Abnormalities in the New Normal

by Niels C. Jensen, Absolute Return Partners

“An abnormal reaction to an abnormal situation is normal behaviour.” Viktor E. Frankl

My grandmother was born on a farm in Denmark back in 1911. As a child, I loved listening to her telling stories about her childhood, which was very different from anything I knew. Her mother would spend many hours every day doing things we now take for granted, if we do them at all any longer. Her day would begin by feeding the pigs. She would then carry clean water into the house as well as wood and coal for the stove, not to mention disposing of all the dirty water again. She would then clean her husband’s clothes, following which she would move on to the children’s and her own. In the evening, when she could hardly keep her eyes open any longer, there were still things to do. By the end of the week, if she was lucky, she was rewarded with a bath.

Now, if you compare her life to that of most people today, I think we would all agree that quality of life has improved immensely, at least in our part of the world. When I was a child in the 1960s, the most life-changing innovation was probably the introduction of colour TV and, today, when our nieces and nephews come to London to visit us, their first question is always the same: “Is the password still the same?” It is all about streaming these days.

The New Normal

My point is a simple one: Innovations are rarely life-changing events nowadays. Almost as important, at least from a macro-economic point of view, they are not likely to have nearly the same impact on productivity as the car had on the productivity of my parents, or the washing machine had on my grandmother’s ability to free up precious time. Productivity enhancements simply get more and more marginal, even if we think that all these new gadgets are wonderful.

I am aware that there are people out there who would disagree with that statement; they don’t think the marginal impact of innovations is diminishing at all, but the macro-economic data suggests otherwise.

Take the driver-less car – probably the innovation-to-come that excites the most. According to at least one well researched estimate1, the introduction of the driverless car would only boost U.S. GDP directly by 1.3% – and that is before the cost of servicing the additional debt has been taken into account.

As I have pointed out before, at the most fundamental level, the change in economic output is equal to the sum of the change in the number of hours worked and the change in the output per hour. If you assume that the size of the workforce is a good proxy for the number of hours worked (and it is), you can express the relationship the following way:

ΔGDP = ΔWorkforce + ΔProductivity

I have just argued that ΔProductivity is not as significant as it used to be, and that is certainly the case, even if some years are better than others. The biggest spike in productivity in more recent times came around the millennium, prompted by the dot-com boom, which regrettably turned into the infamous dot-com bubble, but that is another story. Since 2006-07, productivity changes have trended down pretty much everywhere.

ΔWorkforce will turn negative in many countries in the years to come, and that is in absolute numbers. It is therefore more or less a given that ΔGDP will stay relatively muted for a very long time to come, unless some kind of productivity miracle were to happen.

Just to be absolutely crystal clear: The workforce will fall nearly 1% per year in Japan and Korea between now and 2050; it will fall almost 0.5% per year in the Eurozone but only marginally in the UK, whereas it will rise almost 0.5% per year in the U.S. Significant regional differences in economic growth are therefore to be expected, but economic growth will be weak everywhere, at least when compared to what we got used to between the early 1980s and the Global Financial Crisis (‘GFC’). Those who argue that GDP growth will be disappointingly low for many years to come are on very solid ground. Welcome to the New Normal.

Some dynamics behave in the New Normal no different from the way they used to, but many don’t. In the following, I will review some of the outliers, and I will explain why (and how) that is an opportunity for investors, as long as the investment strategy is adjusted accordingly. Only the most naïve would expect an investment strategy that worked well in the great bull market to deliver similar, spectacular results in the years to come.

Two disclaimers before I begin: In the following, I have made no attempt to pick on every single abnormality that has surfaced in the New Normal. Take ZIRP. Everyone knows that 0% interest rates are part of the New Normal, and I don’t think I will add much value by pointing that out. Secondly, I will be the first to admit that I haven’t figured it all out yet, and I am sure the list of abnormalities will grow as time goes by. The following is only a start.

Long live the confusion

Let us start with one that many investors find confusing, and which may go a long way to explain the noticeable swings in sentiment that we have experienced in recent years. We all know that the correlation, at least in the short term, between GDP growth and equity performance can be all over the place. That has been the case for many years, and investors have always known that equities don’t always do what the underlying economy does. So far so good.

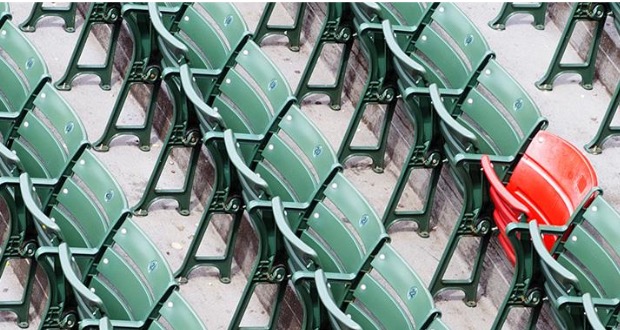

What we didn’t see much of prior to the GFC was that GDP growth and earnings growth - at least here in Europe – can also move in very different directions, but that all changed with the onset of the crisis (chart 1).

