by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday

Treasury bonds hold above support as equities battle around 200 day moving averages

Technical action by S&P 500 stocks to 10:30 AM: Quiet. No intermediate breakouts. Breakdown: Baker Hughes

Editor’s Note: After 10:30 AM, six S&P 500 stocks broke resistance: Amazon.com, Costco, Electronic Arts, Henry Schein, Lam Research, Vulcan Materials.

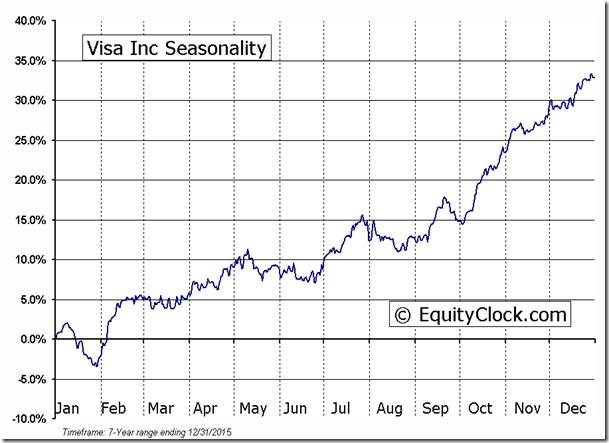

Nice completion of a reverse head and shoulders pattern by Visa $V on a move above $74.64!

‘Tis the season for strength in Visa $V until mid-May!

Trader’s Corner

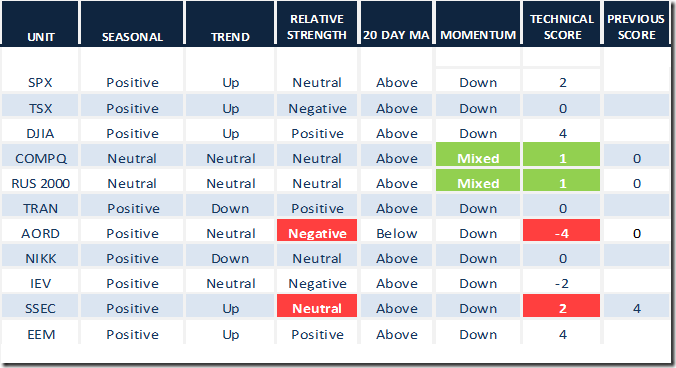

Daily Seasonal/Technical Equity Trends for March 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

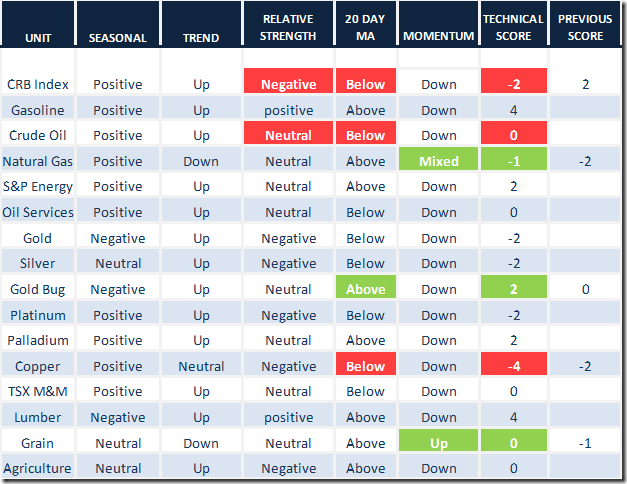

Daily Seasonal/Technical Commodities Trends for March 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

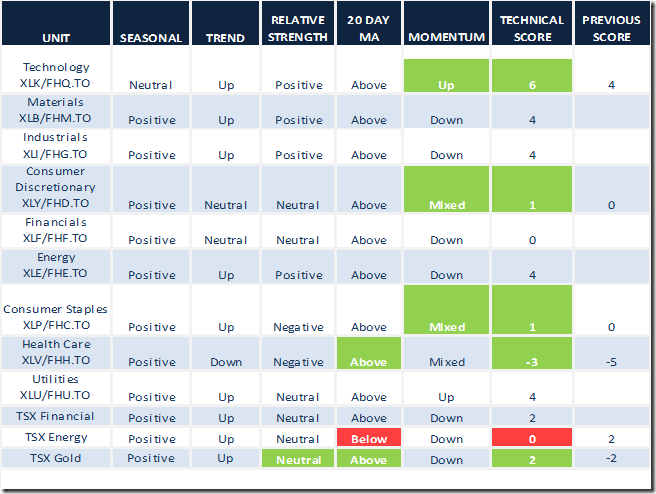

Daily Seasonal/Technical Sector Trends for March 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

