottoms than tops. As a result, the more volatile the investment, the more money they lose in their buying and selling. This malady also affects men more than women, on average.

Put another way, this is choosing your investments based on your circle of competence, such that your probability of choosing a good investment goes up, and second, having the fortitude to hold a good investment through good and bad times. From my series on dollar-weighted returns you know that the more volatile the investment is, the more average people lose in their buying and selling of the investment, versus being a buy-and-hold investor.

Since stocks are a long duration investment, don’t buy them unless you are going to hold them long enough for your thesis to work out. Things don’t always go right in the short run, even with good ideas. (And occasionally, things go right in the short run with bad ideas.)

For more on this topic, you can look at my creative piece, Volatility Analogy. It explains the intuition behind how volatility affects the results that investors receive as they get greedy, panic, and hold on for dear life.

In closing, the dirty secret is this: size your risk level to what you can live with without getting greedy or panicking. You will do better than other investors who get tempted to make rash moves, and act on that temptation. On average, the world belongs to moderate risk-takers.

Copyright © Aleph Blog