Source: Goldman Sachs Global Investment Research, Datastream, April 2016

Although this Absolute Return Letter is not about why that is, let me offer you at least one possible reason. European equity markets are exposed to certain industries very differently from how the real (European) economy is exposed. Take financials and oil & gas. Both are many times bigger in the equity market than they are in the real economy.

All this has led to a considerable amount of confusion amongst investors as, depending on which set of data they focus on, they either have all guns blazing or all alarm clocks ringing.

The foie gras market

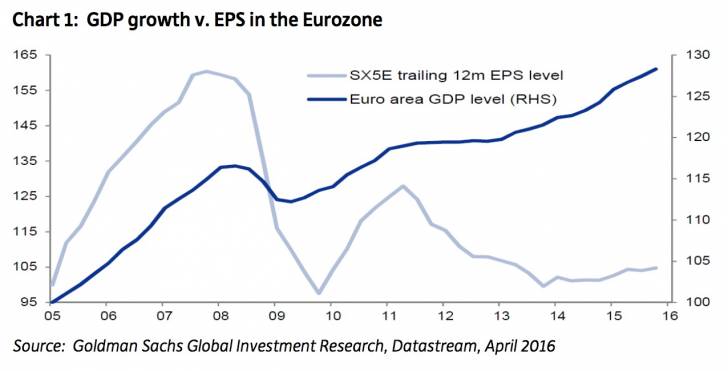

The next one is rather tricky and one that I, quite frankly, find hard to fully understand myself. Before 1982 the days on which the Federal Open Market Committee (‘FOMC’) convened were just like any other day in the U.S. equity market, but that changed with the arrival of the great equity bull market.

Since 1982 a full one quarter of the total return on U.S. equities has been delivered on those 8 days a year the FOMC meet, regardless of whether interest rates were lowered or not. Even more noteworthy, in the first few years following the GFC, the performance of the S&P 500 on those days the FOMC convened was no less than 29 times stronger than average daily returns (chart 2). In other words, the sheer existence of those meetings have had a much bigger say on equity prices than what the FOMC actually decided to do. That is nothing short of astonishing.

Source: GMO, March 2016

By establishing QE, the Fed and other central banks have effectively created a considerable amount of moral hazard by force-feeding investors risk assets, hence the expression the foie gras market2.

The link between monetary policy and financial stability has been discussed repeatedly over the years, but nobody has phrased it more eloquently than the late Nicholas Kaldor, when he wrote (back in 1958):

“Reliance on monetary policy as an effective stabilising device would involve a high degree of instability. The capital market would become far more speculative [and] profitability would play a subordinate role.”

The obvious question to ask is: Have investors lost all common sense or have James Montier and I? Is the fact that the FOMC meet on a given day really more important than what they decide to do? More on this later.

Running businesses for volume rather than profit

Now to one that is easier to understand. These days more and more companies – particularly in the U.S. – are run for volume rather than profit and, as long as investors find it desirable to pay exorbitant amounts of money for companies that have never made a decent profit, you can understand the companies’ desire to pursue such a strategy.

The best known example of a company pursuing such a strategy would probably be Amazon. Despite having seen a huge increase in turnover, profits continue to be tiny. For that accomplishment, Wall Street has rewarded Amazon with a valuation of almost $300 billion.

Amazon’s business model has ensured that it cannot earn a decent profit – at least not in the short term. Having said that, one could also argue that its business model has virtually guaranteed that nobody else can either. In the mid-1990s, before Amazon entered the stage, U.S. department stores generated decent profits (3% of sales on average). They no longer do. So the disruptor doesn’t earn much money, and the disrupted earn no money at all. Now, that is what I would call a disruptive business model.

The obvious winner is the consumer who benefits from the ongoing pressure on consumer prices. How he/she will react when there are no department stores anymore, only time can tell. In the meantime, the ‘volume over profit’ business model will ensure that consumer inflation stays muted.

Excessive stock buy-back programmes

The next one is one we all know about – stock buy-back programmes. Buying back your own company’s shares enhances EPS in the short term, which is typically rewarded by investors here and now. Take the U.S., where buy-backs totalled $1.1 trillion last year. The flipside of that is a deteriorating capital stock. Companies under-invest as a consequence of spending their free cash flow (and sometimes more) on buying back shares and, as a result, the capital stock ages, and it shrinks. Private, domestic investments, measured as a % of GDP, are now at the lowest point for the past 60+ years. Under-investing today reduces profitability tomorrow, and the extraordinarily low U.S. private, domestic investments therefore paint a very dark picture for the profitability outlook of the U.S. corporate sector.

