by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Tuesday March 22nd

U.S. equity index futures were lower this morning. S&P 500 futures were down 10 points in pre-opening trade. Index futures are responding to bombings by terrorist in Belgium

Airline stocks moved lower after one of the bombings that occurred in Brussel’s airport.

Yahoo slipped $0.52 to $34.95 after Citigroup downgraded the stock to Hold from Buy.

Zillow Group (ZG $24.52) is expected to open lower after RBC Capital downgraded the stock to Sector Perform from Outperform.

Abercrombie & Fitch added $0.43 to $31.49 after Jefferies selected the stock as a “franchise pick”.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/03/21/stock-market-outlook-for-march-22-2016/

Note seasonality report on Existing Home Sales.

StockTwits Released Yesterday @EquityClock

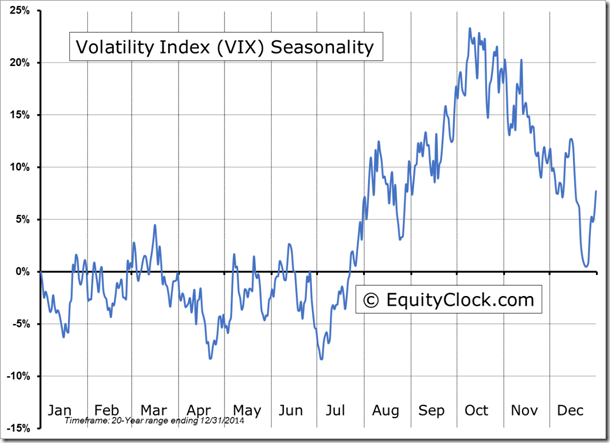

S&P 500 Index over 6% above its 50 day moving average, history suggests declines typically follow.

Technical action by S&P 500 to 10:15 AM: Quietly bullish. Breakouts: $DVN, $STT, $GILD

Editor’s Note: After 10:15 AM, breakouts included UA and NOC. No breakdowns

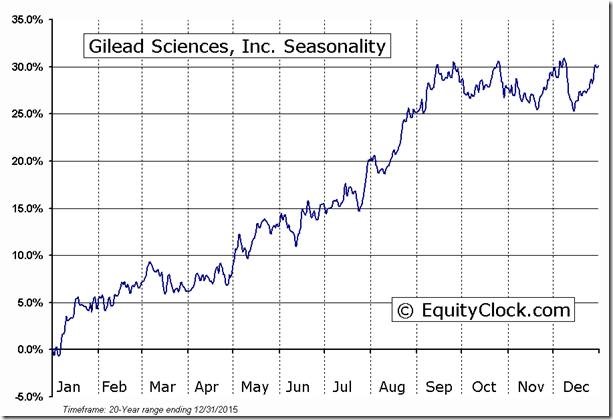

Nice breakout by Gilead $GILD above resistance at $91.06 to complete a base building pattern.

Seasonal influences for Gilead $GILD turn positive at the end of March.

Nice breakout by Under Armour $UA above resistance at $86.29 to complete a base building pattern.

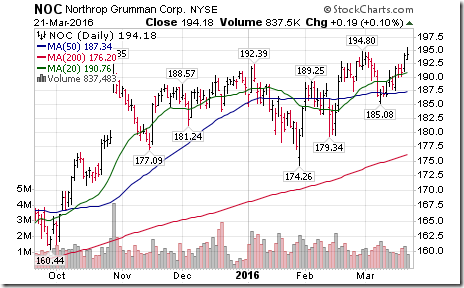

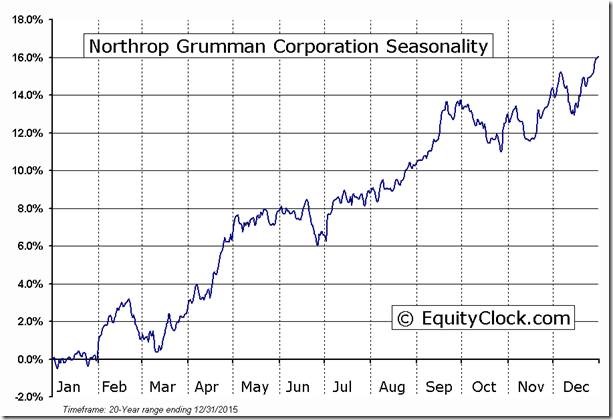

Nice breakout by Northrop Grumman $NOC above resistance at $194.80 to reach an all-time high.

‘Tis the season for strength in Northrop Grumman $NOC to move higher to near the end of May!

Trader’s Corner

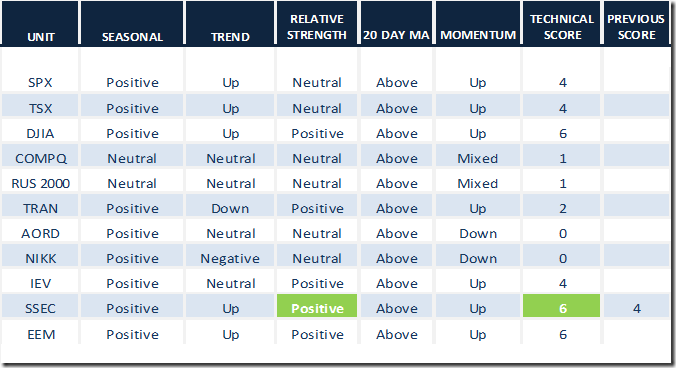

Daily Seasonal/Technical Equity Trends for March 21st 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Commodities Trends for March 21st 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for March 21st 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca

![clip_image002[4] clip_image002[4]](https://advisoranalyst.com/wp-content/uploads/2019/08/9a25725817a3dc5fdd591d1fd81d0c43.png)

![clip_image002[6] clip_image002[6]](https://advisoranalyst.com/wp-content/uploads/2019/08/d9732f989452cbde8793eb6fa0c0fb5f.png)