Buy Canada And Short America!

by J.C. Parets, AllStarCharts.com

What do you guys think? Buy Canada and short America? Some of you might like the sound of that, others might hate it. Personally I don’t care either way. I treat Canada and the U.S. the same way as I would treat Indonesia, China, Peru, Soybeans, Cocoa, Japanese 10-year yields or Aussie Dollars. It’s just letters and math to me, so I don’t care if Apple doubles in price or goes to zero. The implications of market moves are nothing I can control or worry about. I’m just here to try and profit form the changes in price.

Today I want to talk about why I still think we need to be shorting America and buying Canada instead. This is one I’ve been pointing to since late January, but since then price has just confirmed everything that we were originally seeing.

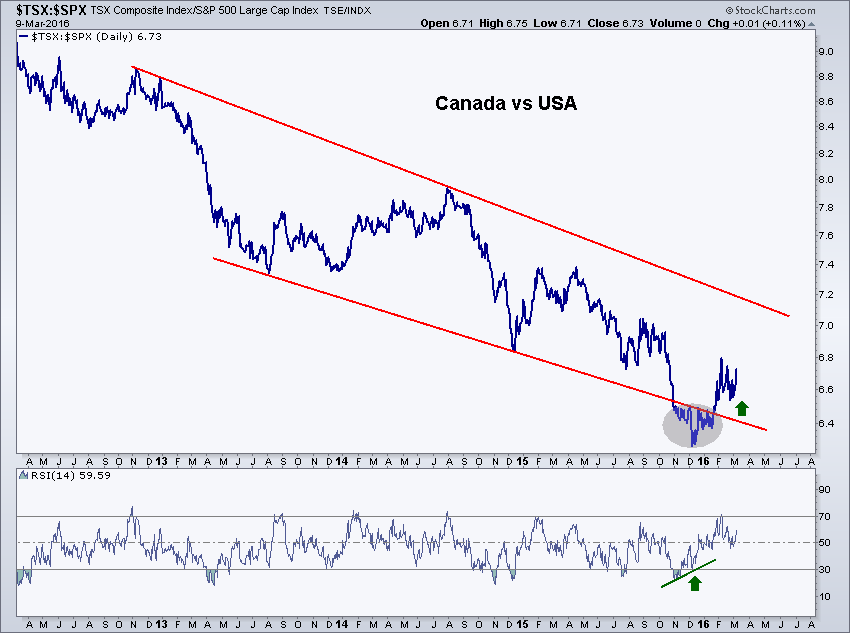

Here is a 4-year chart of Canada’s TSX Composite Index vs America’s S&P500 Index. You can see this ratio trading lower within a nice clean downtrend channel for several years. More recently in the 4th quarter last year, price fell below the lower of the two parallel trendlines, only to quickly recover in late January. This also confirmed a bullish momentum divergence, as you can see plotted below:

This has been trending higher over the past 6 weeks and I still believe that the failed breakdown earlier this year will be the catalyst to continue to take this higher towards the upper of these two parallel trendlines. It looks like we’re heading back above 7 where I would take tactical profits and reevaluate.

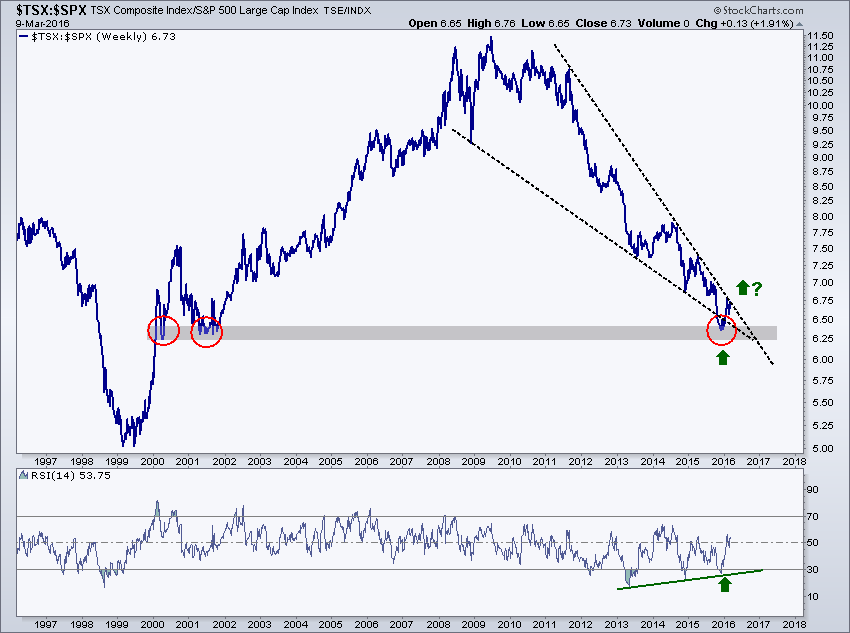

Looking bigger picture, on the other hand, we could be at the beginning of a monster breakout. Here is a longer-term chart going back 20 years. This could be a logical area for this ratio to find support, as it did in 2000 and 2001. Also, we can see that momentum is also diverging positively. Over the past year, this ratio has made 2 lower lows in price, but momentum has put in a higher low on each one of those occasions:

If we can take out the upper of these two converging trendlines over the past 6-7 years, I would expect a big move higher, towards at least 8:1. I would continue to buy Canada and short America with equal nominal amounts. As long as we’re above the lower of these two converging trendlines, I want in!

This post was originally published by J.C. Parets at AllStarCharts.com

Copyright © AllStarCharts.com