Scared of Defaults? Don’t Worry, There’s a Bright Side

by Fixed Income AllianceBernstein

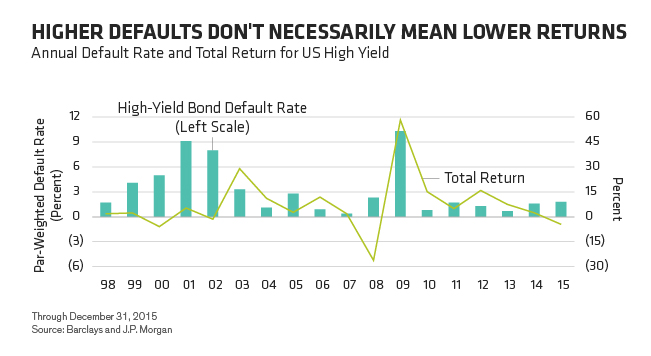

It’s hard to talk about high-yield bonds today without addressing defaults. So here’s our take on the matter: Default rates will rise over the next few years. But don’t fret: returns are likely to rise, too.

Defaults have been below average for years, so an increase shouldn’t come as a huge surprise. High-yield bonds have always been riskier than other types of bonds. And it’s not uncommon for some issuers to default as the credit cycle winds down and borrowing costs rise.

But a higher average default rate doesn’t mean returns have to suffer—provided you’ve been selective about your exposures. Over the past two decades, jumps in the average default rate have usually been followed by big increases in returns (Display).

When Investors Punish High Yield

The reason is tied partly to investor psychology. Defaults usually aren’t spread evenly across the high-yield market, which includes many different regions and sectors. Nonetheless, investors tend to respond to a rise or an expected rise in defaults by punishing the whole high-yield market.

The result: plenty of sound credits trading at very attractive valuations. For example, a large share of defaults in 2001 and 2002 were telecom companies that had borrowed heavily but ran into trouble when the dot-com bubble burst. That led to selling across the US high-yield market. But investors who bought bonds in nontelecom sectors in the years after 2002 did well. In 2003, US high-yield returns soared to 29%.

Beyond Energy, Values Look Compelling

We think something similar is going on now, with energy, metals and mining companies standing in for telecoms. With the price of oil near multidecade lows, we expect these types of companies to account for a large share of defaults over the coming years.

Many investors have reacted to recent volatility as they did in 2002—by bailing out of the market altogether. As a result, some non–energy sector bonds now offer higher yields than they have in years.

That’s important, because starting yield—now above 8% on average—is one of the best predictors of what investors can expect to earn over the next five years. In 2009, high-yield defaults hit a record high—but so did high-yield returns. At one point that year, the average yield on the Barclays US Corporate High Yield Index exceeded 20%.

All of this helps to explain why it’s so rare for the high-yield market to post consecutive down years—and why it tends to rebound so quickly when it does stumble.

It Still Pays to Be Selective

Even so, investors can’t afford to be cavalier about the market and its risks. It’s critically important to be selective, even among higher-quality bonds. That’s especially true in US high yield, which is in the later stages of the credit cycle, and Asian high yield, which is already in contraction. A global, multi-sector approach makes sense, since different regions and sectors are at different stages of the cycle.

But we think it would be a mistake to abandon high yield altogether. The biggest risk today isn’t a rise in defaults—it’s pulling out of the market prematurely and missing the opportunity to buy before it rebounds.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Director—High Yield

Gershon M. Distenfeld is Senior Vice President and Director of High Yield, responsible for overseeing the investment strategy and management of all investment-grade and high-yield corporate bond portfolios, from buy-and-hold investment-grade corporate portfolios to regional and global high-yield portfolios. He co-manages the award-winning High Income Fund, named “Best Fund over 10 Years” by Lipper from 2012 to 2015, and the award-winning Global High Yield and American Income portfolios, two Luxembourg-domiciled funds designed for non-US investors. Distenfeld also designed and is one of the lead portfolio managers of the Multi-Sector Credit Strategy. He has authored a number of published papers and blogs, including “High Yield Won’t Bubble Over” (January 2013), one of the firm’s most-read blogs. Distenfeld joined AB in 1998 as a fixed-income business analyst, and served as a high-yield trader (1999–2002) and high-yield portfolio manager (2002–2006) before being named to his current role in 2006. He began his career as an operations analyst supporting Emerging Markets Debt at Lehman Brothers. Distenfeld holds a BS in finance from the Sy Syms School of Business at Yeshiva University and is a CFA charterholder. Location: New York

Related Posts

Copyright © AllianceBernstein