The Power of High Income

by Fixed Income AllianceBernstein

Did you pull out of high-yield bonds when the year began, and miss the recent rally? If so, don’t worry. We still see opportunities in high-yield and other high-income assets around the globe.

Over the last two and a half months, the high-yield market has enjoyed one of its sharpest rallies in history. Between mid-February and the end of April, US high yield has returned 11.9%, European high yield has returned 6.5%, and global high yield has returned 10.7%.

It’s understandable why some investors might have missed out. After all, things looked different in January, when high yield in particular and risk assets in general were coming off a miserable 2015 and ended up logging one of their worst annual starts in history.

But in high yield, extended rallies aren’t unusual after a downturn, and those who stay invested tend to recoup their losses quickly. The reason: high-yield bonds provide investors with a consistent stream of high income during bull and bear markets alike. This sets them apart from equities and other bonds.

Watch Those Credit Spreads

Some investors are no doubt wondering whether they’ve missed their chance to get back into the market. We don’t think they have. Credit spreads—the extra yield that high-yield bonds offer over comparable government bonds—have narrowed in the US and globally since January, but they’re still above their historical averages. This suggests there’s room for spreads to narrow and for the market to rally further.

For instance, the option-adjusted spread (OAS) on the Barclays US High Yield Index was trading at 608 basis points (b.p.) as of May 6. Between January 1994, when Barclays began calculating the OAS, and April 2016, it traded above 600 b.p. only 30.6% of the time. The long-term average over that period is 521 b.p.

Using the long-term average as a guide can help determine when to tactically allocate to high yield. In a recent exercise, we calculated average six- and 12-month forward returns of US high yield between January 1994 and April 2016 at different spread levels. We did the same for global high yield between March 2001, shortly after the Barclays Global High Yield Index’s inception, and April 2016.

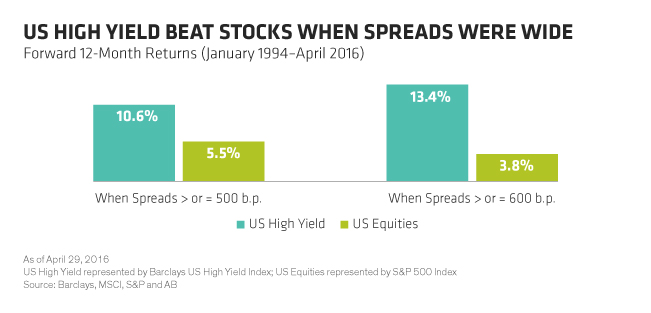

In the US, we found that high-yield bonds delivered an average six-month return of 5% and an average 12-month return of 10.6% when spreads were at or above 500 b.p. In contrast, average six- and 12-month returns of the S&P 500 Index were 2.7% and 5.5%, respectively.

Our exercise even suggested that investors might want to consider staying put if high yield hits another rough patch. When spreads were at or above 600 b.p., high yield still outperformed stocks (Display 1).

Globally, at 591 b.p. the OAS on the Barclays Global High Yield Index is in line with its 590 long-run average. But we found that high yield on average still outperformed the MSCI World Index on a six- and a 12-month basis, both when spreads were at or above 500 b.p. and when they were at or above 600 b.p. (Display 2).

Current yield levels—7.6% for US high yield and 7.1% for global high yield—also bode well for future returns. That’s because history suggests that starting yield is a strong indicator of what you can expect to earn over the next five years.

The Case for European High Yield

European high yield’s a different story—but still an attractive one. While accommodative monetary policy has kept spreads below average (439 b.p. versus a long-run average above 600 b.p.), it’s also likely to keep a lid on defaults. Also, European high yield is in an early stage of the credit cycle as opposed to US high yield, so issuer fundamentals are generally stronger.

Could yield spreads widen in Europe? Sure. But again, long-term investors who select their credits carefully can still come out ahead, thanks to the steady stream of income these bonds provide.

Why Credit Cycles Matter

Credit cycles matter because there are many different ones under way at any given time. Most sectors in the US high-yield market, for example, are in the later stages of the expansion phase (the energy sector is already in contraction), so investors have to be selective.

