Buy and Hold is Great – It's the Hold Part That's Difficult

by James Picerno, The Capital Spectator

Holding stocks for the long run has obvious appeal. The historical record shows that if you simply ignore the short-term noise and focus on the next 10 or 20 years, you’ll do fine, and perhaps substantially better than fine. The big risk is that you chicken out midway through the next period of subpar performance.

Embracing the long run looks easy on paper, when we have the benefit of seeing the outcome for a specific period in the past. Indeed, the long sweep of history suggests that there’s a high probability of a substantial payoff for those who can muster the discipline to look beyond short-term volatility. But how many investors who sign up for the long term will go the distance? A small fraction is probably a reasonable guess, particularly if the investing climate suffers an extended bout of mediocrity of worse.

The challenge is keeping the faith when equity returns are disappointing. There are enough 10-year periods when the S&P 500’s results were soft (or even in the red) to raise the question: What’s the risk that a buy-and-hold strategy will be abandoned before the recovery kicks in? Much depends on the investor, of course, but Mr. Market’s erratic behavior through time implies that buy and hold is sure to be much tougher in practice than it appears to be in theory.

Consider the track record for rolling 10-year returns for the S&P 500. As the chart below illustrates, low and even negative returns occur with enough frequency to keep everyone guessing if there’s another lost decade lurking.

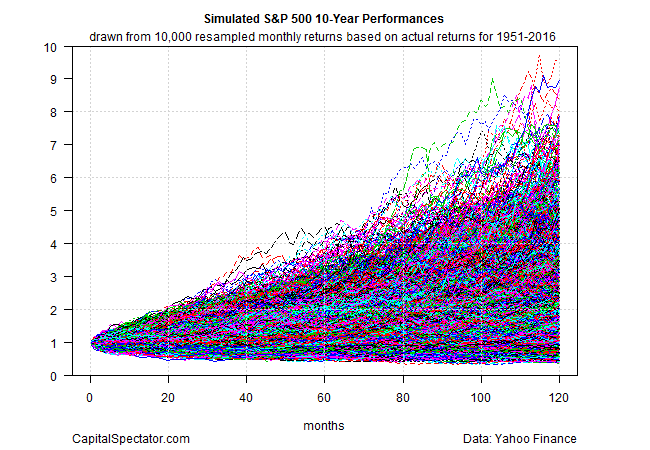

One way to model this risk is to simulate market behavior over 10-year periods by reshuffling the sequence of actual historical returns. Let’s fire up R and resample (with replacement) the S&P 500’s monthly returns and generate 10,000 alternative performance histories. The chart below reflects how investing $1 fared over 10 years (120 months). Not surprisingly, there’s a wide variety of results, albeit with a clear bias to the upside. But there’s also a more-than-trivial number of low-to-negative results.

Roughly 6% of the performance histories in the chart above suffered a loss over the simulated 10-year period. The disappointing results rise to around 10% if we include cumulative returns of 9% or less over the test horizon.

The point, of course, is that there’s a risk of mediocrity or worse for a 10-year holding period. It’s a small risk—perhaps no more than 10%, based on the simulated histories above. But that’s enough to raise doubts about the viability of a buy-and-hold strategy for investors who aren’t emotionally prepared to weather tough times.

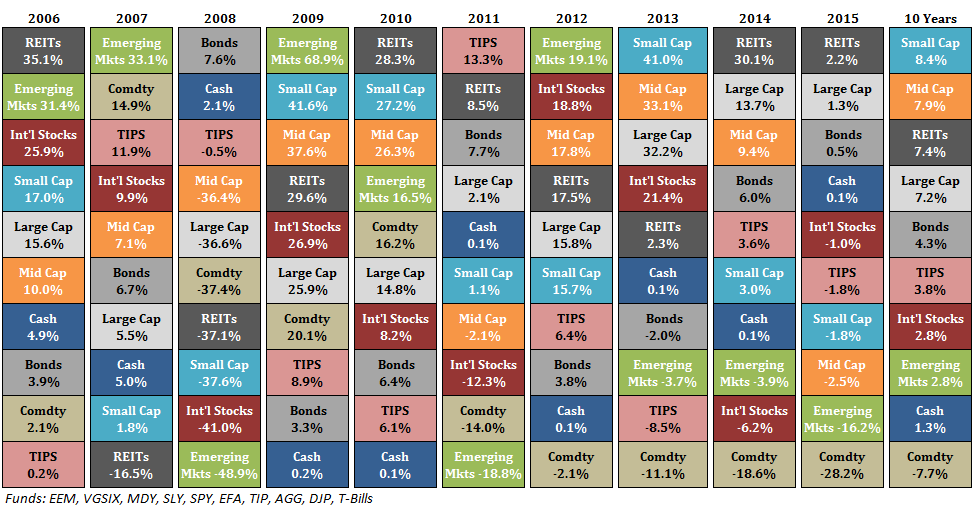

One solution is hire a capable financial adviser to help you stay on the straight and narrow when the pressure to bail becomes extreme. Alternatively, you can complement (or replace?) a buy-and-hold strategy with one of the many flavors of tactical asset allocation. You can also keep a close eye on the ebb and flow of expected return, which can vary dramatically based on trailing return and/or valuation metrics, such as Professor Shiller’s Cyclically Adjusted PE Ratio (CAPE Ratio).

In other words, there are several tools and techniques that can blunt the lost-decade risk that can derail the best-laid plans of investors. But no matter how you choose to manage this risk, all roads begin with a simple observation: buy and hold, for all its merits, comes with its own peculiar set of hazards.

Copyright © The Capital Spectator