Puerto Rico Bonds: Restructure Needed

by Fixed Income AllianceBernstein

A year ago, many people asked us if Puerto Rico’s debt was a good investment. Our answer now, as it was then, is “no.” For investors with strategies that can include high yield, it’s “not yet.”

Puerto Rico has the same problem today that we warned of then: too much debt, especially for an economy that continues to contract. Over the past few months, the questions about Puerto Rico’s government debt have changed to focus on the impacts on the broader muni market of: 1) a Puerto Rico default, and 2) the implications of giving Puerto Rico an avenue to restructure its debt.

In short, a Puerto Rico default has been so well advertised and anticipated that we think its impact on the overall municipal market would likely be negligible and short-lived.

As for clarifying the default process for investors, we believe that a legal framework would create a process for an orderly restructuring of Puerto Rico’s debt. It’s an approach that would benefit both investors in Puerto Rico bonds and the citizens of Puerto Rico. And it’s contrary to some of the arguments we’ve heard.

Why We Think Contagion Will Likely Be Limited

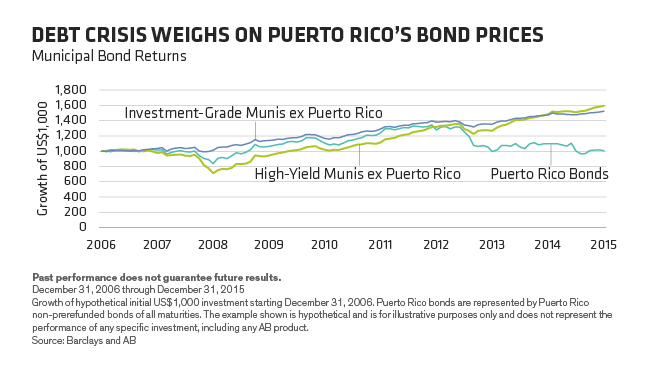

Bonds issued by Puerto Rico represent only 2% of the municipal debt outstanding. And Puerto Rico bond prices have moved independently from those of other municipal bonds over the past few years (Display). After largely moving in line with other muni bonds through the financial crisis, an index of Puerto Rico bonds started to decline in 2013, while most municipals continued to gain. Puerto Rico’s financial crisis continues to weigh on the island’s debt today.

Could there be a “run on the bank”?

The most likely source of contagion we can see would arise if investors in some municipal funds with significant Puerto Rico holdings decide to get out. To meet these liquidations, funds would have to sell both Puerto Rico and non-Puerto Rico bonds. Fortunately, today we believe that any contagion impact on the general muni market from a Puerto Rico default would be short-lived because of the limited supply of municipal bonds. Unlike the corporate and US Treasury markets, which have grown sharply since the financial crisis, the volume of outstanding municipal debt has shrunk modestly.

Clarity Is Better than Uncertainty

As investors, we look first to an issuer’s ability to pay. Legal provisions are important, but as the Detroit bankruptcy and other distressed situations have shown, a borrower’s ability to pay matters more than does its legal requirement to pay. And when an issuer can’t pay its debt, it’s best for issuer and creditors to have a defined process for determining a timely—and ideally equitable—resolution.

In Puerto Rico’s case, the debt load is clearly unsustainable. There’s nearly $70 billion of debt, not to mention a nearly $44 billion unfunded pension liability, weighing on a $69 billion domestic economy. Over the next ten years, Puerto Rico projects that it will have just $9 billion available to make over $34 billion in debt-service payments. That projection includes the impact of reforms proposed by the governor-appointed working group and incorporates positive economic growth assumptions.

Puerto Rico has been in recession since 2006, when a tax incentive for US manufacturers located in Puerto Rico ended because of a sunset provision. The island’s economy has shrunk nearly 14% in real terms since then, and its population has declined by nearly 9%. Puerto Rico’s pension funds for government employees and teachers are nearly completely dry.

Puerto Rico’s government faces a liquidity crisis and will be forced into widespread defaults in the coming months. These defaults will trigger a myriad of new lawsuits, because Puerto Rico has no legal means to restructure. The lawsuits would likely take years to resolve, creating more uncertainty, impeding economic recovery and accelerating Puerto Rico’s debt spiral.

What Should a Solution for Puerto Rico Look Like?

The human and financial costs for Puerto Rico will likely escalate unless the situation is remedied. Congress is debating ideas for legislation, which include imposing a financial control board and giving Puerto Rico an avenue for restructuring.

In our view, both Puerto Rico and its creditors should support such legislation; better financial controls and economic policies should be part of the solution, too. The sooner these happen the better—for creditors and citizens alike.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Director—Municipal Bond Management

R. B. Davidson III joined Bernstein as Director of Municipal Bonds in 1992 and retained that responsibility after Bernstein’s and Alliance Capital’s fixed-income departments were combined. He is Chairman of the Tax-Exempt Fixed Income Investment Policy Group and a member of the Taxable Fixed Income Investment Policy Group. Davidson also serves on the partnership committee at AllianceBernstein as well as on the Investment Advisory Group to the Municipal Securities Rulemaking Board. Before joining Bernstein, he was vice president and head of municipal strategies at J.P. Morgan Securities and an associate economist at Lehman Brothers. He is the author of “The Value of Tax Management for Bond Portfolios,” published in T

he Journal of Private Portfolio Management, Spring 1999; “Maximizing Expected After-Tax Returns,” published by Probus in 1994 in the Handbook of Municipal Bonds; and “Analyzing Quality Spreads,” published in The Municipal Finance Journal in 1991. Davidson was named to the Institutional Investor All-America Research Team in 1992. He earned a BA from Wesleyan University in 1983 and an MBA from the New York University Stern School of Business in 1991. Location: New York

Municipal Credit Research Analyst

John Ceffalio joined AllianceBernstein in 2010 as a Municipal Credit Research Analyst in the Global Credit Group. He has been a municipal credit analyst for over six years, working at Fitch Ratings, Bear Stearns and, most recently, Moody’s Investors Service. Ceffalio also served under the administration of former Alaska Governor Tony Knowles for nearly eight years, including four years as a special assistant to the governor. He earned a BA from the University of Alaska Anchorage in 1994 and a master’s in governmental administration from the University of Pennsylvania in 2004. Location: New York

Related Posts

Copyright © AllianceBernstein