by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Monday March 21st

U.S. equity index futures were lower this morning. S&P 500 futures were down 3 points in pre-opening trade.

Sherwin Williams dropped $2.29 to $286.40 and Valspar gained $23.19 to $107.02 after Sherwin Williams agreed to purchase Valspar for $113 per share cash. Value of the deal is estimated at $11.3 billion.

Starwood Hotels gained $3.43 to $84.00 and Marriott slipped $0.61 to $72.55 after Starwood agreed to a revised cash and stock bid to acquire the company valued at $13.6 billion.

Nike gained $0.41 to $63.40 after JP Morgan upgraded the stock to its Analyst Focus List.

Lululemon slipped $0.51 to $62.00 after JP Morgan removed the stock from its Analyst Focus List.

Lions Gate Entertainment slipped $0.46 to$22.16 after Stifel Nicolaus downgraded the stock to Hold from Buy.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/03/18/stock-market-outlook-for-march-21-2016/

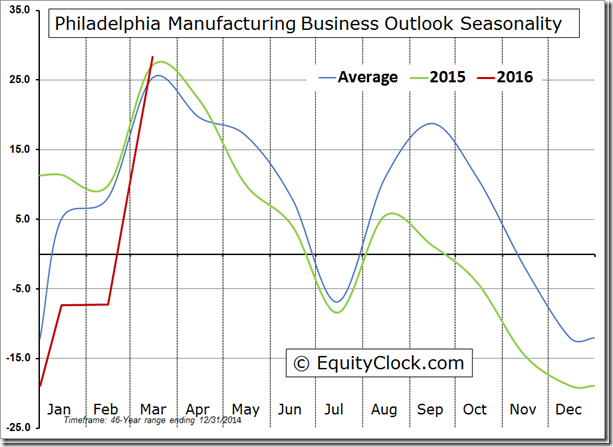

Note seasonality study showing S&P 500 performance when the Index is overstretched.

Economic News This Week

February Existing Home Sales to be released at 10:00 AM EDT on Monday are expected to dip to 5.37 million units from 5.47 million units in January.

February New Home Sales to be released at 10:00 AM EDT on Wednesday are expected to increase to 511,000 units from 494,000 units in January.

Weekly Initial Jobless Claims to be released at 8:30 AM EDT on Thursday are expected to increase to 268,000 from 265,000 last week.

February Durable Goods Orders to be released at 8:30 AM EDT on Thursday are expected to drop 2.9% versus a gain of 4.9% in January. Excluding transportation, February Durable Goods Orders are expected to slip 0.2% versus a gain of 1.8% in January.

Third estimate of Fourth Quarter GDP to be released at 8:30 AM EDT on Friday is expected to be 1.0%, unchanged from the second estimate.

Earnings News This Week

Monday: Carnival

Tuesday: Nike, Red Hat

Wednesday: Eldorado Gold, KB Home, Power Corp., Power Financial

The Bottom Line

Lots of seasonal trades are working. Sectors and markets that are outperforming the S&P 500 market during their current period of seasonal strength include Emerging Markets, Industrials, Materials, U.S. Financials, Canadian and U.S. Energy, Base Metals, Oil Services, U.S. Retail, Brazil, Korea, U.K., Europe, Crude Oil, Gasoline and Canadian Banks. All have been recommended in StockTwits and daily Tech Talk reports during the past six weeks. However, short term momentum indicators for all of the above are overbought. Preferred strategy for investors following seasonal strategies is to accumulate on weakness. Short term traders are watching for momentum indicators to roll over before taking short term profits (with the possibility of repurchasing on weakness).

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 18th 2016

Green: Increase from previous day

Red: Decrease from previous day

Calculating Technical Scores

Technical scores are calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

Higher highs and higher lows

Intermediate Neutral trend: Score 0

Not up or down

Intermediate Downtrend: Score -2

Lower highs and lower lows

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower.

The S&P 500 Index gained 27.36 points (1.35%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average. Short term momentum indicators continue to trend up and are overbought, but have yet to show signs of peaking.