Meanwhile, U.S. corporates are leaving investors with an illusion of improved profitability, but the true story is quite different. Whereas S&P 500 EPS rose marginally from 2014 to 2015, ‘proper’ earnings (GAAP earnings) actually dropped almost 15%. That is likely to come back and bite investors in the derriere at some point.

Keeping non-profitable businesses alive

Now to one that Americans are perhaps not so familiar with, but we Europeans certainly are. Keeping businesses or entire industries alive which are not profitable and shouldn’t really survive is an old habit that we Europeans have lived with for a long time, and (sort of) gotten used to. As we have all learned over the past few years, such government policies have a meaningful impact on pricing, as supplies of the goods and services in question are kept artificially high.

The French do it; the Spanish certainly have a history of doing it, and even the Germans are known for having done those kinds of things in the past. Of all the major European countries, the UK is probably the one with the fewest state sponsored businesses or industries. Of all the major European countries, the UK is also the most inflation prone. Whether the two are related I don’t know, but it is an interesting thought.

More recently, EU laws have made such tactics somewhat more difficult to get away with. We all know it is still happening, at least to a modest degree, but it is not done as openly as previously. Following the GFC, the guiltiest country nowadays is probably China, which explains why pricing is particularly poor across many manufacturing industries.

Growth outperforming value in a low growth environment

Now to the last – but certainly not the least important - abnormality. When U.S. Treasury bond yields peaked in 2007 and began to trade downwards, value stocks also began to underperform growth stocks and have done so ever since (chart 3).

Source: JP Morgan Asset Management, April 2016

All other things being equal, growth companies require more growth capital than value companies do, and growth capital comes at a price. That price equals the cost of servicing the debt, provided the company in question has had to borrow to grow. As interest rates have kept falling, the cost of servicing that debt has fallen to lower and lower levels, improving profitability of growth stocks relative to value stocks.

I am not at all suggesting that growth should not outperform value for so long. Anything is possible, but there appears to be a link between the extraordinary fall in interest rates and the significant outperformance of growth over value. Assuming my logic is correct, growth stocks could therefore begin to underperform value stocks once interest rates bottom out and begin to ‘normalise’.

How to make a decent profit in the New Normal

I will rest my case here. The tricky part, which I will get to next, is how to take advantage of such abnormalities as an investor?

Allow me to briefly summarise my findings so far:

- The GDP story doesn’t always tie up with the earnings story.

- Exuberant investors overreact on FOMC meeting days.

- Businesses are increasingly run for volume rather than profit.

- Excessive stock buy-back programmes paint a misleading earnings picture.

- Non-profitable businesses are kept alive.

- Growth has significantly outperformed value as interest rates have fallen.

That is quite a mishmash of market dynamics. How can investors possibly take advantage? As this Absolute Return Letter is already in danger of getting too long, I have chosen to summarise the conclusions I have reached in nine easy-to-read bullet points:

Identify which industries are subject to the biggest disconnects between economic (GDP) performance and earnings performance, and trade opportunities as they arise.

- Use the FOMC conundrum to time your buys and (in particular) your sells.

- Stay clear of those industries where companies pursuing a disruptive business model have a meaningful market share.

- Expect an ageing investor base to force companies to spend a larger proportion of their free cash flow on dividends; as a consequence, sell those companies that have most actively bought back their own shares and buy those who pay (and can afford to pay) attractive dividends.

- Whilst adverse demographics are likely to suppress inflation for a long time to come (see past Absolute Return Letters for details), keeping businesses alive that don’t deserve it, is likely to have the same effect. In other words, it is very difficult to expect anything but subdued inflation and low interest rates for a long time to come.

- As this is more of an issue in Europe than it is in the U.S. the investment strategy should be adapted accordingly.

- Buy value and sell growth when interest rates begin to rise (which is likely to happen much sooner in the U.S. than in Europe).

- Stay underweight equities overall, but be particularly careful in the U.S. where the true picture is not nearly as good as investors are led to believe.

- Expect U.S. investors to react quite aggressively when the real earnings picture dawns on them. This is partly because U.S. wealth (measured as a percentage of GDP) is way too high, and will have to come back down. I discussed this in the February Absolute Return Letter. See here.

