Energy's Winners and Losers

by Simon Lack, SL Advisors

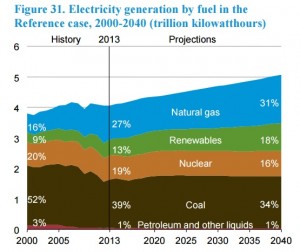

The U.S. Energy Information Agency (EIA) is a powerful resource for those interested in the topic. They recently noted that in 2016, natural gas-fired power generation would exceed coal for the first time in history. 18.7 gigawatts (GW) of new gas-fired capacity is due to come online between now and 2018 replacing dirtier coal plants as they are gradually phased out. Moreover, much of this new capacity is located near its source of energy, so Pennsylvania, West Virginia and Ohio (Marcellus and Utica shales) as well as Texas and Louisiana (Eagle Ford and Haynesville shales) have seen much of this added capacity. The travails of the coal industry are well known, with the bankruptcy filing last week of the world’s biggest coalminer Peabody Coal (BTU) highlighting the economic challenges of producing the dirtiest fossil fuel. Cheap natural gas has long been on course to supplant coal for power generation in the U.S. The EIA’s Annual Energy Outlook 2015 forecasts natural gas to move from 27% to 31% of electricity generation by 2040. Only renewables will also enjoy an increased share, with Nuclear and Coal both slipping in importance.

What’s taking place is a fairly dramatic transformation of the ways in which the U.S. uses energy compared with as recently as five years ago. The unlocking of vast amounts of natural gas has provided very competitively priced power for industry, cheap ethane feedstock for use in the production of plastics and by displacing coal has allowed the U.S. to curb its production of greenhouse gases. This last point is especially ironic since the U.S. never signed up to the Kyoto Protocol, whose goal was to limit emissions of carbon and other pollutants.

Sometimes when chatting with clients about energy consumption and fossil fuels I’m asked why we don’t worry about electric cars and solar power upending the sourcing and consumption of electricity. Electric cars sound clean, but it depends on how the electricity they use is generated. The good news here is that it’s increasingly from relatively clean natural gas although it does vary across the United States. A friend of mine is planning to buy a Tesla, and her environmentally-sensitive decision is supported by the virtual absence of coal-fired electricity production in New York and New Jersey where she’ll be driving. Wyoming may offer spectacular scenery and an environment worth saving, but with 89% of its power coming from coal a Tesla won’t much help the environment there. West Virginia and Kentucky are similar.

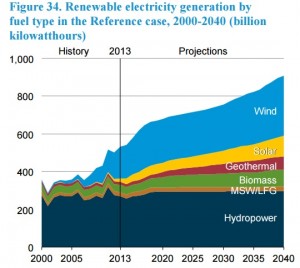

Renewables are expected to gain in importance, going from 13% of our electricity generation to 18% by 2040 according to the EIA as the first chart shows. Solar energy will grow at a fast rate but from a very low base, as is shown in the second chart. It looks to me as if my grandchildren will reach retirement before they inhabit a world in which solar is the dominant source of energy. Although we invest for the long term, that’s too far out even for us to incorporate into our thinking.

Low prices for crude oil and natural gas have also created challenges across many industries beyond their own. For example, the economics of renewables, including solar, have suffered from cheaper competing fossil fuels. SunEdison (SUNE) is close to bankruptcy as it grapples with this problem. Banking hasn’t been immune — JPMorgan, Wells Fargo and Bank of America all reported higher loan loss reserves against their energy portfolios last week. And last October, somewhat improbably, United Airlines blamed a disappointing quarter on fewer corporate executives flying to visit oil fields; most would think cheaper fuel is good for airlines.

Although last week saw the bankruptcy of the biggest miner of “old” fuel in Peabody and the pending demise of a champion of new energy in SunEdison, Tallgrass Energy (TEP) had a good week. This Master Limited Partnership (MLP) provides natural gas transportation and storage services in the Rockies and Midwest through their Tallgrass and Trailblazer systems. TEP has a publicly traded General Partner (GP) called Tallgrass Energy GP (TEGP), which runs TEP. As is invariably the case, management is invested in TEGP rather than TEP. If you want to invest alongside management in an MLP it usually pays to own the GP instead. In the case of TEGP and TEP, management insiders have around $1.9BN invested in the GP and only 18MM in TEP itself, a difference of 101X. They obviously have an opinion about the relative merits of these two securities. Last week, TEGP raised its quarterly distribution by 21.4% compared to the previous quarter. Not every part of the energy sector is struggling.

We are invested in TEGP

Copyright © SL Advisors