Why I'm no longer an economic bull

by Conor Sen

It’s finally happened. I’m starting to look for signs of economic overheating, overly aggressive monetary policy tightening, and eventually, recession.

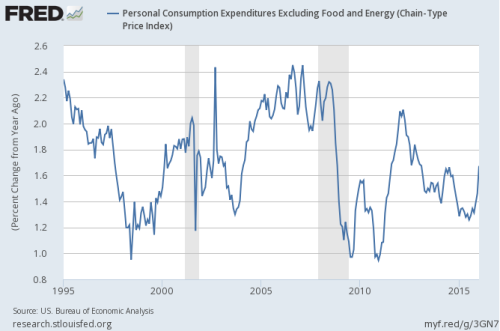

First, overheating. Despite continued drags from dollar appreciation and the decline in energy prices, core PCE has ticked up strongly in recent months, in part due to rises in medical care costs, which have a bigger weighting in core PCE than core CPI. The 2% target is in sight.

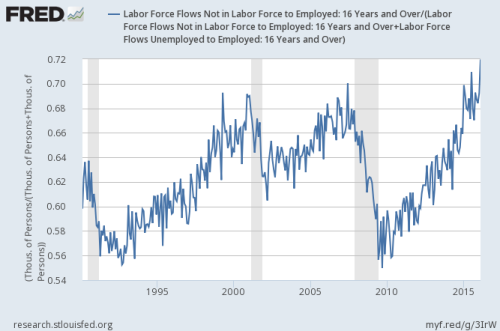

Second, below is a chart looking at what percentage of new employees last month came from outside of the labor force (vs unemployed). It hit a new all-time high of 72%, vs 56% at the lows of 2009-10. To find workers employers are having to look harder than ever. At some point even this shadow slack will run out and wage increases will be the last option available to them.

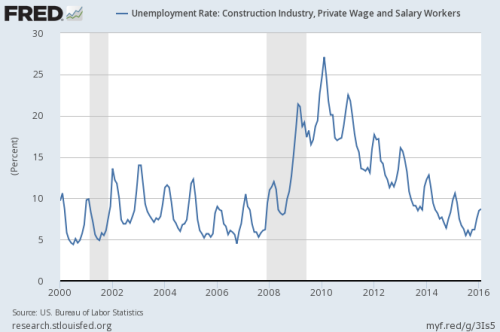

This has been the case in the construction industry for awhile. Unemployment for construction workers is non-seasonally adjusted, but we saw in February that construction unemployment nearly matched its low for this data series set in February, 2006. If we’re going to find more construction workers we’ll have to find them from outside the industry.

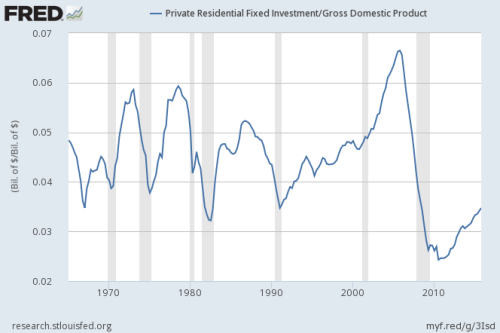

My view is that the housing cycle is the business cycle, and on this basis “potential output” should be much, much higher than it is today. We’ve underbuilt housing, particularly single-family, for years, and Millennial housing needs will be immense for the next two decades.

But because of how much damage occurred in the housing sector and how slow and long the recovery took, other industries absorbed housing sector resources. And now we’re nearing overall US economic resource utilization levels that typically makes the Fed uncomfortable.

Over the next several months as energy and currency-related headwinds subside and the US hits full employment the Fed will begin to snuff out this expansion, which is what they see their job being. Economic growth in 2016 should be pretty good, and there’s a good chance 2017 will be as well. But by 2018? There’s a reasonable chance that by then, if the economy doesn’t fall into recession on its own the Fed will put us there. So that’s beginning to make me cautious in my outlook.