Percent of S&P 500 stocks trading above their 50 day moving average increased last week to 93.40% from 89.80%. Percent remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 61.00% from 55.20%. Percent remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

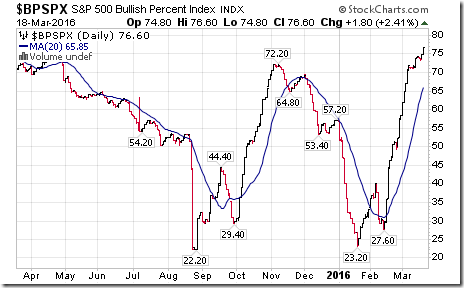

Bullish Percent Index for S&P 500 stocks increased last week to 76.60% from 73.80% and remained above its 20 day moving average. The Index remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

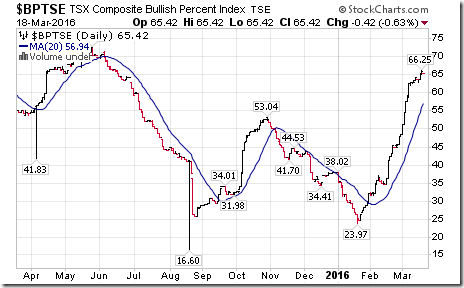

Bullish Percent Index for TSX Composite stocks increased last week to 65.42% from 64.17% and remained above its 20 day moving average. . The Index remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

The TSX Composite Index slipped 24.87 points (0.18%) last week. Intermediate trend remains up (Score: 2). Strength relative to the S&P 500 Index changed on Friday to Neutral from Positive (Score: 0). The Index remains above its 20 day moving average (Score: 1). Short term momentum indicators are trending up (Score: 1) and are overbought but have yet to show signs of peaking. Technical score slipped last week to 4 from 6

Percent of TSX stocks trading above their 50 day moving average was unchanged last week at 85.0%. Percent remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

Percent of TSX stocks trading above their 200 day moving average increased last week to 53.75% from 52.08%. Percent remains in an intermediate uptrend and is overbought, but has yet to show signs of peaking.

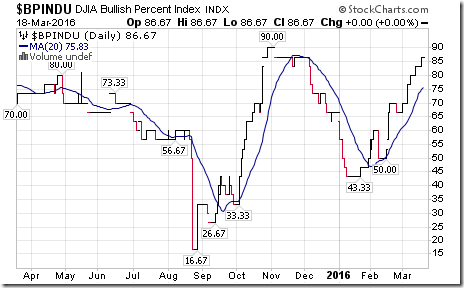

The Dow Jones Industrial Average gained 388.85 points (2.26%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index changed to Positive from Neutral. The Average remains above its 20 day moving average. Short term momentum indicators continue to trend up. Technical score increased to 6 from 4.

Bullish Percent Index for Dow Jones Industrial Average stocks increased last week to 86.67% from 83.33% and remained above its 20 day moving average. The Index remained into an intermediate uptrend and is overbought, but has yet to show signs of peaking.

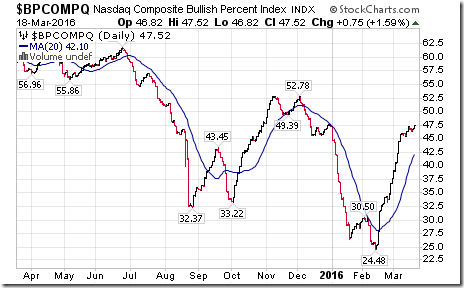

Bullish Percent Index for NASDAQ Composite Index stocks increased last week to 47.52% from 46.32% and remained above its 20 day moving average. The Index remains in an intermediate uptrend.

The NASDAQ Composite Index gained 47.18 points (0.99%) last week. Intermediate trend remained Neutral. Strength relative to the S&P 500 Index remained Neutral. The Index remained above its 20 day moving average. Short term momentum indicators are mixed. Technical score remained last week at 1

The Russell 2000 Index added 14.14 points (1.30%) last week. Intermediate trend remained Neutral. Strength relative to the S&P 500 Index changed last week to Neutral from Positive. The Index remains above its 20 day moving average. Short term momentum indicators are mixed. Technical score slipped to 1 from 3.

The Dow Jones Transportation Average increased 382.11 points (4.97%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index changed last week to Positive from Neutral. The Average remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score increased last week to 2 from -2.

The Australia All Ordinaries Composite Index added 14.50 points (0.28%) last week. Intermediate trend remained Neutral. Strength relative to the S&P 500 Index remains Neutral. The Index remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped last week to 0 from 2.

The Nikkei Average dropped 214.06 points (1.26%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remained Neutral. The Average remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score remained at 0.

iShares Europe 350 units gained $0.20 (0.51%) last week. Intermediate trend remained Neutral. Strength relative to the S&P 500 Index remained Positive. Units remain above their 20 day moving average. Short term momentum indicators continue to trend up. Technical score remained last week at 4.

The Shanghai Composite Index gained 144.84 points (5.15%) last week. Intermediate trend changed to up from down on Friday on a move above 2,933.96. Strength relative to the S&P 500 Index changed to Neutral from Negative on Friday. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score changed last week to 4 from -6.

Emerging Markets ETF gained $0.89 (2.69%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remained Positive. Units remained above their 20 day moving average. Short term momentum indicators continue to trend higher. Technical score remained at 6.

