Stock Markets are in for a Cold Summer

by Brooke Thackray, Alphamountain Investments

“Priced For Perfection When Perfection Does Not Exist”

The above statement is not a metaphysical discussion on the existence of perfection, but rather a description of the current state of the stock market.

The current bull market is 85 months old and is becoming extended. Recently, investors have been lulled into complacency as the S&P 500 has been trading in a band from approximately 1820 to 2135 that was established back in 2014. A lot of investors cannot remember a multi-year sideways stock market. A couple of round trips to the bottom of the trading band and back to the top have left investors with the overwhelming feeling that everything will work out. After all, the S&P 500 is close to its all-time highs. The general belief is that the stock market will resolve its current consolidation phase by rallying substantially above its old highs... and that it is important to just be in the market.

It all sounds a bit Pollyanna-ish. There are times when a buy-hold-and-close-your-eyes approach works well...but not now. A buy and hold approach works well when the stock market is substantially under-priced and the economic and earnings backdrop has a strong growth trajectory. We do not have the necessary conditions to support a strong rally above the all-time high for the S&P 500. The macro economic fundamentals and earnings are not supportive for a strong rally. Currently, the stock market is priced for perfection.

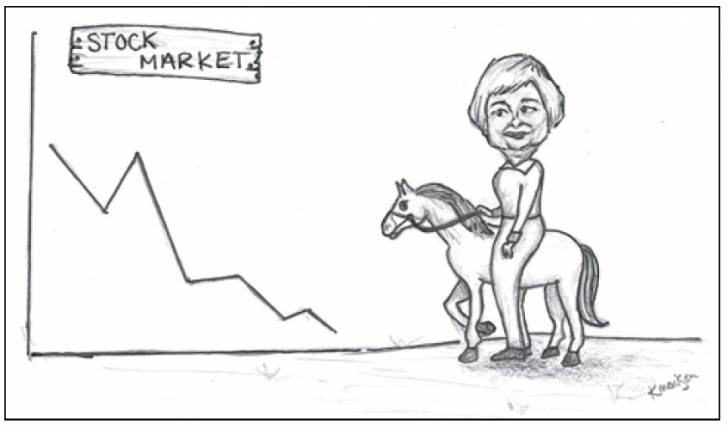

Investors have been conditioned to believe that the U.S. Federal Reserve will have their backs. Who can blame them? For many years, if the economy started to turn down and the stock market corrected, the U.S. Federal Reserve would step in with stimulative monetary policy to help prop up the stock market.

The situation has changed, as the U.S. Federal Reserve is running out of tools to prop up the economy and the stock market. At this point, if the economy starts to slow and the stock market starts to have a severe correction, Janet Yellen, chairperson for the U.S. Federal Reserve is not going to ride in on a white stallion to save day. Janet Yellen’s options are limited...maybe she rides in on a pony?

At times, the stock market can continue to move higher, even without strong prospects. The historical odds are that in the six month unfavorable period for stocks from May 6th to October 27th, stocks are less likely to perform well compared to the other six months, the six month favorable period for stocks. Large gains in the six month unfavorable period for stocks are not common and typically require a strong catalyst. In addition, the six month unfavorable period for stocks has on average suffered larger losses than the other six months of the year.

The conditions in the stock market at this time make it susceptible to a correction as the stock market is overvalued, has little potential for additional support from central banks, corporate earnings that are fading, and a looming period of weak seasonality. Investing in an overvalued stock market that lacks support can still be fruitful, as the market can continue to move up on strong momentum for a long period of time. The potent cocktail of less than desirable ingredients measuring the stock markets valuation has one “kicker” that pushes the probability of a correction to the tipping point - a weak six month seasonal period from May 6th to October 27th.

If there is one time of the year that makes sense for investors to lower the risk in their portfolios, it is the approaching six month unfavorable period for stocks. This is especially pertinent this year as there is a lack of catalysts to propel the market higher. A six month period of reduced risk is not a forever allocation. It may be a rough summer for the stock market ahead, but there is shelter elsewhere. All is not lost, as there are investments that tend to perform well in the six month unfavorable period, including certain sectors of stock and fixed income market.

Read/Download the complete 11-page report below:

Stock Markets Are in for a Rough Summer

Copyright © Alphamountain Investments