Finally a word or two about valuation

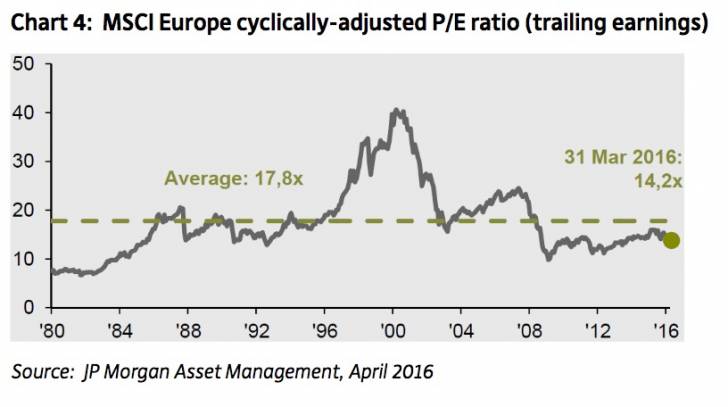

Let me round this month’s Absolute Return Letter off by comparing U.S. and European equity valuations, as quite a few of my conclusions above explicitly or implicitly refer to those two equity opportunities.

As the two are at different stages of the economic cycle – the U.S. cycle being more mature than the European – I am using cyclically adjusted P/E (CAPE) ratios, so that we can compare the two.

Europe first. The forward looking earnings multiple is approximately 15 (not shown here) – not a million miles from the 14.2 CAPE multiple suggested by chart 4 below. How do the European multiples compare to the equivalent numbers in the U.S.?

Source: JP Morgan Asset Management, April 2016

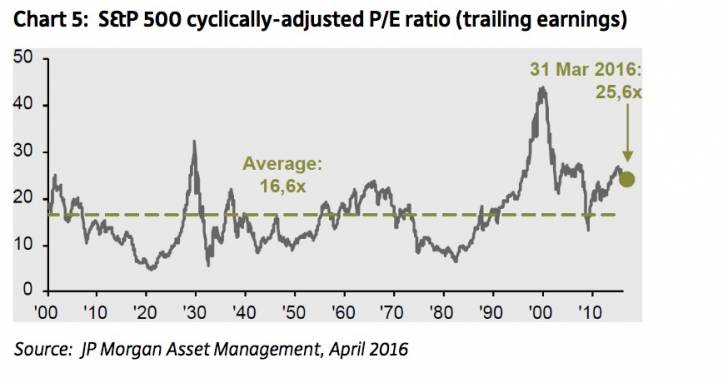

The forward looking P/E multiple in the U.S. is 16.5 (not shown here); not dramatically different from the forward looking multiple in Europe, but here comes the punch line. The U.S. CAPE multiple is 25.6 – a full 80% higher than the corresponding number in Europe, and that is a rather dramatic difference (chart 5).

Source: JP Morgan Asset Management, April 2016

When I was first presented with those numbers, I could hardly believe my own eyes. Could U.S. equities possibly be that much more expensive than equities here in Europe? Why would investors accept such a large difference?

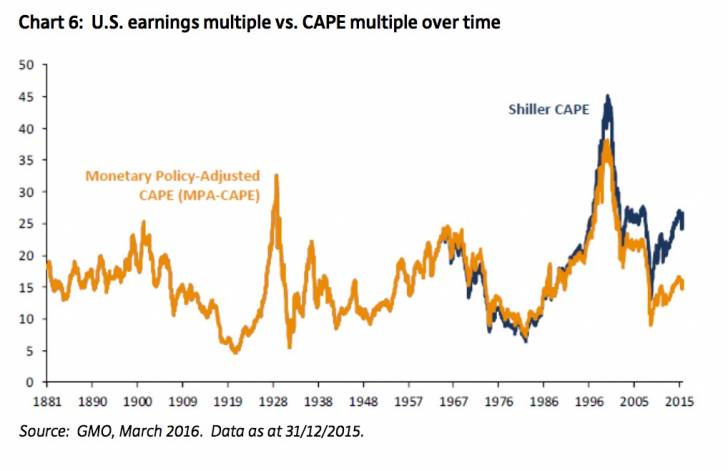

Source: GMO, March 2016. Data as at 31/12/2015.

I then began to think about the foie gras phenomenon again. On the days that the FOMC have convened (and only on those days), if one were to replace the actual S&P 500 return with the average daily return, a very different picture would emerge (chart 6). As you can see, the CAPE multiple drops from the mid-twenties to the mid-teens, which is much more in line with European CAPE valuations.

In other words, if we remove the moral hazard premium created by the Fed, equities in the U.S. and in Europe are roughly equally expensive. As a consequence, I am going to stick my neck out and suggest that U.S. equities are more accident prone than European equities. How much more, only time can tell but, at some point, the love affair with the Fed will turn sour.

Niels C. Jensen 3 May 2016

1 Provided by MacroStrategy Partnership LLP.

2 I have borrowed the expression with gratitude from the brilliant James Montier of GMO.

Copyright © Absolute Return Partners

©Absolute Return Partners LLP 2016. Registered in England No. OC303480.

Authorised and Regulated by the Financial Conduct Authority. Registered Office: 16 Water Lane, Richmond, Surrey, TW9 1TJ, UK