Currencies

The U.S. Dollar Index dropped 1.17 (1.22%) last week. Intermediate downtrend was extended on a move below 95.28. The Index remained below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming.

The Euro added 1.29 (1.16%) last week. Intermediate trend remained up. The Euro remained above its 20 day moving average. Short term momentum indicators are trending up and are overbought, but have yet to show signs of peaking.

The Canadian Dollar gained US1.04 cents (1.37%) last week. Intermediate trend remains up. The Canuck Buck remains above its 20 day moving average. Short term momentum indicators are trending up and are overbought, but have yet to show signs of peaking.

The Japanese Yen gained 1.77 (2.01%) last week. Intermediate trend remained up. The Yen remains above its 20 day moving average. Short term momentum indicators are trending up.

Commodities

Daily Seasonal/Technical Commodities Trends for March 18th 2016

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index gained another 2.82 points (1.63%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained Positive. The Index remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained at 6.

Gasoline slipped $0.02 per gallon (1.35%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained Positive. Gas remained above its 20 day moving average. Short term momentum indicators have just turned down. Technical score: 4

Crude Oil gained another $2.64 per barrel (6.86%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained Positive. Crude remained above its 20 day moving average. Short term momentum indicators are trending up and are overbought, but have yet to show signs of peaking. Technical score remained at 6.

Natural Gas added $0.09 per MBtu (4.95%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remained Neutral. “Natty” remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 0.

The S&P Energy Index added 11.45 points (2.48%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained Positive. The Index remained above its 20 day moving average. Short term momentum indicators are mixed. Technical score remained at 5.

The Philadelphia Oil Services Index slipped 1.68 points (1.02%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained Positive. The Index remained above its 20 day moving average. Short term momentum indicators are mixed. Technical score remained at 5.

Gold slipped $5.10 per ounce (0.40%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index turned Negative. Gold remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week to 0 from 2

Silver added $0.21 per ounce (1.35%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index improved to Neutral from Negative. Silver remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 4 from 2. Strength relative to Gold has just turned Positive.

The AMEX Gold Bug Index added 5.97 points (3.40%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained Positive. The Index remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score remained last week at 4. Strength relative to Gold remains positive.

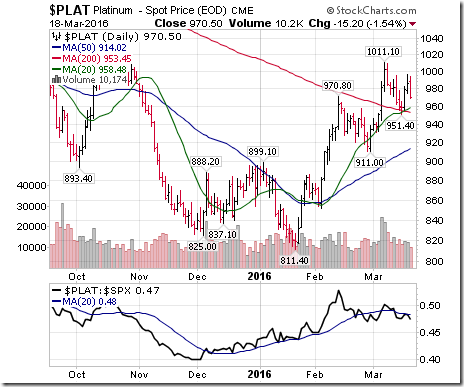

Platinum added $0.80 per ounce (0.08%) last week. Trend remains up. Strength remains Neutral. PLAT remains above its 20 day MA. Momentum indicators are trending down.

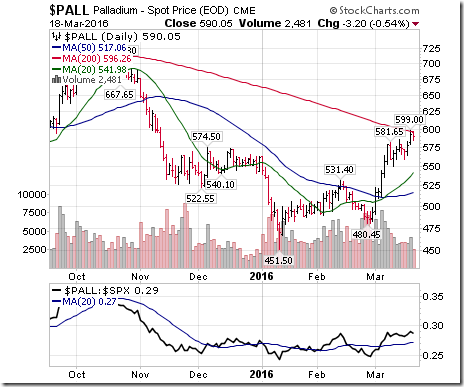

Palladium gained $10.10 per ounce (1.74%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains Positive. PALL remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained at 6.

Copper added $0.04 per lb. (1.79%) last week. Intermediate trend remained Neutral. Strength relative to the S&P 500 Index remained Positive. Copper remains above its 20 day moving average. Short term momentum indicators are trending down. Technical score remained last week at 2.

The TSX Metals & Mining Index gained another 40.72 points (9.01%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained Positive. The Index remained above its 20 day moving average. Short term momentum indicators are trending up. Short term momentum indicators are mixed. Technical score improved last week to 5 from 4.

Lumber gained 5.50 (1.89%) last week. Trend remained up. Relative strength remained Positive. Lumber remained above its 20 day MA. Momentum remained up. Technical score: 6

The Grain ETN slipped $0.11 (0.36%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remained Negative. Units remained above its 20 day moving average. Short term momentum indicators have just turned down. Technical score: -4

The Agriculture ETF added $0.35 (0.74%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained Positive. Units remained above their 20 day moving average. Short term momentum indicators are trending up. Technical score remained at 6.

Interest Rates

Yield on 10 year U.S. Treasuries dropped 10.6 basis points (5.36%) last week. Intermediate trend remained down. Yield remained above its 20 day moving average. Short term momentum indicators have just rolled over from overbought levels.

Conversely, price of the long term Treasury ETF gained $1.70 (1.33%) last week. Intermediate trend remained up. Price remained below its 20 day moving average. Short term momentum indicators have just turned higher.

Other Issues

The VIX Index plunged 2.48 (15.03%) last week. Intermediate trend remained down. The Index remained below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming.

Trading on exchanges take a holiday on Friday for the Good Friday holiday

Canadian economic focus is on the Federal Budget to be released on Tuesday at 4:00 PM EDT

U.S. economic news this week is expected to be mixed.

U.S. equity markets have a history of moving slightly lower in the week after Quadruple Witching.

Seasonal influences by most developed nation equity markets and economically sensitive sectors (Materials, Industrials, Consumer Discretionary, Financials) are positive until at least early May.

Short and intermediate technical indicators are trending up and are overbought, but have yet to show significant signs of peaking.

Earnings news this week is sparse. Nike’s report on Tuesday is a focus. Eight S&P 500 companies are scheduled to report this week. ‘Tis the season until the first week in April when companies pre-empt negative first quarter reports.

Consensus earnings and revenues estimates continued to trend lower last week. According to FactSet, consensus estimates for earnings per share on a year-over-year basis call for a decline of 8.4% in the first quarter (versus 8.3% last week), a decline 2.2% in the second quarter, a gain of 4.0% in the third quarter (versus 4.2% last week) and a gain of 9.0% in the fourth quarter. Consensus estimates for revenues on a year-over-year basis calls for a decline of 0.8% in the first quarter, a decline of 0.6% in the second quarter, a gain of 2.1% in the third quarter and a gain of 4.4% in the fourth quarter.

StockTwits Released Yesterday

Stocks become vulnerable as complacency and overbought readings start to emerge.

Technical action by S&P 500 stocks to 10:30 AM EDT: Bullish. Breakouts: $L, $FSLR, $OXY, $CSX, $DAL, $TWX, $XL, $NVDA, $YHOO.

Editor’s Note: After 10:30 AM EDT, three more S&P 500 stocks broke resistance: RCL, SBUX and ALLE. None broke support.

Sectors

Daily Seasonal/Technical Sector Trends for March 18th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Mark Leibovit’s Comments and Video

WYNN (WYNN RESORTS) topped out at 249 in March, 2014 and nosedived to 50 in January, 2016. It was clearly on my watch list and we’ve discussed it before in these updates. A series of Leibovit Positive Volume Reversals started on January 15. Please note the beautiful Leibovit Positive Volume Reversal on March 10 accompanied by a rising 5/3/3 stochastic which set up the most recent trade. We took profits at vrtrader.com as WYNN surged into the mid-90s following a big opening gap Friday morning. My view is that WYNN can still go higher, but let’s wait for a pullback back to the old high at 88.87 or fill Friday’s gap at 89.28.

FCX (FREEPORT MCMORAN) topped out at 61.34 in January, 2011 and nosedived to 3.52 this past January, 2016. Three big Leibovit Positive Volume Reversals on February 12, March 10 and March 16 all accompanied by a rising 5/3/3 stochastic which triggered trading buys. We ‘rang the register’ here as well Friday morning over 11.00 with a view to pullback following a three day run to the upside.

We have been trading WYNN and FCX several times in recent weeks.

Accountability Report

Several equities with positive seasonal influences supported in Tech Talk reports and StockTwits when their technical parameters turned positive have started to underperform the S&P 500 Index and record negative short term momentum indicators. Given the current overbought level for North American equities, now is a good time to cull these holdings either at a small profit or small loss. They are:

Mattel (MAT US$32.78) recommended on February 3rd in a StockTwit at $29.93

Schlumberger (SLB US$73.52) recommended on February 18th in Tech Talk at $72.93

ARC Resources (ARX.TO $18.75) recommended on February 18th in Tech Talk at $19.04

Metro (MRU.TO $43.19) recommended on February 23rd in a StockTwit at $42.09

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca

![clip_image002[4] clip_image002[4]](https://advisoranalyst.com/wp-content/uploads/2019/08/762d0bb12042c9549223877ed067d3ca.png)

![clip_image002[7] clip_image002[7]](https://advisoranalyst.com/wp-content/uploads/2019/08/e9fc30f1d5a7578371090246eece3f37.png)

![clip_image002[9] clip_image002[9]](https://advisoranalyst.com/wp-content/uploads/2019/08/404365cccb2a399202a4392909c61561.png)