by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Friday April 1st

U.S. equity index futures were lower this morning. S&P 500 futures were down 9 points in pre-opening trade.

Index futures were virtually unchanged following release of the April employment report. Consensus for March Non-farm Payrolls was an increase of 200,000 versus a gain of 242,000 in February. Actual was an increase of 215,000. Consensus for Private Non-farm Payrolls was an increase of 195,000 versus a gain of 230,000 in February. Actual was an increase of 195,000. Consensus for the March Unemployment Rate was unchanged from February at 4.9%. Actual was an increase to 5.0%. Consensus for March Hourly Earnings was an increase of 0.3%. Actual was an increase of 0.3%.

Blackberry dropped $0.50 to US $7.59 after reporting a larger fourth quarter loss and lower than consensus revenues.

Urban Outfitters (URBN $33.09) is expected to open higher after the company raised its first quarter sales guidance.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/03/31/stock-market-outlook-for-april-1-2016/

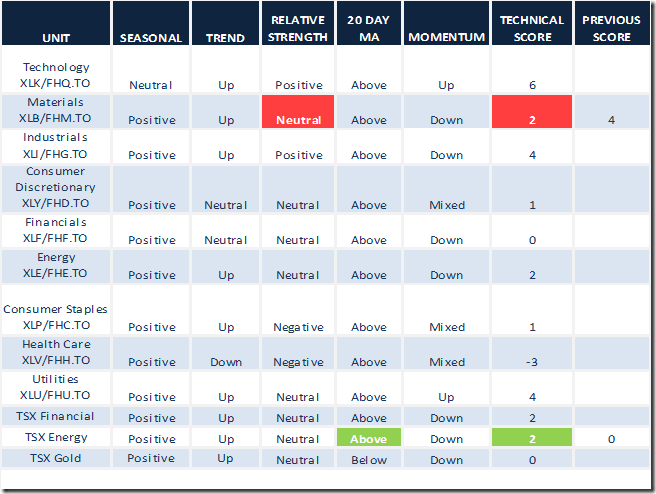

Note seasonality charts on Materials, Energy and Health Care

Editor’s Note: Mr. Vialoux is scheduled to appear on BNN at 8:15 AM EDT on Monday

Interesting Phenomenon

Historically, the first trading day in April is one of the strongest days of the year for the S&P 500 Index and TSX Composite Index. During the past 20 periods, the S&P 500 Index gained 0.8% per period and the TSX Composite Index improved 0.7% per period. A major reason is money flows entering the equity market coming from pension plans on the first trading day of the second quarter.

Today, North American equity markets face a major event that could preclude the phenomenon: the reporting of the April employment report.

StockTwits Released Yesterday

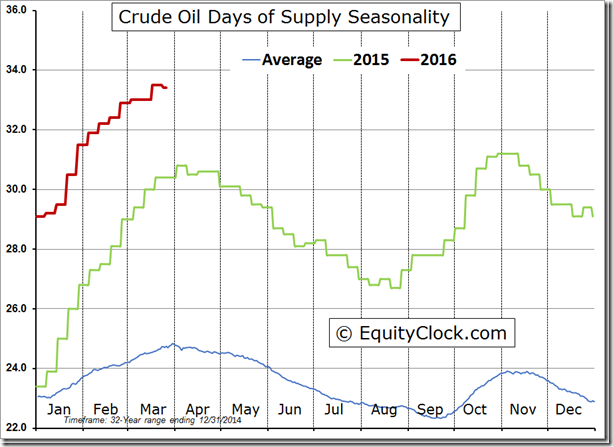

The peak in oil inventories should be revealed within the next month according to seasonal trends.

Technical action by S&P 500 stocks to Noon: Quietly bullish. Intermediate breakouts: $HAS, $ILMN, $WU.

