Looking for Value in High Yield? Avoid ETFs.

by Fixed Income AllianceBernstein

Are high-yield bonds cheap today? Relative to history, yes. But they’re not all alike. That’s why using a passive exchange-traded fund (ETF) to tap into the market can be costly.

High-yield mutual funds and ETFs have both pulled in money at a rapid clip over the past month. That makes sense: after an extended sell-off, high-yield bonds—particularly in the US—look attractive compared to other return-seeking assets, including equities.

But how investors access the market—via an active mutual fund or a passive ETF—matters. After downturns in 2008, 2011 and 2013, investors who blindly bought the market did well. That approach won’t work this time. US high yield is late in the credit cycle. Even at current valuations, disciplined credit selection is more important than ever.

A Tale of Two (Hypothetical) Bonds

To get a sense of what we mean, imagine a scenario where credit research turns up two hypothetical high-yield bonds, both trading at a discount and offering attractive yields.

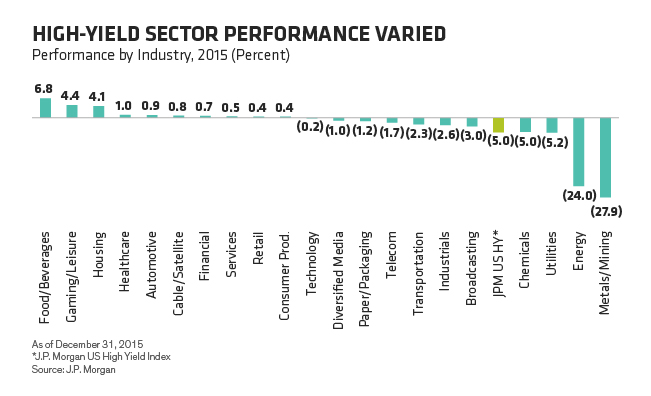

Let’s say the first bond was issued by a firm in the food and beverages industry, the highest-performing sector in the US high-yield index last year. The company has strong fundamentals and benefits from lower commodity prices and an improving US economy.

The second offers an even higher yield. But the issuer, an oil exploration and production company, has watched the recent collapse in oil prices cut into its revenues and shrink its margins. Default is a distinct possibility.

If the investor in this scenario is comfortable owning both, then he should buy an ETF. If not, we think an active strategy is a much better way to go.

Passive Strategies and Bonds: A Poor Fit

Here’s why: ETFs track an index, so their asset allocation must mirror that of the index. An active manager, on the other hand, can isolate the securities or sectors she thinks are most likely to do well and avoid those that look risky.

Indexing is especially tricky in fixed income. This is because the companies that have issued the most debt become the biggest weights in the index. So when you invest in a bond ETF, you’re lending the most to the biggest debtors. In a market like high yield, that’s not an ideal strategy. It’s akin to turning over the keys to your portfolio to issuers, whose interests are rarely the same as investors’.

For example, energy-sector companies became the biggest weight in the index in recent years by borrowing heavily when oil prices were high. Then prices began to plunge. By the end of last year, the energy sector—by that point, the market’s largest—was one of its worst performers (Display).

On Performance, ETFs Don’t Measure Up

ETFs’ inability to discriminate among credits and sectors is one reason (there are others, too) that these vehicles have consistently underperformed the average actively managed high-yield fund.

Let’s look at HYG and JNK, the two largest high-yield ETFs. Between the start of 2008, shortly after they began trading, and February 29, 2016, they’ve delivered annualized returns of 4.8% and 4.3% respectively.

The average actively managed high-yield mutual fund, as rated by Lipper, delivered 5.2% over that period. For the top 20% of high-yield managers, annualized returns rose to 6.1%. What’s more, the active managers delivered these results with lower volatility.

ETFs can be useful for short-term trades and to hedge portfolio positions because, like stocks, they can be bought and sold at any time. But they’re a poor choice for long-term investors.

We think there’s value in the high-yield market today, but it takes an active, bottom-up approach to make the most of it. In our view, investors who go passive may be missing a rare opportunity.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Director—High Yield

Gershon M. Distenfeld is Senior Vice President and Director of High Yield, responsible for overseeing the investment strategy and management of all investment-grade and high-yield corporate bond portfolios, from buy-and-hold investment-grade corporate portfolios to regional and global high-yield portfolios. He co-manages the award-winning High Income Fund, named “Best Fund over 10 Years” by Lipper from 2012 to 2015, and the award-winning Global High Yield and American Income portfolios, two Luxembourg-domiciled funds designed for non-US investors. Distenfeld also designed and is one of the lead portfolio managers of the Multi-Sector Credit Strategy. He has authored a number of published papers and blogs, including “High Yield Won’t Bubble Over” (January 2013), one of the firm’s most-read blogs. Distenfeld joined AB in 1998 as a fixed-income business analyst, and served as a high-yield trader (1999–2002) and high-yield portfolio manager (2002–2006) before being named to his current role in 2006. He began his career as an operations analyst supporting Emerging Markets Debt at Lehman Brothers. Distenfeld holds a BS in finance from the Sy Syms School of Business at Yeshiva University and is a CFA charterholder. Location: New York

Related Posts

Copyright © AllianceBernstein