Finding Silver Linings in Cloudy US Equity Markets

by Equity Research, AllianceBernstein

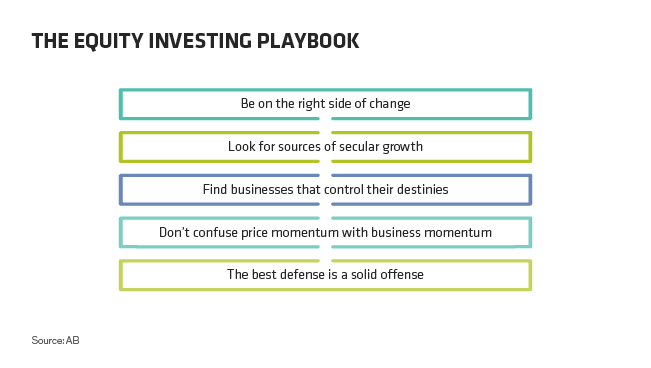

Investors in US equities are facing tricky market conditions. To help stay focused in today’s environment, we’ve outlined five “plays,” or investing principles, for identifying the long-term drivers of a company’s business, which should foster sustainable growth.

After the recent correction, equity managers can access stocks of stronger companies at attractive valuations to better position a portfolio for long-term investment performance. By using research to focus on the long-term drivers of a company’s business—and with a disciplined approach to portfolio construction—we believe investors can find silver linings in cloudy US equity markets by following a playbook of five clear investing principles (Display).

Play 1: Be on the right side of change: Changes in technology or regulation, or structural shifts in specific markets, are excellent sources of growth potential—even in an earnings-constrained world, in our view.

Play 2: Look for sources of secular growth: Identify growth trends that aren’t held hostage to a country’s macroeconomic fortunes.

Play 3: Find businesses that control their destinies: Companies with better products, superior operating execution and more responsible financial behavior are likely to exercise a greater degree of control over their own fate.

Play 4: Don’t confuse price momentum with business momentum: There are countless reasons to explain why share prices rise or fall sharply. It’s not always a sign of the strength or weakness of the underlying business.

Play 5: The best defense is a solid offense: Popular safe havens in the markets aren’t always as secure as they might seem. Be creative when searching for stocks that can withstand volatility.

In the coming weeks, we’ll publish additional blogs providing more detail on each of the plays. All five plays share a common denominator: they’re aimed at finding companies with sustainable growth prospects in a volatile, low-growth world. While relatively few companies fit this profile, our research suggests that investors who find them can enjoy outsize returns (Display).

When volatility strikes, it’s hard to stick to an investing playbook. Just like a football team that’s losing an important game might abandon a plan and improvise in the hopes of staging a recovery, investors under duress can be tempted to shift a portfolio or allocation in response to market surprises, while losing sight of their strategic goals.

It usually doesn’t work. Staying disciplined in the face of adversity is more likely to yield better results, in our view.

Of course, there are many different ways to implement our investing plays in the US equity market. A growth-centric manager can use them to find high-return, cash-generative businesses with clear paths to implement their strategy. An unconstrained manager can use them to create a portfolio of companies that balances high-quality cyclical and noncyclical holdings.

The playbook can also be used to create a concentrated equity portfolio of a very small group of stocks with unique, differentiated business advantages. For a thematic approach, a portfolio manager can apply these ideas to navigate disruptive trends that are creating big opportunities in new markets. With these concepts in mind, we believe investors can find the right approach to capture excess returns over long time horizons, no matter how unruly markets are.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Chief Investment Officer—US Growth Equities

Frank Caruso is a Senior Vice President and Chief Investment Officer of US Growth Equities, a position he has held since 2012. In this capacity, he oversees three services: US Large Cap Growth, US Core Opportunities and US Growth & Income. Caruso has been Team Leader of US Growth since 2008 and Team Leader of US Growth & Income since 2004. From 1995 to 2004, he served as a Growth & Income portfolio manager. Caruso joined the firm in 1993, when it acquired Shields Asset Management, where he had been director of Equities. Previously, he was a managing director and senior member of the Investment Policy Committee at Shearson Lehman Advisors, as well as CIO for Shearson Lehman Asset Management’s Directions and Capital Management businesses. Caruso was also formerly the lead portfolio manager for Shearson’s family of growth and income mutual funds. He holds a BA in business economics from the State University of New York, Oneonta, and is a member of the New York Society of Security Analysts and the CFA Institute. He is a CFA charterholder. Location: New York

Chief Investment Officer—Select US Equity Portfolios

Kurt Feuerman is Chief Investment Officer of Select US Equity Portfolios, focusing primarily on equity securities traded on US exchanges. Prior to joining the firm in June 2011, he was a senior managing director and senior trader with Caxton Associates for more than 12 years, and a managing director for nine years with Morgan Stanley, where his responsibilities included managing part of the firm’s US equity business. Earlier, Feuerman was a managing director with Drexel Burnham Lambert for six years, specializing as a sell-side securities analyst. He began his career in 1982 at the Bank of New York. Feuerman holds a BA in philosophy from McGill University, an MA in philosophy from Syracuse University and an MBA in finance from Columbia University. Location: New York

Chief Investment Officer—Global Growth and Thematic

Daniel C. Roarty was appointed Chief Investment Officer of AllianceBernstein’s Global Growth and Thematic team in 2013. He joined the firm in May 2011 and was named sector head for the technology sector on the Global/International Research Growth team on July 1, 2011, and team leader for that team in early 2012. Roarty previously spent nine years at Nuveen Investments, where he co-managed a large-cap growth strategy and a multi-cap growth strategy. His research experience includes coverage of technology, industrials and financial stocks at Morgan Stanley and Goldman Sachs. Roarty holds a BS in finance from Fairfield University and an MBA from the Wharton School at the University of Pennsylvania. He is a CFA charterholder. Location: New York

Chief Investment Officer—Concentrated US Growth

James T. Tierney, Jr. is Chief Investment Officer of Concentrated US Growth. Prior to joining AllianceBernstein in December 2013, he was CIO at W.P. Stewart & Co. Tierney began his career in 1988 in equity research at J.P. Morgan Investment Management, where he analyzed entertainment, healthcare and finance companies. He left J.P. Morgan in 1990 to pursue an MBA and returned in 1992 as a senior analyst covering energy, transportation, media and entertainment. Tierney joined W.P. Stewart in 2000. He holds a BS in finance from Providence College and an MBA from Columbia Business School at Columbia University. Location: New York

Related Posts

Copyright © AllianceBernstein