Interesting responses to Janet Yellen’s comments:

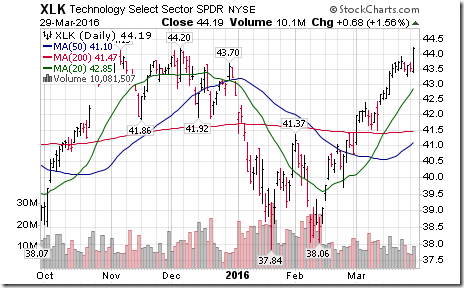

Technology SPDRs broke above resistance at $44.20 to reach a 15 year high

The U.S. Dollar Index virtually collapsed:

Despite weakness in the U.S. Dollar Index, commodity prices continued to move lower.

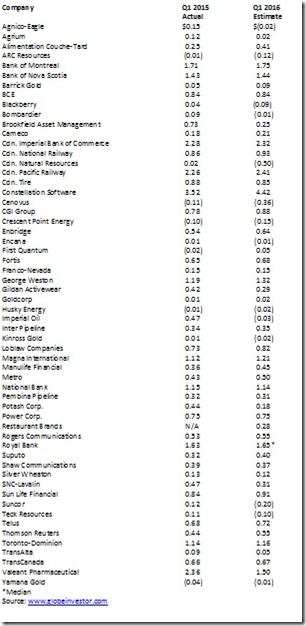

First Quarter Year-over-year Earnings Expectation for TSX 60 Companies

Benefits of a lower Canadian Dollar relative to the U.S. Dollar Index are starting to appear. Unlike the first quarter consensus earnings estimate decline of 8.7% for S&P 500 companies, consensus for TSX 60 companies is calling for an average (median) earnings gain of 1.2%: 29 companies are expected to report higher earnings, 27 companies are expected to report lower earnings, three companies are expected to report no change and one company is not comparable.

Companies expected to record the highest percent gains included Couche Tard, CGI Group, Saputo, Constellation Software and Manulife Financial

Companies expected to record the highest percent declines include mining and energy companies.

Following is the data:

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Designing Your Model For Top Trading

By Adrienne Toghraie, Trader’s Success Coach

What is the ultimate level of success that you would like to realize as a trader? It is important to note that how you answer this question gives insight as to whether you will allow this level of success for yourself. Here are some examples of how you might approach this answer:

· The sky is the limit

· I want as much as my strategy will allow

· I just want to make enough money to pay my bills and live a comfortable life

· I would be happy with earning a living as a trader

· I will never be able to make it to the top, but I think I can be successful

Here is how a top trader answered this question:

“I would like to continually enjoy the process of reaching for

my best in all areas of my life. Each new level is my top.”

The important thing to note about his answer is that:

· Feeling good is involved

· Balancing life is involved

· He sees himself as already competent

· He is open to new levels

Once you have defined what success in trading looks and feels like, your second step is to write down a complete plan on how you will make this happen:

· Write about a model of what you believe the ideal model of a top trader looks like

· Write about all the talents, skills, attributes and resources a person like this has

· Compare this list with where you currently place yourself in acquiring all of these winning qualities

· What do you have to have or do to achieve each one of these qualities?

· What is within your power to work on right now?

· Who can you enlist to assist you in acquiring these qualities?

Next step is to surround yourself with successful role models. They carry mental seeds that when planted and fertilized will grow into creative ideas, concepts, strategies, dimensions that can improve your life.

Where to find them:

· Family, friends, associates, colleagues

You do not have to find the whole model of perfection in one person. Take the best and model that best and leave the rest.

· Books, newspapers, television

You do not have to personally know someone to model them. Very often people make themselves available for questions. I often get the phone number of authors or write to them through their website. Most answer.

· Meet-up groups

Look up meet-up groups in your area. Mentors can be modeled from groups that are not traders.

· Webinars

This is a wonderful source for meeting great models of success and do not require much time or commitment.

· Live Seminars

This is one of the best ways to get in-depth modeling from not only the instructor, but the participants as well.

· Conferences

At conferences you can hone in on several people you would like to model. Make sure that your questions are prepared in advance and always sit in the front of the room. This way you can establish a more personal relationship with the speaker. Ask questions after the talk, and ask if you can call in the future.

Conclusion

Creating a model by designing a plan for how you visualize your success gives your neurology a map for what to look for in the world you live. When you then follow a logical pattern and sequence with the assistance of good models to get there, you are more likely to realize your dream of success.

Free Webinars Presented by Adrienne Toghraie

Email for Details – Adrienne@TradingOnTarget.com

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca