Panic?

by Jeffrey Saut, Chief Investment Strategist, Raymond James

The markets (any market) are seldom surprised by shocking events. But during those rare instances when the market is caught by a surprise a panic may result. My own definition of a panic is this:

A panic is a collapse (triggered by fear and unforeseen circumstances) which causes the price of the item to fall precipitously within a short span of time. That’s a loose definition but it will do.

We’ve had a few panics declines in the markets over the last few years. Panics are particularly interesting for one reason. The reason is this: The surest action in the markets is the recovery following a panic. It is almost a rule (if anything in the markets can be called a rule) following a panic, there will be an advance that will recover roughly one-half of the price lost during the panic. This applies to individual stocks, to commodities, to indices, and to the averages.

. . . People forget that what prolongs a bull market, any kind of bull market, is the phenomenon known as the correction. A rocket-rise type of bull market, one with little or no corrective action, always ends up as a short bull market. Thus, seasoned investors tend to welcome corrective action during bull markets. They know that the more corrections and the longer and more often a bull market is held back, the bigger that bull market will be – and ultimately the higher that bull market is fated to climb. Of course, the same thing is true (in reverse) during bear markets.

. . . Richard Russell, The Dow Theory Letters (1991)

Richard Russell began publishing The Dow Theory Letters in 1958. My father turned me on to his letter when I entered this business in 1971. Between my Dad, and Richard Russell, I avoided making a lot of the mistakes neophyte investors make when developing a workable stock market investment model. Unfortunately, we lost Richard last November, yet a man is not gone while his name is still being spoken. And, Richard’s name will be spoken for a long time because he touched the lives of so many people! His words still live because of people like me that learned so much from his tutelage. Take the aforementioned prose, written by Richard in 1991.

The wisdom of these words is as relevant today as it was 25 years ago. Indeed, “The markets (any market) are seldom surprised by shocking events. But during those rare instances when the market is caught by a surprise a panic may result.” Take 2001 when the D-J Industrials peaked in May at ~11338 and subsequently declined to about 9600 into the beginning of September. At the time, I was writing that something was out of balance in the universe; stocks should have been going up and they were not. The markets were then “surprised” by the horrific attack on 9-11-01, and after a four-session shutdown, the senior index fell to 8235.81 and bottomed. The ensuing rally took the Dow back to ~10635 by March 2002. Obviously more than the “half” price recovery Richard wrote about, but there you have it.

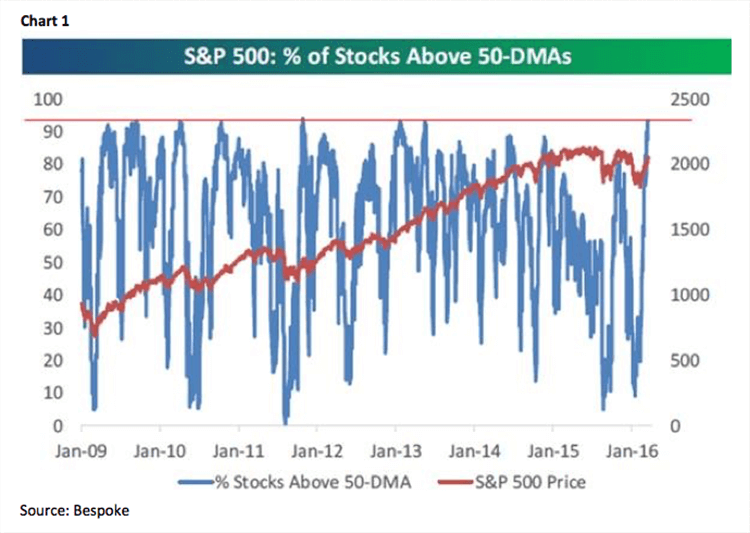

More recently, the past 12 months have seen two “panic plunges.” It was last July when our proprietary models suggested the equity markets were getting ready to go into a “period of contraction.” The S&P 500 (SPX/2035.94) was changing hands around 2120. Beginning in mid-August, the decline arrived, taking the SPX from ~2100 into its August 24 capitulation low of ~1812. On that date, I told CNBC’s sagacious Becky Quick the markets were bottoming. My next call, however, was not so good, since it was for a Santa Claus “rip your face off rally,” which was a dud, and I had to admit that rather quickly on the same CNBC show a week and a half later. That cautionary counsel should have left investors/traders on the defensive coming into 2016. On February 5, 2016 (Friday), and again on Becky’s show, I said my model was calling for a low next week. On February 11 (the next Thursday), the SPX made an undercut low of ~1810 (marginally below last August’s 1812 low), and that was it! At the time, both Andrew and I said the “lows” are in, and we featured a number of stocks for purchase in these letters. Since those February “lows”, the SPX has rallied, rather quickly I might add, an impressive 13.6% and, in the process, became more overbought than it has been in more than a year (see chart 1). Hence, in mid-March, we again counseled for caution, on a trading basis, thinking it would take a number of tries to break decisively above the 2000–2040 overhead resistance zone, which brings us to this week.

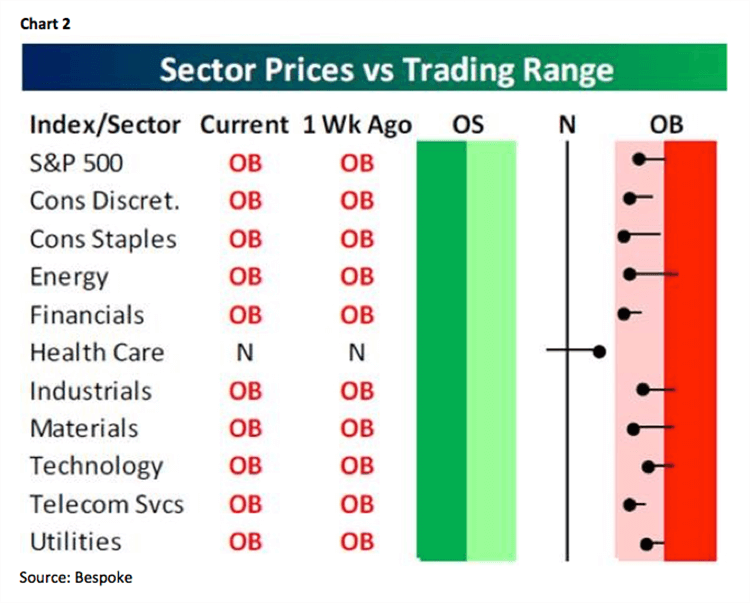

Some seers suggest what we have just experienced is an upside “blow off” top in the equity markets, and termed it a rally in a bear market, driven by the surprise dovish verbiage from the Federal Reserve on February 16 (read: upside panic). We, however, do not see it that way. It is our belief we remain in a secular bull market! While it is true the equity markets are pretty extended on a trading basis, with all but one (healthcare) of the S&P macro sectors overbought (chart 2), we think that, after a pause/pullback, stock markets will extend their rally. This belief is imbibed by the belief the economic recovery will surprise most participants like our economist Scott Brown Ph.D. wrote last Thursday:

Fourth quarter growth was revised higher, reflecting better growth in consumer spending, offset slightly by weaker business fixed investment and a larger drag from inventories. Private Domestic Final Purchases (the meat and potatoes) rose at a 2.0% pace (+2.8% y/y). This report also included some new information (not just revised numbers): Real Gross Domestic Income rose at a 0.9% annual rate (+1.4%), while the average of RGDP and RGDI rose at a 1.1% pace (+1.7% y/y). Corporate profits took a tumble, with sharp weakness in the domestic nonfinancial sector (not a good sign). We don’t have a lot of detail on the government’s profit figures, but on foreign profits, the U.S. is making less from the rest of the world, while the rest of the world is making less from the U.S. (these are nominal figures, reflecting lower prices of imports and exports). Market reaction to these figures (on Monday) may be mixed (with the headline GDP number possibly seen as bringing a Fed rate hike closer), but other elements (falling profits, declining business fixed investment) should give the Fed a reason to hold off.

The call for this week: And “hold off” is our operative phrase, as we believe the Fed is on HOLD until after the election in raising interest rates! If correct, the equity markets should follow the path of least resistance, which should be to the upside. While the near-term overbought condition could limit the upside at 2060 on the SPX, longer term, the upside should continue to be favored. As for the constant “recession fears” that have been trumpeted for the past seven years, our friend, Jason Goepfert writes:

Recession fears have eased, as they should. Barely a month ago, the fear of a U.S. recession was palpable, even though econometric models mostly downplayed those risks. Over the past few weeks, most of those models have recovered even further and one in particular shows that the business cycle just hit a new all-time high. While the sample size is woefully small, stocks did well going forward on a risk/reward basis (chart 3).

We continue to favor the upside, believing pullbacks are for buying rather than selling the rallies.