Are FANG Stocks Long in the Tooth?

by Walter Price, Allianz Global Investors

What does FANG mean and why should investors care?

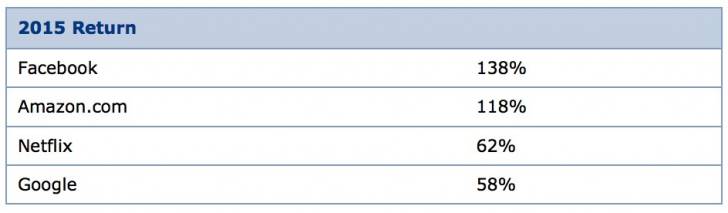

FANG is an acronym made from the names of four tech stocks – Facebook, Amazon, Netflix and Google – that led the US stock market in 2015. Yet as the accompanying table shows, the idea that these four stocks simply “led” the market is a major understatement.

2015 Return

When equity investors talk about market leadership, they are generally referring to market breadth – in other words, how many stocks participate when the market moves higher or lower. These movements, which can be broad-based or narrow, are carefully scrutinized by technical analysts. In general, analysts are hoping to see a large number of stocks moving up or down – this equals good breadth – to confirm new highs or new lows and help them gauge the market’s direction.

The narrow leadership in 2015 gave rise to the term FANG as shorthand for the four stocks that significantly outperformed the overall market. This “FANG phenomenon” raised the concern of an unhealthy market with an unhealthy outlook, since narrowing breadth is often the sign of a market nearing its peak. As a result, many analysts were not surprised when stocks headed lower earlier this year – and the FANGs joined the downward trend.

What do falling FANGs mean for investors?

Over my multiple decades as a technology investor, I have seen many configurations in the distribution of stock performance. My experience tells me that we have all seen this movie before: In the last few years, we’ve witnessed sentiment-driven risk-on/ risk-off shifts as the market changed from a low-volatility, relatively complacent one to a higher-volatility market; we’ve also seen a gradual increase in stockmarket dispersion. Yet even as sentiment swings wildly during these market shifts, investors can filter through the noise by keeping three key points in mind:

- fundamentals eventually matter a great deal, regardless of shorter-term swings in sentiment;

- accelerating company earnings ultimately translate into share-price performance; and

- the technology sector, by definition, is rich with new growth opportunities.

The last point is a particularly important one when judging the prospects of FANG stocks. As high-tech advances render former methods of operation obsolete, entirely new industries have emerged – and the FANGs are textbook examples:

- Consider how the digitization of music and videos dramatically changed the delivery of entertainment content – and how Amazon and Netflix captured these high-tech shifts and turned them into growth opportunities.

- Since Facebook’s founding just 12 years ago, the company built a user base of more than 1 billion people and captured the world’s attention with its ubiquitous social media platform.

- Google dominates the search business and, through its subsidiary YouTube, is the leader in internet video.

- Amazon dominates two other major areas: Amazon Web Services is the global leader in the “cloud computing” mega-trend, and Amazon is the global leader in ecommerce.

Clearly, it’s hard to get too negative on the outlook for FANG stocks. At the same time, many investors have learned the painful Wall Street lesson that “trees do not grow to the sky”; even fast-growing businesses eventually mature. When that happens, companies reach their market potential and their growth rates decline – a process that is likely affecting the FANG complex.

For each of these companies, investors should be looking for answers to key questions to assess future prospects:

- Will Amazon continue to improve its profitability in both its retail business and its cloud business?

- Is Amazon’s cloud-computing advantage sustainable and scalable?

- Can Google and Facebook continue to rapidly take advertising-dollar market share away from media properties, especially TV?

- Can Netflix be successful outside of the US with its over-the-top video service?

- Can Google find another great business in its collection of “other bets”?

Investors should approach the task of investing in FANG stocks the same way they approach investing in any company: by conducting their own research and continually challenging standing assumptions. With that as a foundation, investors can aim to participate in exciting themes while enduring short-term shifts in market sentiment.

Investors should approach the task of investing in FANG stocks the same way they approach investing in any company: by conducting their own research and continually challenging standing assumptions. With that as a foundation, investors can aim to participate in exciting themes while enduring short-term shifts in market sentiment.

Copyright © Allianz Global Investors