Asian corporates and global energy firms are in contraction. But Latin American companies are in recovery, as are US and European financials: leverage is decreasing and debt growth is stable.

That’s why a global multi-sector approach is so important. The most effective high-income strategies draw from multiple sources of income around the world. Here are a few sectors we think look promising:

• European banks: Weakness in this sector has created some buying opportunities, if investors are prepared to scrutinize lenders’ credit fundamentals and business models.

• US energy bonds: This is another bruised and battered sector. But some of these bonds—particularly “fallen angels” that have lost their investment-grade rating—look like bargains at current prices—notably midstream companies that can withstand lower oil prices.

• Emerging-market (EM) debt: EM currencies look attractively priced after years of dismal performance. That, along with more political stability in Brazil and Argentina, makes some currencies and local-currency bonds attractive. Also, dollar-denominated African sovereign debt might be an attractive way to play the rebound in commodity prices.

• US securitized assets: This sector is tied to the health of US consumers, who are actively deleveraging, and the US housing market. Credit risk–sharing transactions, a relatively new sector in the securitized mortgage market, are among the attractive assets.

Selectivity is critically important. But if approached with care, these sectors can combine with high-yield bonds to produce a strong income-generating strategy for globally minded investors. In our view, there’s still time to seize these opportunities.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Director—High Yield and Investment-Grade Credit

Gershon M. Distenfeld is Senior Vice President and Director of High Yield and Investment-Grade Credit at AB, responsible for overseeing the investment strategy and management of all investment-grade and high-yield corporate bond portfolios and associated portfolio-management teams. Strategies under his purview span the credit and risk spectrum, from short-duration investment-grade corporate bond portfolios to regional and global high-yield portfolios, encompassing a range of investment approaches, objectives and alpha targets, from income-oriented buy-and-hold strategies to active multi-sector total return strategies, and including both publicly traded securities and private placements in developed and emerging markets. Distenfeld also co-manages AB’s award-winning High Income Fund, recently named “Best Fund over 10 Years” by Lipper from 2012 to 2015, and the award-winning Global High Yield and American Income portfolios, flagship fixed-income funds on the firm’s Luxembourg-domiciled fund platform for non-US investors. He also designed and is one of the lead portfolio managers for AB’s Multi-Sector Credit Strategy, which invests across investment-grade and high-yield credit sectors globally. Distenfeld is the author of a number of published papers, including one on high-yield bonds being attractive substitutes for equities and another on the often-misunderstood differences between high-yield bonds and loans. His blog “High Yield Won’t Bubble Over” (January 2013) is one of AB’s all-time most-read blogs. Distenfeld joined AB in 1998 as a fixed-income business analyst, and served as a high-yield trader (1999–2002) and high-yield portfolio manager (2002–2006) before being named Director of High Yield in 2006. He began his career as an operations analyst supporting Emerging Markets Debt at Lehman Brothers. Distenfeld holds a BS in finance from the Sy Syms School of Business at Yeshiva University, and is a CFA charterholder. Location: New York.

Director—Emerging-Market Debt

Paul DeNoon directs all of AllianceBernstein’s investment activities in emerging-market (EM) fixed income and is a senior member of the Global Fixed Income and Absolute Return teams. He oversees a variety of global fixed-income assets and has overall responsibility for all of the firm’s Multi-Sector teams. DeNoon is also Portfolio Manager for the Next 50 Emerging Markets Fund and a member of the EM Multi-Asset Strategy Committee, the Dynamic Asset Allocation Committee and a number of other management committees. Prior to joining the firm in 1992, he was a vice president in the Investment Portfolio Group at Manufacturers Hanover Trust and an economist in the bank’s Financial Markets Research Group, where he was primarily responsible for the analysis of monetary and fiscal policy. DeNoon began his career as a research analyst at Lehman Brothers. He holds a BA in economics from Union College and an MBA in finance from New York University. Location: New York

Related Posts

Copyright © AllianceBernstein