Editor’s Note: After Noon, one more stock broke above resistance: Alliance Data Systems (ADS). None broke support

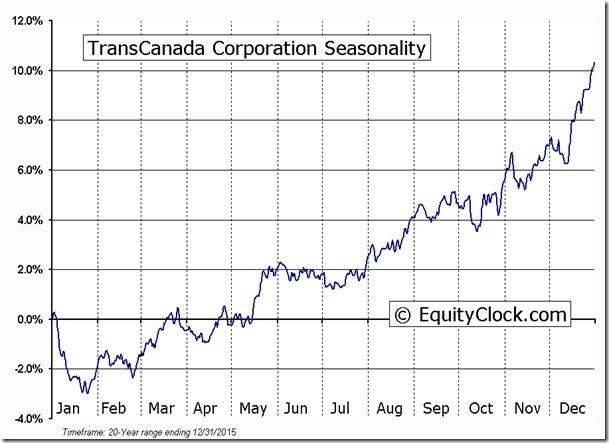

Nice breakout by TransCanada $TRP.CA above resistance at $50.67 to extend an intermediate uptrend!

Trader’s Corner

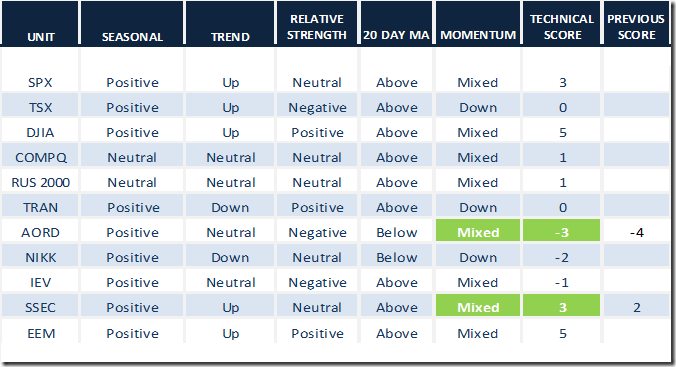

Daily Seasonal/Technical Equity Trends for March 31st 2016

Green: Increase from previous day

Red: Decrease from previous day

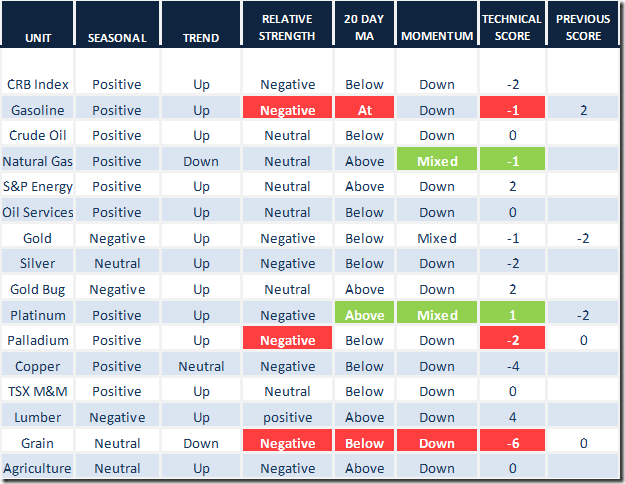

Daily Seasonal/Technical Commodities Trends for March 31st 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for March 31st 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following are examples:

Interesting Charts

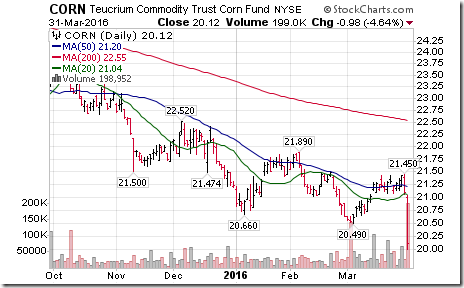

The largest change in technical score yesterday occurred in the Grain ETN. Score fell to -6 from 0 when units fell below their 20 day moving average, short term momentum indicators turned lower and relative strength turned negative.

A breakdown by corn prices was the trigger.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca