by Don Vialoux, Timingthemarket.ca

Pre-opening Comments for Thursday March 17th

U.S. equity index futures were lower this morning. S&P 500 futures were down 5 points in pre-opening trade.

Index futures recovered slightly following release of economic news at 8:30 AM EDT. Consensus for Weekly Jobless Claims was 266,000 versus 258,000 last week. Actual was 265,000. Consensus for March Philadelphia Fed Index was -1.4 versus -2.8 in February. Actual was 12.4.

FedEx added $8.46 to $152.73 after reporting higher than consensus earnings and after raising its guidance.

PayPal (PYPL $39.80) is expected to open higher after Wedbush raised its target price to $45 from $40.

Caterpillar dropped $1.82 to $72.52 after the company lowered its guidance for first quarter sales and earnings.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2016/03/16/stock-market-outlook-for-march-17-2016/

Note seasonality charts on the U.S. Financial sector, Industrial Production and U.S. Housing Starts

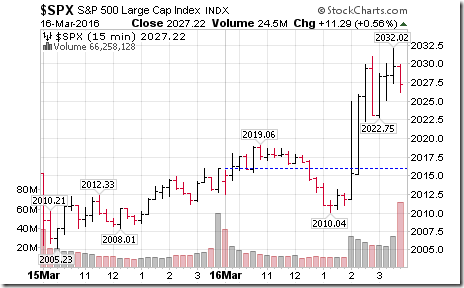

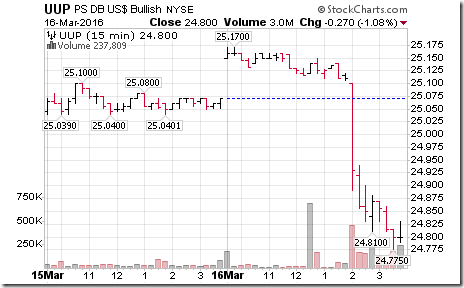

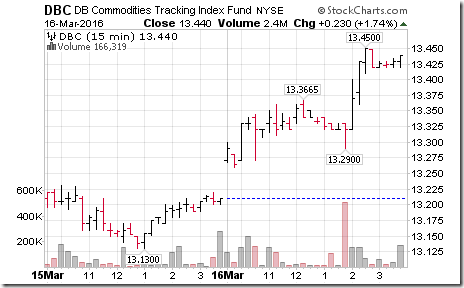

Responses to the Fed’s announcement yesterday at 2:00 PM

U.S. equity indices moved higher

Ditto for TSX indices!

Price of long term Treasury ETF was volatile, but closed on the upside

The U.S. Dollar Index and its related ETF plunged

The Canadian Dollar soared on U.S. Dollar weakness

Gold, precious metals and related equity ETFs soared on U.S. Dollar weakness

Commodity prices (in addition to Gold) also soared on U.S. Dollar weakness

StockTwits Released Yesterday @EquityClock

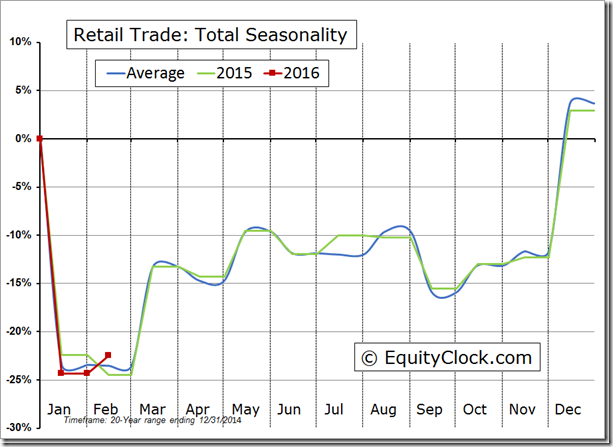

Retail sales running above average through February; not as bad as what headlines suggest. http://stkw.it/xBm $XRT $RTH $SPX $STUDY

Strange, but true. No S&P 500 stocks have broken intermediate support or resistance by 10:45 AM EDT.

Editor’s Note: After 10:45 AM, technical action by S&P 500 stocks turned bullish with the exception of health care stocks. Breakouts included AMT, COL, COST, CTSH, EQT, FISV, GGP, MCD, NEE, NFX and STZ. Breakdowns included ALXN, MNK and VRTX

Trader’s Corner

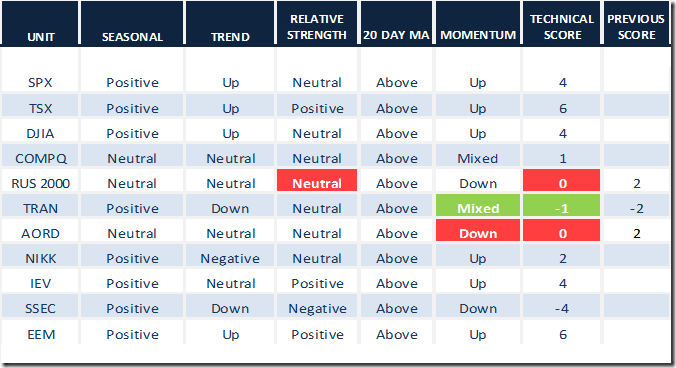

Daily Seasonal/Technical Equity Trends for March 15th 2016

Green: Increase from previous day

Red: Decrease from previous day

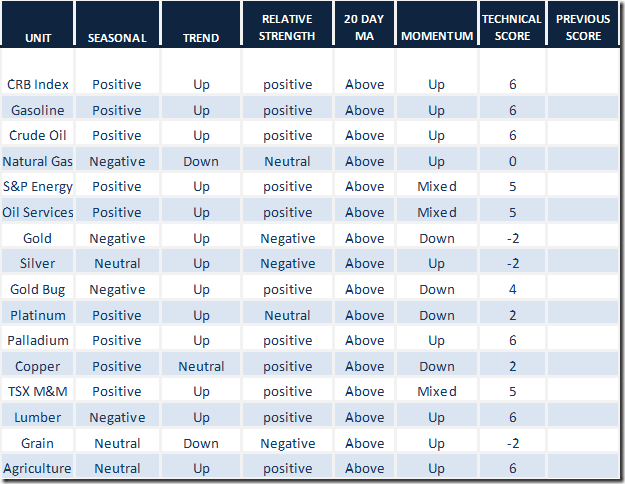

Daily Seasonal/Technical Commodities Trends for March 15th 2016

Green: Increase from previous day

Red: Decrease from previous day

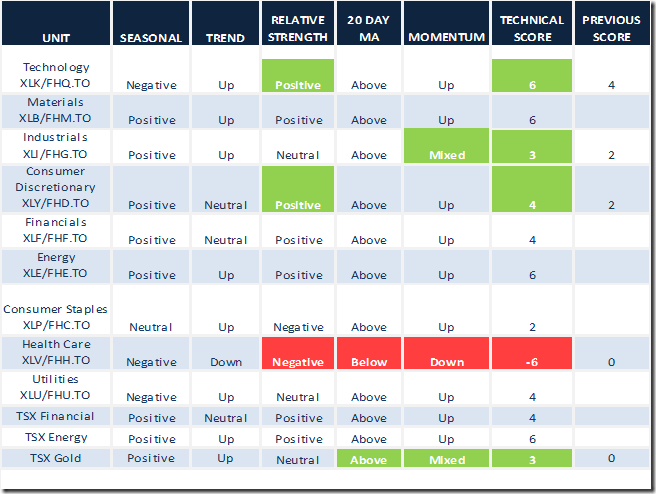

Daily Seasonal/Technical Sector Trends for March 15th 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

Technical score on the S&P Health Care sector fell to 0 from 6 when relative strength turned negative, the index moved below its 20 day moving average and short term momentum indicators turned negative.

The Biotech subsector led the Health Care sector on the downside.

Cameco (CCJ, CCO.TO) is acting strange. Technicals have turned strongly positive. On balance volume shows that the stock is being accumulated. Meanwhile, the spot price for uranium oxide dropped US $2.35 per lb. last week to $28.75.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca